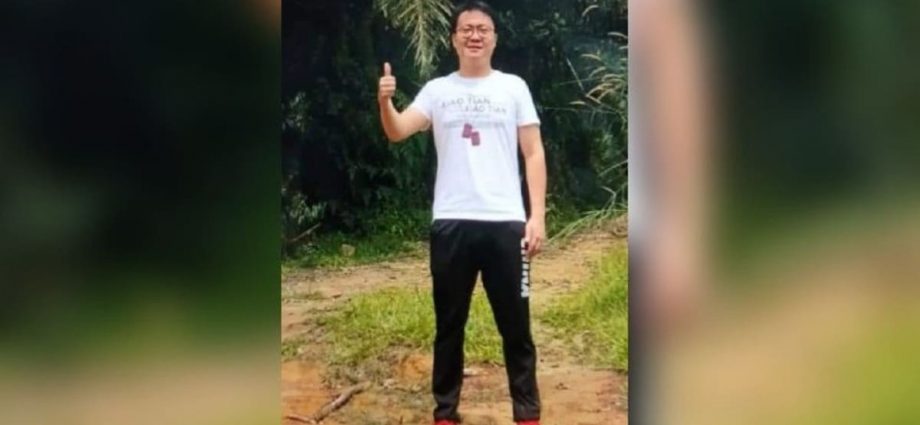

Search ongoing for Singaporean hiker missing in Kota Tinggi forest reserve: Johor police

Rescue operations had been suspended on Saturday night due to darkish conditions but efforts to relocate Jerrika Ren Jie possess resumed on Weekend.Continue Reading

Singaporean hiker who went missing in Kota Tinggi forest reserve found safe with minor injuries: Johor police

Jason Ren Jie was discovered along the Kota Tinggi-Mersing Highway, according to the Kota Tinggi police main.Continue Reading

Russia’s security chief begins two-day visit to China on Sunday

BEIJING: Russian Security Council secretary Nikolai Patrushev will hold security consultation services and meetings throughout a two-day visit to China and taiwan starting Sunday (Sep 18), China’s international ministry said. Patrushev may attend the 17th round of China’s Russia strategic safety consultations and the seventh meeting of the China-Russia lawContinue Reading

UN condemns ‘shameful’ year-long ban on Afghan girls’ education

KABUL: The United Nations advised the Taliban on Sunday (Sep 18) to reopen high schools for girls throughout Afghanistan, condemning the particular ban that started exactly a year ago since “tragic and shameful”. Weeks after the Taliban seized power in August last year, the hardline Islamists reopened higher schools forContinue Reading

Powerful earthquake hits southeast Taiwan, tsunami warning issued

TAIPEI: A 6. 8 magnitude earthquake hit the sparsely filled southeastern part of Taiwan on Sunday (Sep 18), the island’s weather bureau mentioned, with some initial reports of damage including a derailed teach carriage, and sparking a tsunami caution. The weather bureau said the epicentre was in Taitung county,Continue Reading

Powerful earthquake hits southeast Taiwan, collapsing building

TAIPEI: The 6. 8 degree earthquake hit the sparsely populated southeastern part of Taiwan upon Sunday (Sep 18), the island’s weather bureau said, derailing train carriages plus causing a comfort store to fall. The elements bureau said the epicentre was in Taitung county, and adopted a 6. 4 magnitudeContinue Reading

Govt revokes contracts with 9 private hospitals over fraudulent claims

The National Health Security Workplace (NHSO) has decided to revoke its agreements with nine private hospitals in Bangkok because they allegedly filed false claims for repayments for their services underneath the universal healthcare system.Continue Reading

27 people killed in China COVID-19 quarantine bus crash

BEIJING: Twenty-seven people died en route to a COVID-19 quarantine facility when their bus crashed in southwest China on Sunday (Sep 18), local authorities said, in the country’s deadliest road accident this year. The crash took place on a highway in rural Guizhou province when the vehicle carrying 47 peopleContinue Reading

27 killed after bus overturns on highway in southwest China

BEIJING: A tour bus crash killed 27 people and hurt a further 20 once the vehicle rolled more than on a highway within southwest China’s mountainous Guizhou province, local police said in a statement on Weekend (Sep 18). The incident took place in the early hours of Sunday morning inContinue Reading

Boy, 14, beaten to death for alleged theft

CHON BURI: Police are looking for a team of four young men who have been said to have beaten a 14-year-old boy to death in Bang Lamung area of this coastal province.Continue Reading