Kenneth Jeyaretnam issued fifth POFMA order over comments on government spending, Ridout Road rentals

“NIRC, combined with operating revenue, form the total revenue that is used to meet annual public spending and contributes to the government’s overall fiscal position,” it said. “The NIRC has provided an annual revenue stream of about 3.5 per cent of gross domestic product (GDP) on average over the past fiveContinue Reading

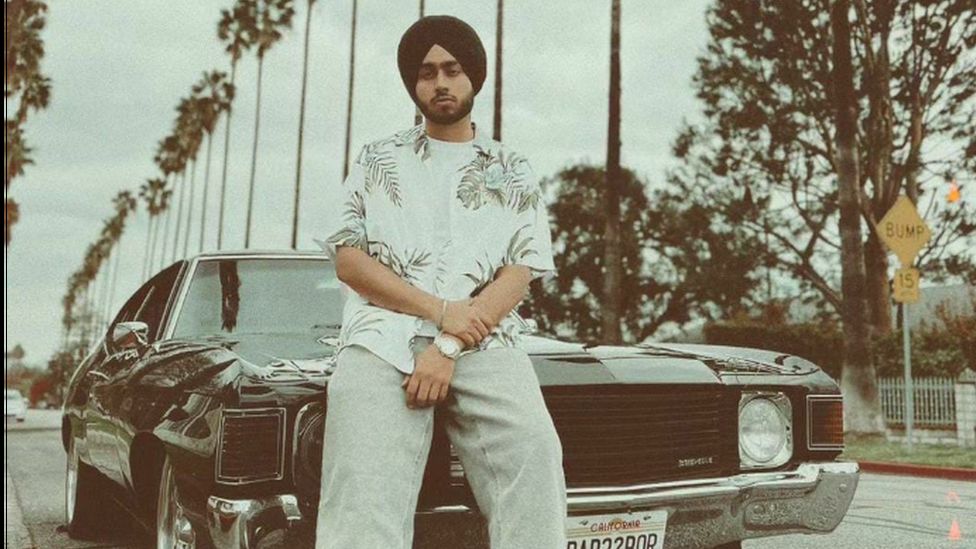

Shubhneet Singh: Punjabi rapper faces heat over concert hoodie

Instagram

InstagramPopular Punjabi rapper Shubhneet Singh has asked people to stop spreading “hate and negativity” after a controversy broke out over a hoodie he held up at a concert in London.

Some Indian social media users claimed the hoodie had imagery supporting the Sikh separatist movement.

The Canada-based singer said a fan threw it at him and he did not see what was on it before displaying it.

The issue of Sikh separatism is a sensitive topic in India.

The rapper – known to fans as Shubh – has previously been in controversies over the issue.

In September, his India tour was cancelled after a row over an old social media post where he had shared an incorrect map of India. He was accused of supporting the demand for Khalistan, or a separate Sikh homeland – which had led to a violent insurgency in India in the 1980s. At the time, he had asked his critics to “refrain from naming every Punjabi as a separatist or anti-national”.

That row occurred soon after ties deteriorated between Delhi and Ottawa – Prime Minister Justin Trudeau said his country was investigating the potential involvement of Indian government agents in the murder of a Sikh separatist leader in Canada, an allegation India angrily denied.

Canada has the largest population of Sikhs outside India’s Punjab state, and is home to popular Punjabi diaspora musicians such as Shubh.

The recent controversy began after Shubh’s weekend concert in London – videos that began circulating on X (formerly Twitter) show him picking up a black hoodie from the floor and holding it up to the audience.

Critics said the hoodie showed the map of Punjab, along with a drawing of India’s former prime minister Indira Gandhi being shot dead.

Gandhi was assassinated by her Sikh bodyguards in 1984, months after the Indian army stormed the Golden Temple, Sikhism’s holiest shrine, in Amritsar to flush out separatist militants who were inside.

It’s difficult to clearly establish the image on the hoodie from the hazy videos that are currently online.

On Tuesday, the rapper put up a statement as an Instagram story, where he said that “a lot of clothes, jewellery and phones were thrown at me by the audience at my first show in London”.

“I was there to perform, not to see what got thrown at me and what is on it.”

He has received support from fans who have shared videos from his other shows, where he can be seen picking up items thrown on the stage and displaying them to the audience.

BBC News India is now on YouTube. Click here to subscribe and watch our documentaries, explainers and features.

Read more India stories from the BBC:

3 men jailed after coming to Singapore to steal from donation boxes at churches, temples

SINGAPORE: Three men from China came to Singapore to steal from churches and temples using a “fishing” method they had learnt from Douyin videos.

Zou Fangshou, 32, Qin Xiaonuo, 29, and Qin Chaoban, 38, were sentenced to seven months’ jail each on Thursday (Nov 2).

They each pleaded guilty to one charge of theft with common intention, amounting to S$1,479 (US$1,082) in cash shared among them and smaller amounts of other currencies such as US and Hong Kong dollars.

The court heard that the trio had watched Douyin videos in China about how to steal from a donation box.

The method featured a string that was tied around a piece of metal, with sticky tape pasted on it. When the piece of metal with sticky tape was lowered into the hole of a donation box, money bills would stick to the exposed sticky part of the tape, allowing one to “fish” for money bills.

Zou bought a black bag in China that had a hole and a zipper. It was modified to cover up the action of stealing, as the thief would place the bag over the mouth of the donation box and pretend to be rummaging through the bag, when in reality he was fishing for money.

The trio arrived in Singapore on social visit passes on Sep 6 this year. They bought pieces of metal, string and tapes from shops near their hotel and returned to their room to practise the method.

On Sep 7 and Sep 8, Zou used his mobile phone to locate churches and temples in Singapore to steal from. The three of them then took taxis to their targeted locations.

Over the two days, the trio visited three churches, two temples and one monastery in places like Thomson Road, Punggol and Woodlands.

They took turns to “fish” for money from the donation boxes and to keep a lookout, communicating with each other using their mobile phones.

Closed-circuit television cameras caught them stealing from the donation boxes.

Several employees in the places of worship noticed the three men who were loitering suspiciously and looking around, and they made police reports.

The photos of the three men were also shared in a WhatsApp chat group containing church staff and volunteers across Singapore, warning each other about them.

At the Church of the Transfiguration, Zou realised that an employee was watching the three of them and felt that something was wrong.

Afraid of getting caught, Zou threw the makeshift fishing device into the river to dispose of the evidence.

Once they felt they were in the clear, Qin found another wooden stick, intending to use it for subsequent “fishing” operations.

The police traced the three men back to their hotel and arrested them.

They seized multiple items from the trio, including their clothes, the stick, the phones used, the black bag with the hole at the bottom, and money in various currencies. Many of the notes had a sticky substance on them.

The three men admitted to stealing S$1,479, US$16, RM 63, 26.05 yuan, CAD$10, HK$100 and 100 Omani Baisa from donation boxes.

They said they had already spent some of the stolen money on their expenses such as taxi fares. No restitution has been made.

Deputy Public Prosecutor Jocelyn Teo sought seven to nine months’ jail each for the three men, saying it was necessary to prevent foreigners from seeing Singapore as an easy target to perpetrate crimes.

There was a transnational element to their crimes, and they were group offences, with six places of worship visited in two days.

In mitigation, the men asked for leniency. In particular, Zou admitted to his guilt and said he did not know the law, asking for leniency. The judge asked him if stealing from a temple in China would be correct.

Analysis: Scandals involving Indonesiaâs anti-corruption chief a test of Jokowiâs commitment to fighting graft

Another senior official charged with graft was Henri Alfiandi, the disgraced chief of the national search and rescue agency, a non cabinet position but is directly appointed by Jokowi.

His case is still being investigated by the military police, as Henri is an active Air Force general, and it has not moved to trial.

Mr Fickar of Trisakti University said Jokowi must take the selection process of strategic public posts seriously. Equally important is how these positions are monitored and supervised.

“In the case of the KPK, these supervisions must be double or triple the strictness compared to other institutions because the KPK is supposed to be a model of what a clean and transparent public institution in Indonesia should look like,” he said.

“The fact that a person like Firli can get away with so many ethical violations and misconduct for so long shows that there is something wrong with how KPK officials are monitored.”

The KPK is supposed to be scrutinised by a supervisory committee, all five members of which are also vetted and nominated by a presidentially appointed selection committee.

But Mr Kurnia of Indonesia Corruption Watch said the supervisory committee is moving too slowly and its sanctions too weak.

“Firli is a repeat offender and yet every time he was found guilty of violating the KPK’s ethics code, he got no more than a written reprimand,” he said.

The committee, Mr Kurnia added, should have been more firm towards Mr Firli, who kept snubbing orders to appear before the ethics tribunal, delaying the committee’s investigation process.

“Firli met a person of interest who was the subject of corruption probe. That is a clear violation of the ethics code. What more (evidence) does (the committee) need?” he said.

Singapore warns foreigners against using country to further political causes amid Israel-Hamas war

SINGAPORE: Singapore’s government agencies on Thursday (Nov 2) reminded foreigners working or living in the country to not use it as a platform to further their political causes, amid the ongoing war between Israel and militant group Hamas.

“Given the heightened tensions, it is important that we remain calm and not let these external events affect the racial and religious harmony and peace in Singapore,” the Manpower Ministry (MOM) said in a Facebook post.

“We would also like to remind everyone to engage in responsible and respectful discussions on this sensitive topic.”

A joint advisory by MOM, the Ministry of Home Affairs and Internal Security Department reiterated Singapore’s zero-tolerance approach against extremism, violence or terrorism.

Foreigners in Singapore were also asked to “not support or import foreign politics”, including through the public display of materials such as banners, flags and posters.

They were reminded not to write, post or share any information in-person or online that may “stir up emotions that result in violence or cause hatred among different races or religion”.

“Doing so is an offence and punishable under Singapore law. Offenders may be banned from working in Singapore,” the advisory read.

It also called on the foreign workforce to not speculate or spread unverified information “that may cause discomfort to others”.

Those who wish to donate to help victims of the conflict were advised to use official channels such as the Singapore Red Cross or the Rahmatan Lil Alamin Foundation.

Hacker of 100 govt sites nabbed in Chiang Rai

Suspect used hacked sites to display links to his illegal online sites

PUBLISHED : 2 Nov 2023 at 16:43

A hacker accused of breaking into at least 100 government websites has been arrested in the border district of Mae Sai in Chiang Rai, police said on Thursday.

The suspect, identified only as Warakorn, was caught as he was about to cross into Myanmar, said Pol Col Niphaphon Sukniyom, superintendent of Metropolitan Police Division 8 in Bangkok.

According to Pol Col Niphaphon, the suspect hacked many government websites and used them as the main domain for operating his illegal websites.

Typically, illegal websites are automatically blocked from Google search, while government agency websites can usually be found on the first page of search results.

By gaining access to the agencies’ websites, the hacker was able to exploit their prominence to advertise illegal websites. The illegal links were damaging to the agencies and also confused the public, said Pol Col Niphaphon.

To make matters worse, the investigation showed the suspect also opened bank accounts to receive money from the gangs that hired him to hack into the websites, he added.

Mr Warakorn was being detained for further questioning. Police have advised state agencies to regularly check their websites, especially those that have been dormant for some time, for any suspicious access.

If a website displays an illegal advertisement, it may have been hacked. The agencies should immediately address the problem or alert the authorities, said Pol Col Niphaphon.

Indonesia’s Jokowi to push for domestic seaweed processing, including for fuel

JAKARTA: Indonesia President Joko Widodo on Thursday (Nov 2) said the government will push for the development of a domestic seaweed processing industry, including for the production of fuel. Speaking at a business conference, Jokowi, as the president is known, said he will implement downstream policy for other commodities afterContinue Reading

Li Keqiang: China bids quiet farewell to popular ex-premier

EPA

EPANational flags flew at half-mast across China on Thursday as the country put its former premier Li Keqiang to rest.

Li, whose body was moved to Beijing from Shanghai where he had died of a heart attack on 27 October, was cremated.

Pictures show crowds gathered along the streets as a convoy said to be carrying his body drove past.

Muted state coverage of his funeral stands in contrast to the outpouring of sorrow among ordinary Chinese.

Li, 68, was once tipped to be China’s future leader. But he was overtaken and then swiftly sidelined by Xi Jinping, who has centralised power in his own hands during his more than 10 years at the helm.

State news agency Xinhua issued a statement on Thursday afternoon accompanied by a picture of Mr Xi offering condolences to Li’s widow Cheng Hong.

In an obituary published last Friday, China’s Communist Party described Li as a “time-tested communist soldier” and urged the people to “turn grief into strength” and rally around the current leadership of Mr Xi.

Li’s funeral was held at the Babaoshan Revolutionary Cemetery, where his body lay on a bed of flowers and was covered with the Communist Party’s flag. Mr Xi and his wife Peng Liyuan were in attendance, along with new premier Li Qiang and other members of the Politburo Standing Committee, which makes up the top rung of the Party leadership.

Across the country, Li’s sudden death prompted tributes, showing warm praise and grief. While some analysts say Li’s track record as an administrator was uneven, they believe people are mourning as much for the man as the loss of what China could have been under his leadership.

“The public outpouring of grief for Li reflects the mourning of some Chinese people for a more open and optimistic time, before Mr Xi steered the country in a more authoritarian, statist, and nationalist direction,” said Neil Thomas, fellow for Chinese Politics at Asia Society Policy Institute.

He adds that the the public reaction to Li’s death is especially strong because he died soon after leaving office.

Li served as China’s premier for a decade until March this year. A trained economist, he entered Chinese elite politics at the young age of 28 and rose through the ranks to become the youngest provincial governor in China. His ascent in the Party was particularly noted given he had no power base and was not a “princeling” like many Chinese leaders whose fathers were high-ranking officials. Mr Xi’s father, Xi Zhongxun, was the first secretary-general of China’s State Council.

Li was known for being pragmatic rather than ideological in his economic policies, with a focus on reducing the wealth gap and providing affordable housing. But he struggled to implement reforms under Mr Xi, whose leadership saw the party taking a firmer grip of China’s economy, which has increasingly raised concerns among foreign businesses.

Li was best-known outside of China for the Li Keqiang index, a term coined by The Economist to measure China’s true economic growth, after Li described his country’s gross domestic product figures as “man-made” in a private meeting with US officials.

Kyle Jaros, a professor on global affairs at the University of Notre Dame, says the Chinese public tends to feel a closer affinity to premiers whose mandates involve more domestic issues – as was the case with Li who often spoke of China’s challenges, including jobs and cost of living.

In the days since Li’s death, crowds of mourners have laid thousands of chrysanthemum bouquets across the country – including in Zhengzhou, the capital city of Henan where Li once served as the top provincial official, and around his childhood home in the city of Hefei in Anhui province.

Many bouquets had cards bearing Li’s words, including his parting words to the State Council, China’s cabinet, when he stepped down in March: “The heavens are looking at what humans are doing. The firmament has eyes.”

“Sometimes to praise the path not taken is to make a comment on the path that was taken… Li represented a top leader who looked out for the little guys. He made them feel ‘seen’,” says Wen-Ti Sung, a political scientist at the Australian National University who studies China and Taiwan.

By the time he retired, Li was the last of the top Party leadership who was not handpicked by Mr Xi. In an attempt to crush the once-powerful Youth League faction that Li hails from, Mr Xi sidelined him. He left Li and former vice-premier Wang Yang out of the Party’s top decision-making body in a twice-a-decade leadership reshuffle last year.

The decision came days after Xi’s predecessor Hu Jintao, who is part of the same faction, was asked to leave the Communist Party Congress while it was still under way. Mr Hu, 80, patted Li, widely seen as his protégé, on the shoulder as he was escorted out. Li briefly nodded in acknowledgement. Many viewed Mr Hu’s exit as a public display of Mr Xi cementing his hold on power.

There has also been an outpouring of emotion online, despite the authorities’ attempt at managing comments. According to the US-based China Digital Times, which also monitors Chinese censorship, Beijing had ordered platforms and media outlets to “pay particular attention to overly effusive” comments.

In contrast, on Chinese social media platform Weibo, a hashtag related to Li received more than 360 million views and 17,000 comments as of 13:30 local time (5:30 GMT) on Thursday.

Some users commented that this scale of mourning reflects “the highest regard” from the people. “The people know who are really serving them. The premier worked hard. He was too tired,” wrote another Weibo user. Some users described Li as the “people’s premier”, although those comments and the like were swiftly censored.

In Li’s hometown Hefei the BBC encountered difficulty speaking to mourners as local officials and party volunteers interrupted interviews and ordered the crew to leave.

A middle-aged woman who witnessed the commotion told the BBC: “[Li was] a great leader. Why can’t we show it?”

“He’s gone. We are all very sad,” she said and teared up.

While he did not visibly challenge any of Mr Xi’s priorities, prof Jaros says people in and outside of China nevertheless valued his more liberal and less ideological outlook: “He stood as a symbol of a different path that China might have taken.”

Some have labelled Li a “weak premier” who was quickly sidelined, but in death he seems to have become a symbol of quiet opposition to Mr Xi.

Additional reporting by Fan Wang and Ian Tang

Related Topics

Two more officials sought for helping prison escapee

Accused getaway driver caught but ‘Sia Paeng Na Nod’ still at large 10 days after fleeing hospital

PUBLISHED : 2 Nov 2023 at 15:16

Arrest warrants have been approved for two public servants in connection with aiding the escape of Chaowalit Thongduang, a prisoner who fled from a Nakhon Si Thammarat hospital on Oct 22.

Police were hunting the unidentified officials after the Nakhon Si Thammarat provincial court on Wednesday night approved the warrants. The pair were expected to turn themselves in to police in one or two days, a police source said on Thursday.

Chaowalit, 37, alias “Sia Paeng Na Nod”, was serving time for attempted murder when he escaped from the hospital on Oct 22. He had been taken there for dental treatment and was subsequently admitted after collapsing, citing severe leg pain. He remains at large.

On Tuesday, police arrested Sutiwas Khunnarong, 28, who is accused of driving the car that took Chaowalit from the hospital, in Ratchaburi province.

Sutiwas, alias Non Thung Lan, was taken to the Muang district police station in Nakhon Si Thammarat for questioning on Wednesday. He initially denied any involvement, but after intense questioning, he admitted to having abetted the escape.

He reportedly told police that he picked up the prisoner from the hospital and drove him away in a car. On the escape route, he switched to a pickup truck and dropped Chaowalit off in an area in the Banthat mountain range in Phatthalung province.

Police were planning to take Mr Sutiwas to the Maharat Nakhon Si Thammarat Hospital on Thursday to show how he helped the prisoner escape.

On Wednesday, a Songkhla provincial prosecutor whose name was not revealed filed a report with police after receiving a life-threatening letter from a friend of Chaowalit.

The letter, dated Oct 27, demanded the prosecutor return money to Chaowalit or he and his family would risk death.

The prosecutor denied personally knowing the runaway prisoner, adding that he had been transferred to work in Songkhla from the Office of Juvenile and Family Prosecution in Phatthalung in April.

Chaowalit was sentenced to 20 years and six months in jail last year by the Phatthalung Provincial Court for attempted murder in connection with an armed attack on police during an attempted abduction on Sept 2, 2019, in Phatthalung.

He began serving his sentence at Phatthalung Prison in January 2022 and was transferred to Nakhon Si Thammarat Prison on Aug 7 this year. He also faces multiple other criminal charges.

Mahua Moitra: TMC MP appears before parliamentary panel over bribery charge

Getty Images

Getty ImagesIndian opposition MP Mahua Moitra is appearing before a parliamentary ethics panel for questioning over her alleged misconduct in parliament.

A fierce critic of Prime Minister Narendra Modi’s government, Ms Moitra has been accused of asking questions in parliament in exchange for bribes.

An MP from the Trinamool Congress party (TMC) of West Bengal state, Ms Moitra strongly denies the allegations.

She has said she is willing to “face any kind of inquiry”.

On Thursday, she appeared before an ethics committee of the Lok Sabha – the lower house of India’s parliament – which started hearing the case last week.

Ms Moitra said she initially asked for time until Saturday citing prior engagements, but the committee “categorically denied” her request “and forced her to appear before it” on a date which clashed with her “constitutional commitments”.

In a letter released on Wednesday, she also questioned whether the ethics committee was the appropriate forum to look into criminal allegations, saying “it does not have criminal jurisdiction and no mandate to investigate alleged criminality”.

“This can only be done by law enforcement agencies,” she added.

The proceedings against Ms Moitra started after a complaint by Nishikant Dubey, an MP from the government Bharatiya Janata Party (BJP).

Mr Dubey has alleged that Ms Moitra asked several questions targeting the Adani group – a business conglomerate owned by Gautam Adani, who is perceived as being close to Mr Modi – in exchange for gifts and cash from a rival businessman Darshan Hiranandani.

The Adani group’s financial dealings came under scrutiny earlier this year after Hindenburg Research – a US-based short seller – accused it of “brazen” stock manipulation and accounting fraud. The Adani Group denied these allegations, calling the report “malicious”.

In his complaint, Mr Dubey claimed that “until quite recently”, 50 of 61 questions Ms Moitra asked in the Lok Sabha were focused on the Adani group and accused her of accepting bribes adding up to 20m rupees ($240,542; £197,700) from Mr Hiranandani.

The BJP leader alleged he had received “irrefutable evidence” against Ms Moitra from an advocate named Jai Anant Dehadrai – whom Ms Moitra has described as a “jilted ex”.

On 19 October, Mr Hiranandani also submitted an affidavit before the ethics committee, accusing the TMC leader of targeting Mr Adani “for becoming famous”.

Ms Moitra, who strongly denies every allegation, has questioned the authenticity of the affidavit. She has also filed defamation cases against Mr Dubey and Mr Dehadrai in the Delhi high court.

In her statement on Wednesday, she demanded that the parliamentary panel should allow her to cross-question Mr Dehadrai and Mr Hiranandani.

She said that neither of them “have given any documentary proof to back the allegations of bribery” against her and that any inquiry without giving her the chance to cross-question them would be “incomplete and unfair”.

Read more India stories from the BBC: