CBRE hires Hugh Macdonald as Apac head of capital advisers | FinanceAsia

CBRE, a US real estate and investment firm, has appointed veteran investment banker Hugh Macdonald as head of capital advisers for Asia Pacific.

Starting his role in Sydney on November 18, Macdonald will relocate to Singapore in the first quarter of 2025, according to a company media release.

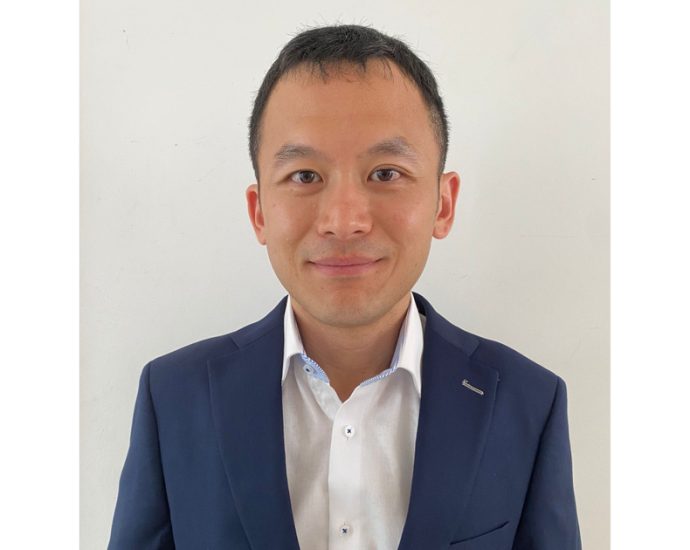

Macdonald (pictured) is joining CBRE from Deutsche Bank, where he was most recently head of investment banking coverage and advisory for Australia and New Zealand. He was at the German bank for over 16 years, according to his LinkedIn profile.

He has previoulsy worked at Citi, Morgan Stanley and Bankers Trust, and has experience in real estate, gaming, leisure, and lodging sectors across M&A, financing, and capital markets.

Macdonald has originated and executed many large transactions across Apac and will report to Leo van den Thillart, global head of investment banking, and Greg Hyland, head of capital markets, Apac.

Commenting in a media release, Hyland said: “Our capital advisors business has experienced exceptional growth in Apac, raising over $3.5 billion of capital in the past 18 months. With Hugh’s established relationships, we are confident in expanding our investment banking services across the region, providing top-tier capital markets, M&A, and strategic solutions to our clients.”

Macdonald added: “I’m eager to collaborate with my new colleagues to enhance the value we provide to our clients, meeting their diverse capital requirements and driving business growth throughout the Apac region.”

For more FinanceAsia people moves click here.

¬ Haymarket Media Limited. All rights reserved.