Why did US miss the China-led battery revolution? – Asia Times

Once in a great while, Twitter X can still be a place for interesting discussions instead of breathless political screeching. July 29 was one of those times. I wrote a thread asking why America missed the battery revolution and got a lot of very interesting responses. So I thought I’d redo that thread as a blog post and expand on it a bit.

Basically, batteries are a technological revolution in progress. They’re a key part of a larger, more general revolution: the replacement of controlled combustion with electricity as the main way that human beings produce energy and move it around.

The key advantage of batteries – the thing that no other technology or energy source can really do well – is that they let you store energy, move it around, and then remove it again. They’re a way to move energy through both time and space.

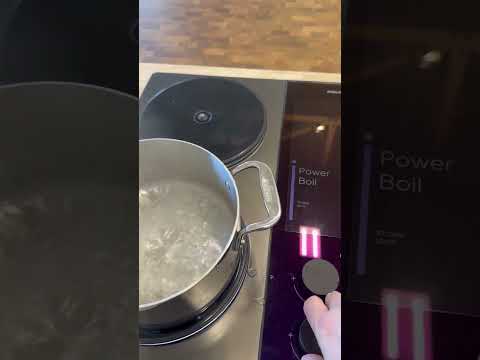

I first realized the transformative power of batteries when I saw people using battery-powered leaf blowers as a weapon in the riots of 2020. But what really drove it home for me was when I invested in a startup called Impulse that makes battery-powered appliances. Once you’ve seen a battery-powered stove boil a pot of water in a few seconds, it’s hard not to think the world has changed:

This kind of magic wasn’t possible even a few years ago – batteries didn’t have the power density required to do this. The technology has been advancing by leaps and bounds in recent years.

That’s why you’re seeing battery-powered drones suddenly take over the modern battlefield, e-bikes transform transportation, and China’s car companies conquer the automotive industry.

It’s why you’re seeing solar power suddenly become smooth and reliable instead of intermittent. It’s why your phone can run all day without needing to be recharged. And these are only the beginning of what batteries will be able to do, since the technology is still improving rapidly at a fundamental level.

But what’s strange is how surprising this all feels – not just to me, but to the United States as a whole. I knew about Tesla and the coming of EVs years ago, of course. And from reading climate pundits, I knew that battery storage would be an important complement to solar power. I knew about Barack Obama’s attempts to support American battery companies.

But I didn’t have any idea how many different things batteries would be used for, or how good they would get. Relatively few media outlets, politicians, or intellectuals talked about batteries as a transformative technology. This is still true today — outside of solar storage and EVs, I don’t see many people gushing about batteries.

The US government, too, seems to have been caught a bit flat-footed. Obama did support some battery companies (including Tesla!). But there was never any big government push for better batteries, the way there was for genetic sequencing, fracking or even solar power.

When you read a history of the lithium-ion battery, it’s all just a scattered network of researchers at British and Japanese universities — and, strangely, Exxon — creating the chemistries that enabled the revolution.

The key discoveries happened in the 70s, 80s, and 90s, but it wasn’t until the 2000s that US government research started making some important contributions and US policy started supporting the commercialization of batteries.

Batteries are the first big technological revolution that the US missed

The failure of both American media and the American government to anticipate the battery revolution is actually a huge historical outlier.

When it comes to any other major technological revolution I can think of, the US was very early to the party — driving the key research and development, hyping up the technology well before it was commercially viable, and making a major effort at early commercialization. Here are a bunch of examples:

Computers: The US was very early to the computer revolution, including technology, theory, and applications. It produced the first digital electronic computer and the first modern computer (ENIAC) in the 1940s. The US defense establishment recognized the importance of computing early on, and supported it over the years. No other country has done as much to advance computing technology or commercialize computers.

Space: This was the case where the US came closest to getting “scooped” on a technology. Both the US and the USSR recognized the potential importance of space and rocketry after World War 2, but the USSR’s big push in the field allowed it to get to space first.

The US made a mighty — and ultimately successful — effort to catch up and overtake its rival, and still dominates the space industry and space innovation to this day. The hype about space in the US was absolutely enormous, especially after the “Sputnik moment.”

Nuclear power: The US and USSR both developed nuclear power at around the same time in the 1950s. Both countries hyped the technology heavily and poured government funding into building and improving nuclear reactors.

Semiconductors: The US invented the semiconductor, and its potential applications for civilian computing and for military weaponry were recognized and widely discussed shortly afterwards. The US also invented the microprocessor, extreme ultraviolet lithography, and most of the other core technologies associated with semiconductors – always with heavy government support. Much has been made of Taiwan’s dominance of semiconductor fabrication in recent years but the US still holds the pole position in research, design and many key areas of tool manufacturing and software.

Solar power: The US was very early to the idea that solar power would be a replacement for fossil fuels. The Carter administration heavily promoted the technology (famously putting solar panels on the White House), more than 30 years before it became cost-competitive with fossil fuels. Popular consciousness of solar’s potential was high; my parents told me from a young age that solar would eventually power the country. US government-funded research was the main force pushing solar costs down until the mid-2000s.

The internet: The US invented and/or funded the invention of all of the key technologies of the internet up until the 2010s. It built out most of the key internet infrastructure. Excitement about the internet’s potential was off the charts for decades, and US policymakers supported the industry’s development with far-sighted laws.

Fracking: The US government heavily funded and supported the development of hydraulic fracturing technology since the 1970s, and the US is still overwhelmingly dominant in this technology.

Genetics: The US promoted research into genetics from the very start, doing much of the basic discovery work, and funding the famous Human Genome Project that unlocked a revolution in biotechnology. The US also pioneered mRNA vaccines and many other biotech breakthroughs, again with the help of far-sighted government and industry support.

AI: The basic technologies of modern AI were invented in the US, with far-sighted investments from big companies (especially Google) and heavy support from the US government. Although the big breakthroughs in the 2010s came as a surprise, US policy has always acted rapidly to make sure that the US has a #1 position in the field.

In other words, the US almost always anticipates each technological revolution, supports that technology with far-sighted government and industry action, invents many of the key technologies, innovates many of the key products, and at least attempts to commercialize the technology via American companies. This is overwhelmingly the norm.

But for batteries, the US did only some of these steps. The potential of batteries doesn’t seem to have been widely anticipated decades in advance by the US media or government.

Battery technology received a bit of support, but not a huge amount. Some of the key invention was done in the US, but more was done in Japan and the UK, and the key products were innovated and successfully commercialized in Japan.

And in recent years, it has been the People’s Republic of China that has seized the lead in battery technology. China is the leader in battery manufacturing, of course, just as it is the leader in solar manufacturing. That has allowed China to electrify its economy much faster than the rest of the world:

But in batteries, China is pushing the boundaries of what’s possible. CATL, China’s leading battery company, appears to have invented a new kind of semi-solid lithium-ion battery that has enough energy density to power an airplane.

The country is launching a big effort to invent the first commercially viable solid-state batteries. There are various other cutting-edge efforts happening in the country as well.

This is not to say that China anticipated the battery revolution well in advance either. But had the US done so, we might have had a bigger head start on China.

So why did the US fail to anticipate this one technological revolution, while catching all the others? Maybe no country gets a perfect 1.000 batting average. But when I asked this question in my thread, I got a number of interesting hypotheses in the replies.

Hypothesis 1: Supply chains

The first hypothesis, suggested by Glenn Luk and some others, was that innovation in batteries comes from supply chains. Battery manufacturing is dominated by China, since it’s a low-margin, capital-intensive, heavily polluting industry.

China also dominates the upstream primary industries that create the components and materials used in batteries — graphite mining and processing, lithium processing, and so on. And China dominates the downstream electronics industries — consumer electronics, drones, and now EVs — that use lots of batteries. These factors probably helped China innovate faster than America in the space.

When you control the upstream industries that feed into batteries, you’re able to get cheaper inputs. That allows faster iteration and cheaper experimentation.

When you control battery manufacturing itself, you have a lot of knowledgeable battery engineers and scientists who sit around thinking about ways to make batteries even better. You also have big dominant companies like CATL who are motivated to invest in basic battery R&D.

And when you control the downstream electronics industries that use batteries, you get better and faster input about what kinds of battery breakthroughs would be most useful. This helps steer the direction of innovation.

I generally buy the “supply chains” hypothesis for why China is innovating faster than America in batteries right now. But it can’t easily explain why the US paid insufficient attention to the technology before it was commercialized, back in the 1980s and 1990s.

All of the points above are equally true about solar power, and yet Americans have been excited about solar power for many decades, while arguably they’re not even that excited about batteries right now.

Also, the US has long been dominant in the design of phones and laptop computers, which are some of the most important downstream industries that use batteries. And for many years, the US was dominant in EV manufacturing too, thanks to Tesla. It’s worth asking why that didn’t give the US the opportunity to steer battery innovation more than it did.

Hypothesis 2: Political and industrial opposition

Matt Yglesias suggested that Republicans blocked America from making a big push for batteries during the Obama years. In general, Americans will turn anything into a culture war, and there certainly does seem to have been quite a lot of battery-skepticism from the right:

Many others suggested opposition from oil companies. It is true that oil companies have tried to discourage adoption of electric vehicles, which probably held back an important downstream industry to some degree. But I can’t find information about whether they also tried to stop battery research.

Anyway, opposition from Republicans and oil companies is plausible, but there are reasons to doubt that this is a full explanation either. For one thing, the Department of Energy, the National Science Foundation, and other government granting agencies are neither partisan Republicans nor in thrall to Big Oil.

Neither are America’s major newspapers, TV stations and other media outlets. And yet these actors also weren’t as excited about batteries as they should have been.

Also, GOP and oil-company opposition was probably even stronger in solar, and that didn’t stop America’s writers, researchers, engineers, and bureaucrats from maintaining a strong interest in it for decades. Batteries, in contrast, were an afterthought.

Also, it’s worth noting that despite GOP domination and a strong oil industry presence, the state of Texas is charging ahead with battery storage — beating out even California:

Source: Cleanview

This may represent a sea change from 10 or 20 years ago, but I have my doubts.

Hypothesis 3: A few bad bets and some unfair competition

Much of the discourse around America’s difficulties in the battery industry revolves around the story of A123 Systems. This was a promising battery startup in Massachusetts that received a lot of support from the US government, but ultimately failed and was sold to a Chinese company in 2012.

Sam D’Amico of Impulse (the guy who made the super-powered battery stove) argues that A123’s failure, in addition to some other smart bets by Chinese manufacturers, was decisive in China pulling ahead:

Jigar Shah, the director of the Loan Programs Office at the Department of Energy, wrote a thoughtful thread in response to my own thread. He thinks that technology theft was another key reason for A123’s demise:

He also points out that like in solar, China subsidizes its producers to produce both batteries and EVs below cost, making it very hard for other countries’ companies to stay in those markets:

A number of other people also pointed out the case of a cutting-edge battery technology, invented in the US, that the Department of Energy licensed to China — undercutting American startups that were trying to use it, and strengthening China’s own industry.

These examples are all concerning and should prompt changes in how the US handles R&D, industrial policy, and technology licensing. They all help explain how China has managed to take the lead in batteries and related technologies.

But they don’t really explain why concerted efforts at battery research got started so late in the US, or why these efforts have still received only modest funding, or why the media and scientific establishment generally failed to anticipate how big of a deal batteries would be.

Although other countries — Germany, Japan, the USSR — all laid claim to the mantle of “country of the future” at various times throughout the 20th century, there was never any real doubt that the title still belonged to the US.

America had the institutional competence, market size, industrial prowess, and cultural foresight to almost always see the Next Big Thing well before it hit the shelves. But as the failure in batteries shows, the mantle of “country of the future” is not America’s by birthright.

The US didn’t totally miss the battery revolution – it did eventually start supporting some research and some companies and excitement built gradually.

But given the fact that batteries are pretty much the only way of storing energy in a portable form (to be joined by synthetic fuels at some unspecified point in the future), it seems pretty obvious that the US should have gotten a lot more excited about them a lot earlier than it did.

All of the potential explanations for why America didn’t see the potential of a battery-powered future, as it had seen the potential of so many other transformative technologies, fall short in some way. The true answer remains something of a mystery.

Whatever the reason, though, the US should respond by A.) playing catch-up in batteries the way we caught up to the USSR in space in the 20th century, and B.) making sure our scientific, governmental and media institutions aren’t broken in some way that causes them to miss other revolutions coming down the pipe.

This article was first published on Noah Smith’s Noahpinion Substack and is republished with kind permission. Read the original here and become a Noahopinion subscriber here.

.jpg) According to the Priority Economic Deliverable 2025,” We are thrilled to announce our main Cradle deliverables.” Each of these deliverables has been carefully selected to address both regional and local issues. By acting as one entity, we hope that all Asean Member States can draw on our shared strengths, address common difficulties, and create a vibrant ecosystem that benefits all member states. Our concerted efforts will help us secure a prosperous and sustainable future, according to Cradle Group CEO Norman Matthieu Vanhaecke ( pic ).

According to the Priority Economic Deliverable 2025,” We are thrilled to announce our main Cradle deliverables.” Each of these deliverables has been carefully selected to address both regional and local issues. By acting as one entity, we hope that all Asean Member States can draw on our shared strengths, address common difficulties, and create a vibrant ecosystem that benefits all member states. Our concerted efforts will help us secure a prosperous and sustainable future, according to Cradle Group CEO Norman Matthieu Vanhaecke ( pic ).

Fuqaha’s words are n’t just rhetoric – they’re born from experience. The rise and fall of DriveMark, one of the bank’s first advances, was perhaps best illustrated by the company’s own trip, which is punctuated by calculated dangers and proper pivots.

Fuqaha’s words are n’t just rhetoric – they’re born from experience. The rise and fall of DriveMark, one of the bank’s first advances, was perhaps best illustrated by the company’s own trip, which is punctuated by calculated dangers and proper pivots.