MYStartup pre-accelerator Cohort 4 launches with 30 promising startups

MYStartup, in partnership with WatchTower and Friends, happily announces the selection of 30 high-potential companies for the MYStartup Pre-Accelerator Cohort 4. The MYStartup program, spearheaded by Cradle Fund Sdn Bhd and carried out by the company, aims to encourage the development of product-market suit and contribute to the overall success of the Indonesian startup ecosystem.

Chosen from a dynamic lake of close to 100 candidates across Malaysia, the selected companies may embark on a four-month designed program. The programme covers essential topics, including aligning co-founder goals, crafting mission and vision statements, developing business models, designing and iterating Minimum Viable Products ( MVP), conducting market validation, exploring valuations and funding, and understanding Sustainable Development Goals ( SDGs ) and governance. Individuals gain knowledge and tools to create and scale effective startups through this structured approach.

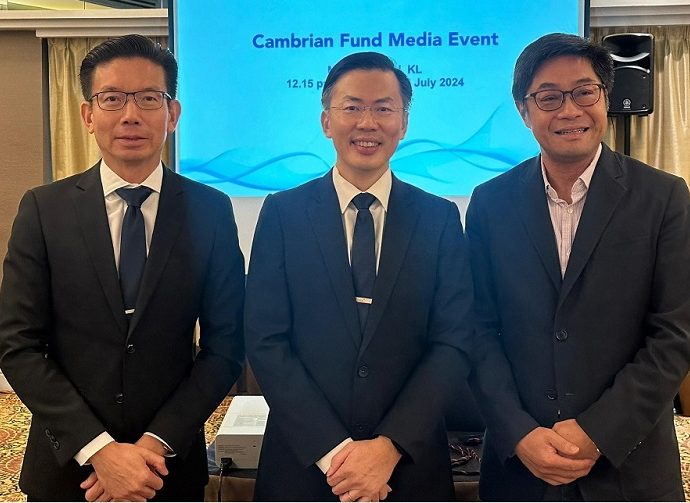

Cradle’s Group CEO, Norman Matthieu Vanhaecke ( pic ), stated that MYStartup is dedicated to advanceing the local startup ecosystem by providing access to essential early-stage support tools and resources like expert mentoring, seed funding, and market access. MYStartup Pre-Accelerator has supported more than 100 Malay businesses in three groups since the first group was launched in 2022. In line with the Ministry of Science, Technology, and Innovation’s goal of placing Malaysia among the top 20 global startup ecosystems by 2030, as defined in the Malaysian Startup Ecosystem Roadmap ( SUPER ) 2021- 2030, this program embodies our commitment to position Malaysia as a key player in fostering innovation and advancement in local and global technology sectors.

Cradle’s Group CEO, Norman Matthieu Vanhaecke ( pic ), stated that MYStartup is dedicated to advanceing the local startup ecosystem by providing access to essential early-stage support tools and resources like expert mentoring, seed funding, and market access. MYStartup Pre-Accelerator has supported more than 100 Malay businesses in three groups since the first group was launched in 2022. In line with the Ministry of Science, Technology, and Innovation’s goal of placing Malaysia among the top 20 global startup ecosystems by 2030, as defined in the Malaysian Startup Ecosystem Roadmap ( SUPER ) 2021- 2030, this program embodies our commitment to position Malaysia as a key player in fostering innovation and advancement in local and global technology sectors.

” Since 2015, we’ve happily supported Malaysian companies, with many from our WTF Accelerator evolving into the world’s most successful projects. Partnering with Cradle through MYStartup, we’re totally committed to the president’s goal of creating 5, 000 companies by 2025. During this four-month program, our focus is on achieving product-market meet across different industries like SaaS, E-commerce, Edtech, Fintech and AI. We anticipate seeing major accomplishments and ability growth under WatchTower and Friends, according to Sam Shafie, the co-founder of WatchTower and Friends.

The pre-accelerator program offers a coherent bundle for each chosen business, encompassing regular learning modules, hands-on mentoring, on-demand resources, and proper connections within the tech and entrepreneur industry. These solutions have been carefully created to assist businesses in creating viable business versions and securing growth opportunities.

Participants will provide their tested and positive MVP to prospective investors by the program’s conclusion, giving them a crucial opportunity to secure funding and advance their growth trajectory. This organised approach not only prepares startups for long-term victory in the fiercely competitive business environment but also provides them with crucial skills and insights.

.jpg)

Kristoffer Jacek Soh (pic), co-founder & CEO of Beep, said, “We’re grateful for the continued vote of confidence from our investors who have been with us on our journey, supporting our growth to date. Our rapid progress is a result of the immense support we have received from our investors, partners, industry leaders, and government agencies.”

Kristoffer Jacek Soh (pic), co-founder & CEO of Beep, said, “We’re grateful for the continued vote of confidence from our investors who have been with us on our journey, supporting our growth to date. Our rapid progress is a result of the immense support we have received from our investors, partners, industry leaders, and government agencies.”

.jpg) According to the Priority Economic Deliverable 2025,” We are thrilled to announce our main Cradle deliverables.” Each of these deliverables has been carefully selected to address both regional and local issues. By acting as one entity, we hope that all Asean Member States can draw on our shared strengths, address common difficulties, and create a vibrant ecosystem that benefits all member states. Our concerted efforts will help us secure a prosperous and sustainable future, according to Cradle Group CEO Norman Matthieu Vanhaecke ( pic ).

According to the Priority Economic Deliverable 2025,” We are thrilled to announce our main Cradle deliverables.” Each of these deliverables has been carefully selected to address both regional and local issues. By acting as one entity, we hope that all Asean Member States can draw on our shared strengths, address common difficulties, and create a vibrant ecosystem that benefits all member states. Our concerted efforts will help us secure a prosperous and sustainable future, according to Cradle Group CEO Norman Matthieu Vanhaecke ( pic ).