SINGAPORE: Singapore and India on Tuesday (Feb 21) launched a real-time link to facilitate cross-border fund transfers between bank accounts or e-wallets, using mobile phones.

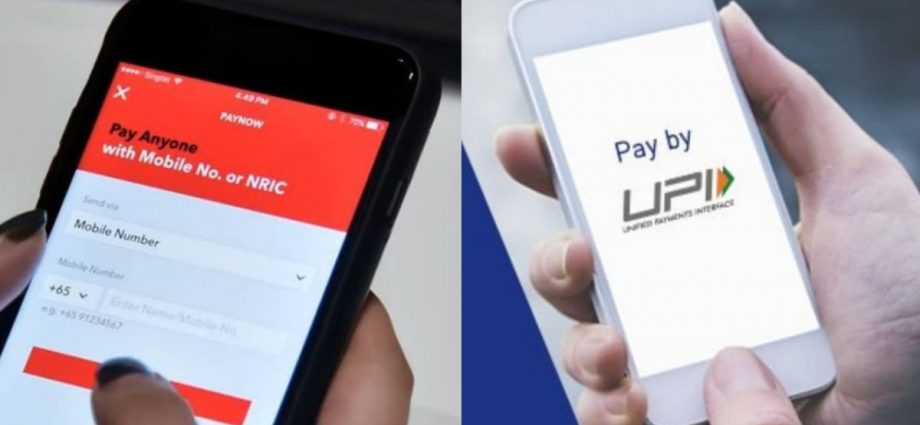

This is possible through a tie-up between Singapore’s PayNow facility and India’s Unified Payments Interface (UPI).

Customers of participating financial institutions can transfer funds using just their mobile phone number, UPI identity or Virtual Payment Address.

“The linkage provides customers with a safe, simple and cost-effective way to make cross-border fund transfers,” said the Monetary Authority of Singapore (MAS) in a media release.

In Singapore, the service will be made available in phases to customers of DBS and fintech company Liquid Group.

For a start, selected DBS customers will be able to transfer funds of up to S$200 per transaction, capped at S$500 per day. By Mar 31, the service will be available to all DBS customers, who may transfer funds of up to S$1,000.

In India, four banks – State Bank of India, Indian Overseas Bank, Indian Bank and ICICI Bank – will facilitate both inward and outward remittances to begin with, while Axis Bank and DBS India will facilitate inward remittances.

A user in India can remit up to 60,000 Indian rupees (US$725) a day for a start.