DNB leads the digital transformation of Malaysian manufacturing with 5G and AI

- Visitors explored 5G’s impact on manufacturing with situation reports &, operations

- DNB, KPJ Healthcare signed an MoU to observe 5G for better care &, performance

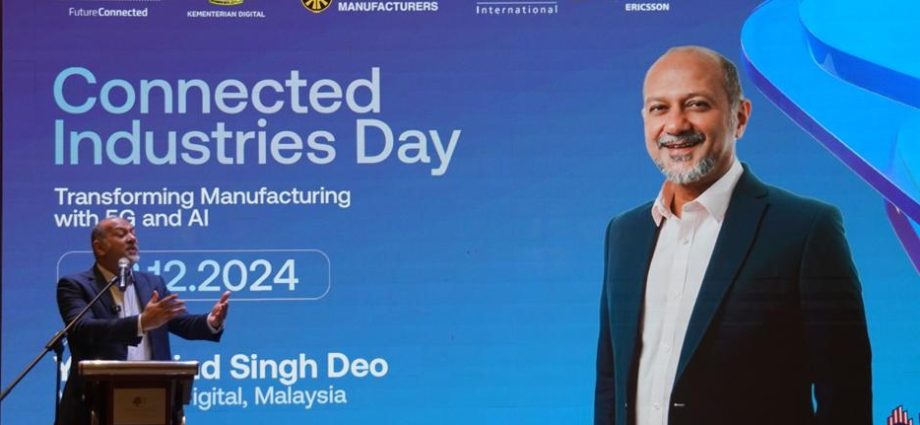

Digital Nasional Berhad ( DNB), in collaboration with China Mobile International, ZTE, and Ericsson, and supported by the Federation of Malaysian Manufacturers, hosted the” Connected Industries Day: Transforming Manufacturing with 5G and AI” workshop. This second installment of the series aimed to inspire Johor-based manufacturers in the Southern region to embrace digital products.

Held at the DoubleTree by Hilton, the factory was inaugurated by the chancellor of Digital, Gobind Singh Deo. State and federal government representatives from the production and technology sectors were present at the full-day function.

Through interactive classes and discussions, the occasion provided a crucial forum for business leaders, website experts, and stakeholders to influence the direction of manufacturing. Participants presented case reports of 5G Shop applications and illustrations of 5G answer deployments that increased operational efficiency, demonstrating the transformative potential of 5G in production.

In his handle, Gobind underscored the importance of modernization, technology, AI, and 5G in revolutionising Johor’s manufacturing industry. He remarked,” As a major hub for modernization in the country, with 13 information areas spanning over 1.65 million square feet, Johor is poised to get billions in foreign funding. It is crucial for state-owned businesses to adopt 5G use cases and electronic solutions to fully exploit this possibility.

DNB CEO Azman Ismail highlighted the organisation’s development in deploying a world-class 5G network foundation, which presently covers over 80 % of Malaysia’s filled areas—a full time ahead of schedule. He added,” Our 5G system is recognized by Ookla, the online tests and testing company, as one of the fastest and most consistent world. We have even earned accolades from OpenSignal, Global Telecom Awards, and FutureNet for functionality and creativity, showcasing our network’s eagerness for 5G-Advanced systems”.

He added,” As we transition to a dynamic, dual-network environment, DNB remains committed to supporting the Government’s online mission by driving 5G implementation to stimulate economic growth and change how Malaysians live, learn, function, and play”.

Additionally, DNB and Johor Corporation’s subsidiary KPJ Healthcare Bhd exchanged a Memorandum of Understanding. This collaboration seeks to harness 5G technology to improve healthcare services, enhance operational efficiency, and deliver better patient outcomes.

In addition, DNB conducted research with regional municipal mayors and city councillors to look into potential smart city transformation opportunities. This initiative builds momentum towards the Smart City Expo 2025, scheduled for the end of next year, in conjunction with Malaysia’s Asean Chairmanship.