PM takes hard line on strife

PUBLISHED: 21 October 2023 at 4:00 p.m.

NEWSPAPER SECTION: News

At the Asean – GCC Riyadh Summit in Saudi Arabia tuesday, Prime Minister Srettha Thavisin denounced the crime in Israel, which included 30 Thais among the dead.

” I join my colleagues in urging all events to act quickly to put an end to violence and seek a peaceful resolution based on agreements and political indicates.”

We demand that all hostages be returned in a safe, prompt, and absolute manner, with no further casualties. In the end, we want to see peace win ,” Mr. Srettha said.

NACC vows greater scrutiny

PUBLISHED: 4:00 on October 21, 2023.

The government’s 10,000 baht digital money handout scheme is being closely examined, the National Anti-Corruption Commission ( NACC ) announced yesterday. It is also inviting more economic and financial experts to join its inspection of the project.

The NACC stated in a speech released yesterday that it is required to determine whether the project, which is the cornerstone of the ruling Pheu Thai Party, runs the risk of turning into policy-oriented problem, as some have speculated.

The NACC responded immediately and took activity by looking more closely into the scheme, despite the fact that no specifics of how the system will be implemented have been made available. This was due to growing concerns, particularly among senators, about the danger it poses to the president’s financial security, the statement said.

The NACC’s action came after a preliminary investigation it carried out into the digital wallet program, during which all relevant data about the scheme— including — a government policy statement — presented in parliament on September 11 – 12 — had been gathered and examined.

After the Senate invited NACC participant Suwana Swanjuta to a questioning session on this subject on October 10, the first investigation got under way.

Another development is that the Network of Students and People Reforming Thailand, a group, has petitioned the State Audit Office to use its power to halt the job.

The Pheu Thai family’s patriarch, Paetongtarn Shinawatra, urged those eagerly anticipating the plan to exercise patience as the case resolves issues related to its execution.

She was in response to Deputy Finance Minister Julapun Amornvivat’s Thursday note that the implementation of February 1 might be postponed.

BMA to go after old vehicles

PUBLISHED: 21 October 2023 at 4:00 p.m.

70 % of these dangerous dust particles, according to the Bangkok Metropolitan Administration( BMA ) and the government, are caused by vehicle emissions. They have vowed to combat Bangkok’s ultra-fine PM2.5 dust pollution.

According to AirBKK, the BMA’s air quality control center, up to 48 zones in the capital were given the orange color code yesterday, indicating that the dust pollution is at risk of harming peoples’ health. The average level of PM2.5 in Bangkok was 39.8 microgrammes per cubic metre( g / m3 ).

It was suggested that people in these 48 places wear masks to shield themselves from potential health effects.

This issue also exists, according to Bangkok government Chadchart Sittipunt, despite the BMA’s daily efforts to combat dirt pollution for more than a year.

The BMA and the Department of Land Transport may tighten their restrictions on older cars in internal Bangkok, he said, adding that the traffic-related resources of PM2.5 are the most important aspect of this issue.

According to the government, 2, 141 of the 135 000 lorries in Bangkok that have been tested to see if they are causing air pollutants failed the test, 529 of which were cars.

According to government official Chai Wacharonke, heat stagnation, the weather condition blamed for accumulating these extremely fine dust particles in Bangkok’s air, occasionally happens as the rainy season transitions to the cold season.

Stricter settings of aging vehicles that emit waste in Bangkok, according to Deputy Prime Minister and Natural Resources and Environment Minister Phatcharavat Wongsuwan, are a vital step to reduce PM2.5 levels in the area at this time of year when weather slowdown is an ongoing issue.

According to Mr. Chai, the BMA, police, pollution control section, and government of transportation will work together to address the issue.

Review of Prawit case gets rejected

PUBLISHED: 4:00 on October 21, 2023.

The anti-graft organization’s ask for a review of the case involving Prawit Wongsuwon, the former deputy prime minister, was rejected yesterday by the Supreme Administrative Court, which upheld that ruling.

The National Anti-Corruption Commission( NACC ), which had been asked to reveal the specifics of its investigation into the wristwatch controversy to political activist Veera Somkhwamkid, claimed there was no basis for the review requested by the court.

When Gen Prawit did not list 22 luxury watches and jewelry on his list of assets, the NACC ruled 5:3 in December 2018 that there was no evidence to support the claim that he had erroneously declared his money. They belonged to companions, according to Gen Prawit, and had since been given back.

When Gen Prawit was seen wearing a silver Richard Mille RM 029 valued at about 2.5 million ringgit and an engagement ring on December 4, 2017, at an event held at the Government House, the luxury watch investigation was launched.

Mr. Veera petitioned the Supreme Administrative Court for the publication of the information about the investigation after the NACC dismissed the event, and the request was immediately granted.

According to the court’s decision, the NACC was required to give Mr. Veera three sets of data.

Fact-finding information, the anti-graft officials in charge of the case’s opinions, and meeting reports from the NACC were all included in them.

However, the NACC merely provided Mr. Veera with two pieces of information and opted not to share the views of the anti-graft officials in charge.

The NACC secretary-general Niwatchai Kasemmongkol stated in an interview in August that the organization needed to maintain its integrity and that it was necessary to black out the witness names in the documents given to Mr. Veera in order to preserve the witnesses’ personality and dignity.

Narongdej kin find key evidence

The papers in the WEH event” were forged.”

21 October 2023 at 05:35 PUBLISHED

According to a family statement, the Narongdej family — led by the siblings Kris and Korn — as well as their family attorney — provided crucial evidence on Friday that, according to the family, dispelled all prior rumors and established the falsity of Kasem( their father’s ) signature.

In a case that was brought before the Southern Bangkok Criminal Court in 2021 under the name of case 1708 / 2564, the attorney general charged Mr. Nop Narongdej( Mr. Kasem’s middle son ) and Khunying Kokeaw Boonyachinda, Mrs. Kope and Mrs. Sop, for forging several documents and using forged documents.

Mr. Nop asserted that his father was Khunying Kokaew’s choice to buy and transfer the shares of Wind Energy Holding ( WEH ), one of the largest wind farm operators in Thailand, to Golden Music Company, a$ 1 holding company with Hong Kong registration.

This was the principal justification for the Narongdej family’s announcement in 2018 that Mr. Nop had been removed from community affairs in a statement.

Since Mr. Kasem and his household first made it known officially that all of his names had been forged in order to transfer his stocks to Khunying Kokaew, a lot of rumors have been flying around in recent years.

Since then, two major official government organizations— the Criminal Evidence Division of the Royal Thai Police and the Institute of Forensic Science under the Ministry of Justice — have verified and proven Mr. Kasem’s signatures. Checks conducted by both organizations revealed that the names were forged.

The Sale Purchase Agreement ( SPA ) of Wind Energy Holding ( WEH ), an Agency Agreement stating that Mr. Kasem was the nominee for Khunying Kokaew in the purchase of WEH shares, and an Instrument of Transfer claiming Mrs. Kale M. transferred Golden Music Limited shares to him were all deemed to have been forged by the Southern Bangkok Criminal Court on September 28.

A Bought and Sold Note and a Declaration of Trust, in which Mr. Kasem acknowledged that Khunying Kokeaw owned Golden Music Limited stock and any advantages accrued from those securities, were the other files.

The Narongdej mom’s attorney, Picha Pomkai, stated that the main goal of Friday ‘ statement from the home was to tell the truth and demonstrate that they strongly believe in conducting their business ethically. According to his brothers, Mr. Kasem would never have consented to run for Khunying Kokeaw. The community also emphasized that Mr. Kris and Mrs. Korn are the only people in charge of running all family-affiliated businesses. When asked how much harm had been done to the company, Mr. Kris replied that it was numerous because his papa was the one who was hurt the most.

Houthi’s Iranian missiles aimed for US ship, not Israel

It is doubtful that Israel was the target of the Houthis’s release of eight drones and three cruise missiles in Yemen. Instead, the harm was directed at USS Carney, a US destroyer.

The boat rockets fired at the USS Carney, a destroyer of the Admiral Burke class, perhaps lacked the range to hit Israel unless fresh, many longer-range boat rockets have arrived in Yemen. The US Navy has said it is looking into the matter but has not yet stated whether the weapons were fired at the Carney or Israel.

The Carney destroyed eight Naval robots and three cruise missiles. SM-2 missiles fired by the AEGIS air defense system intercepted the boat missile launch. What arms were used to pursue the robots has not been disclosed by the Navy.

The US has not retaliated against the cruise missile and drone strikes, attacked Yemen harshly, or sanctioned Iran, the true origin.

The Houthis have used drones and boat weapons as a strategy in the past to target the Patriot Air Defense System. The US has deployed Patriots there as well, and Saudi Arabia has the Patriot method.

The plan is to disable the Patriot technique by using robots to crash into its scanners. The cruise missiles can either attack the Patriot order facilities or launchers after the transponders are destroyed, or they can pursue various crucial targets since they won’t be able to do so.

In the 2019 attack on the & nbsp, Khurais, and Abqaiq and nfspp, oil installations in Saudi Arabia, Iran used cruise missiles in addition to drones. Either from northwestern Iraq or Persian territory, these were launched. & nbsp,

Instead of the cruise missiles in Iran’s personal army, such as the Soumar, which is based on the Russian KH – 55″ Kent”( the NATO name ), the Iranians used the concept Iran prepared for the Houthis. If launched from Yemen, the Soumar could hit targets in Israel because of its 3, 000 km( 1, 864 miles ) range. In addition, & nbsp,

There is no data on the presence of cruise missiles of the Soumar type in Yemen. The Quds – 1 boat missiles are known to be present in Yemen, as are the Qur’s 1 and 2. The Quds – 2’s range is 1, 350 kilometers( 840 miles ), whereas the Quss – 3 may be 2, 000 kilometers( 1, 243 miles ). & nbsp,

The Quds uses a less potent turbofan website and is somewhat smaller than the Soumar or Kent. Most of a Quds – 2 boat weapon that crashed in the plain was recovered by the Saudis. Due to its larger fuel tank, only the & nbsp, or Quds – 3 & nBSP, has the potential to hit Israeli targets. & nbsp,

The Houthis even have one-way robots, also known as Kamikaze. The Qasef-1 is the most well-known. It is a modified version of the Iranian Ababil-1, but it is now an errant weapons. It has a range of 100 kilometers( 60 miles ), according to published reports. If the eight robots that the Carney destroyed were Qasef 1 models, they were undoubtedly not intended for Israel and were instead directed at the murphy.

The Carney’s precise location have not been made public by the US Navy. It was conducting business in the Red Sea off Yemen’s east coast. Near al Hudaydah, which is approximately half up Yemen’s west coast, is where the majority of Houthi ballistic missiles, cruise missile, and drone launches have historically taken place. The Carney has not disclosed that knowledge, but it can undoubtedly identify the actual launch area.

Seven US stand and services have been attacked in the interim in Iraq and Syria. Missiles and torpedo robots were used in these. Most have been intercepted, but not all. & nbsp,

Given that Hezbollah is an Egyptian proxy, it is certain that Iran gave the go-ahead for these additional attacks in Syria. Pro-Iranian militants, including the Kataib Hezbollah army, carried out the attacks in Iraq. Some US soldiers suffered minor injuries in these attacks, and one US company passed away from a suspected heart attack.

President Joe Biden andnbsp never mentioned Iran in his televised speech on Thursday( October 20 ) evening.

Although Biden undoubtedly wants to avoid conflict with Iran, doing so is challenging given that Iran’s intermediaries are attacking US bases in Iraq and Syria as well as the US Navy. Biden has a significant social issue as well because he provided financial support for Iran while lessening the stress on its nuclear program. & nbsp,

Not just the most recent strikes on US services in the Middle East during the Biden administration have been addressed. These assaults were organized by Egyptian proxies. In addition, & nbsp,

A significant Hezbollah-Syrian assault on Israel is currently underway. Both are Iran’s customers, though Syria even depends on Russia. Israel has already left Kiryat Shmona, which is close to the Syrian border, and is getting ready for a two-front battle. & nbsp,

There is no barrier to the impending conflict because Biden is unable to exert any pressure on Iran or even to notice how Iran is planning the hazard to both Israel and US objectives.

Stephen Bryen, who oversaw the Near East Subcommittee of the

As a lieutenant director of security, the US Senate Foreign Relations Committee, and nbsp

is currently a senior fellow at Yorktown Institute and the & nbsp, Center for Security Policy.

This andnbsp, an essay, was first released on his Substack, Weapons, and Strategy. Asia Times is republishing it with their consent, nbsp.

Carbon ambitions: Inside Cambodia’s REDD+ boom

Additional reporting by Anton Delgado, Meng Kroypunlok, Roun Ry and SourceMaterial

When the Cambodian rainy season turns dirt roads into rutted mud, the villages tucked into rugged folds of the western Cardamom Mountains can feel far from just about everything.

In the Areng Valley, a river-carved flatland in the range sparsely populated by villages of indigenous Chorng people, that includes any semblance of cellular reception.

This means it’s usually best to meet in-person with Reem Souvsee, the deputy chief of the valley’s Chomnoab commune. Otherwise, Souvsee explained, she might get some reception near the roof of her house, or up the neighbouring mountains where local men go to harvest resin from trees to sell for a bit of income.

Despite that isolation, in recent months this stretch of rural communities amongst densely jungled peaks has been pulled into the centre of global debate about carbon credits – a development scheme organised under a U.N.-backed framework called REDD+.

These credits are intended to limit the emissions that cause climate change by preventing deforestation in places like Areng. They’re purchased by major polluters, including some of the world’s largest oil and gas firms, to offset their fossil fuel emissions by essentially sponsoring the protection of forests, in developing countries such as Cambodia.

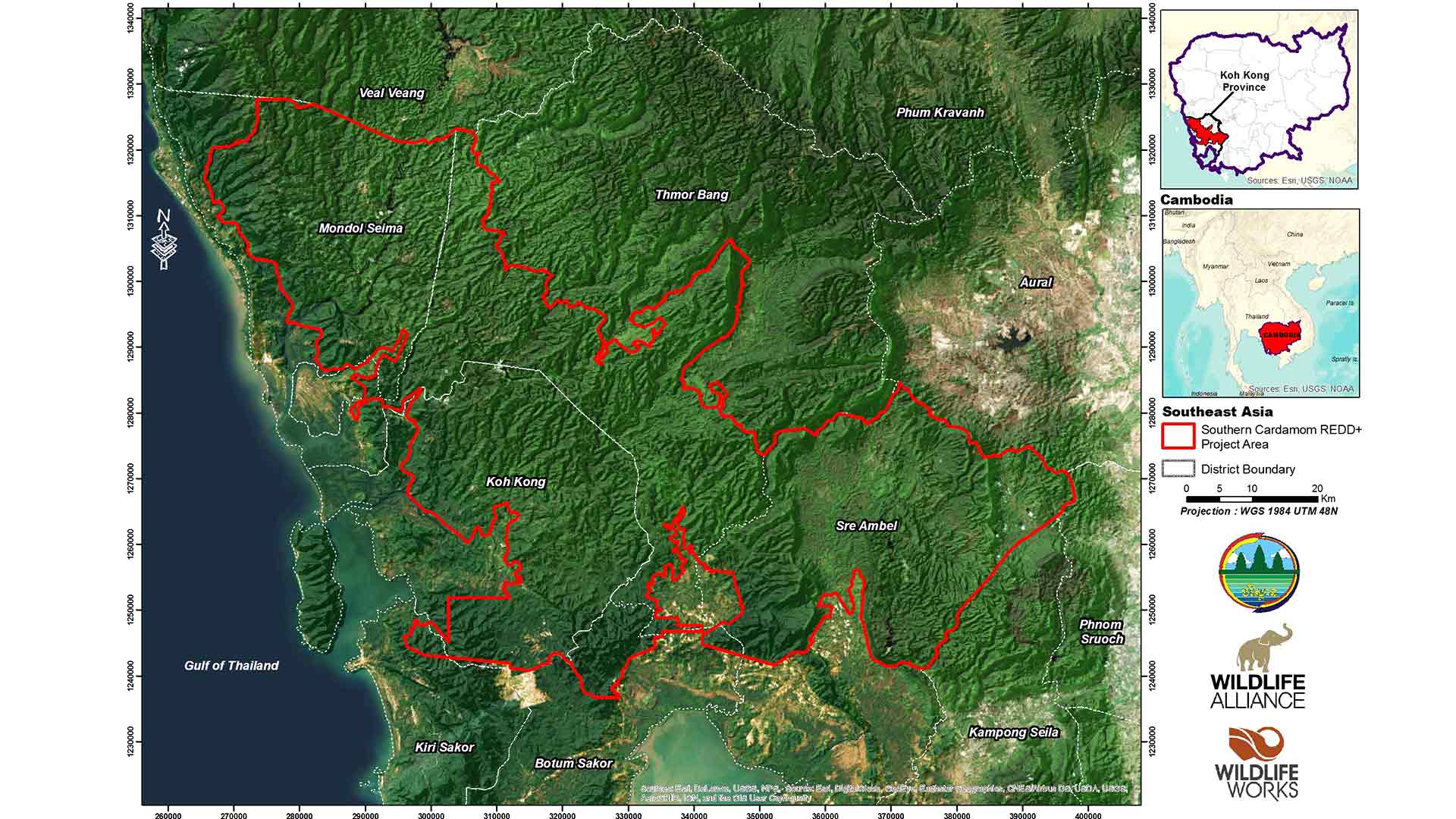

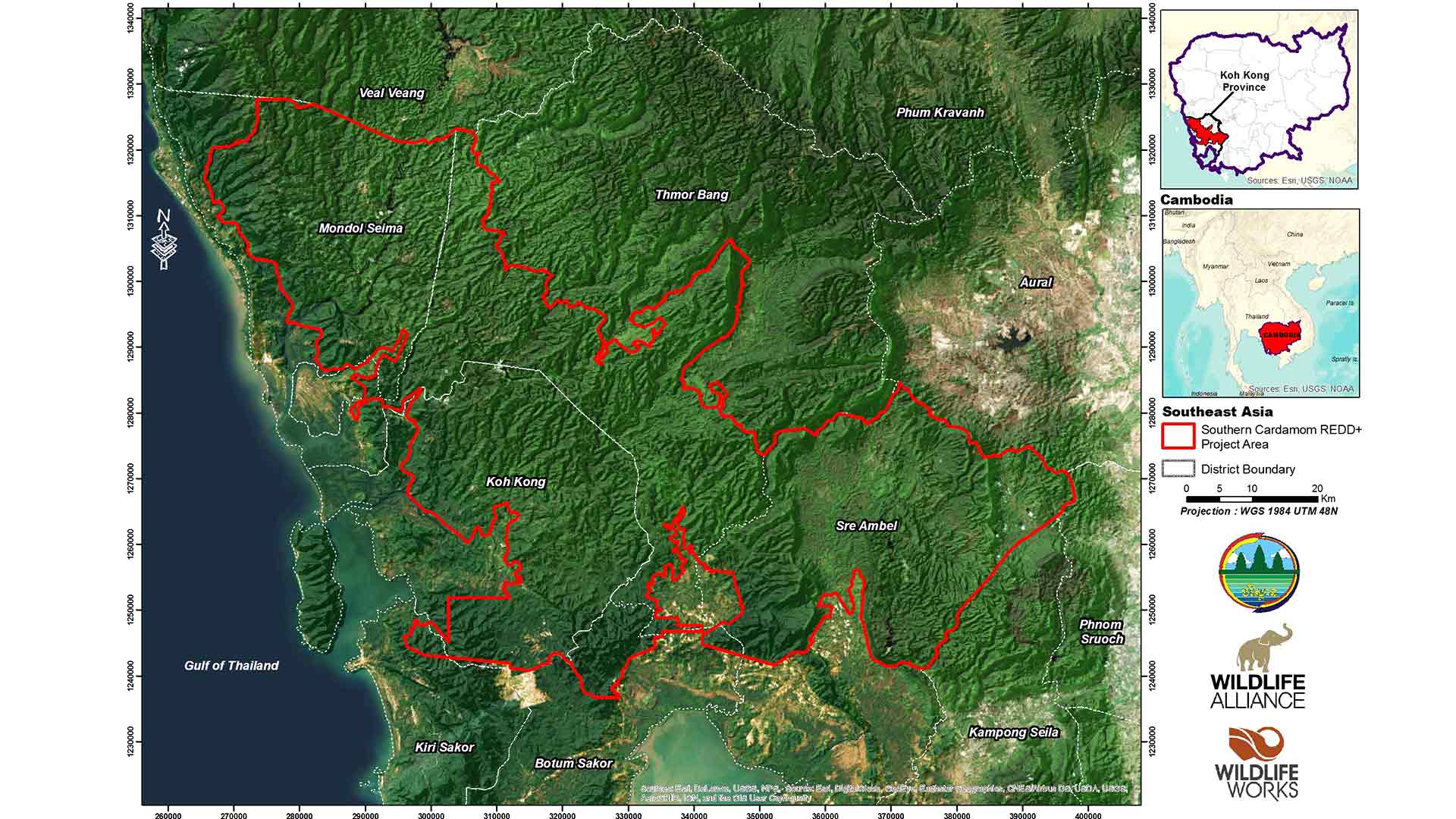

Some of these credits are already coming from the mountains near Souvsee’s home, which lies within the Southern Cardamom REDD+ project. Managed by the nonprofit Wildlife Alliance in partnership with the Cambodian government, the roughly 4,453-square-kilometre project in Koh Kong province includes portions of two national parks and another officially protected area. It is the largest of four such registered carbon credit zones in Cambodia.

The project has also been seen abroad as one of the flagships for the burgeoning climate finance sector. But that image took a major hit in June when the world’s leading carbon credit registry service, a U.S.-based non-profit called Verra, abruptly suspended issuing new credits for the site in response to an as-yet unreleased investigation from global advocacy group Human Rights Watch alleging rights abuses by environmental officials and rangers within the project area.

The finer mechanics of the carbon credit model are mostly unknown to locals in Areng, who were unaware of these developments. But Souvsee – a member of Cambodia’s besieged political opposition Candlelight Party and a former affiliate with the conservation activist group Mother Nature – saw reason to support the programme, which has funded local infrastructure and community development.

“We want REDD+ to be here, but we want them to respect our rights as indigenous people,” she said. “They can help protect our forest, our culture – and they can help protect [our land] from companies too.”

For rural forest communities such as those of Areng, the threat presented by outside companies is very real.

Rights organisations annually rank Cambodia among the most corrupt in the world, pointing to well-documented elite networks that have granted themselves near-total control of the Kingdom’s natural resources under a sprawling political patronage system. This has seen the country’s once-vast forests and other officially protected landscapes traditionally doled out among an overlapping class of tycoons and politicians, usually to be stripped for timber and developed into agricultural plantations.

At the same time, the Cambodian government has pledged to expand carbon credit programmes across its many officially protected areas, as well as a deepening partnership with regional finance hub Singapore to bring its sprouting credits to a global market.

The Ministry of Environment has announced at least eight credit projects in the works in recent years, with two currently awaiting registration with Verra. Officials didn’t answer questions about their plans when contacted by a reporter.

Some conservationists argue the basic financial premise of REDD+ offers an alternative path forward, a means of changing the status quo for forests in Cambodia and other developing countries. They say credit sales provide a funding model that’s actually sustainable on the ground, allowing for more concerted efforts to protect nature. Project developers also assert a system that rewards states for keeping trees standing – as opposed to clear-cut for timber, mining or other development – is a much-needed step in the future of environmental protection.

But critics say these plans still fail to defuse the key drivers of deforestation by powerful economic interests, especially in countries such as Cambodia where land rights and environmental protections wither in the face of political clout and profit-seeking. Worse, some say, the brunt of the protections brought with REDD+ often fall on some of the world’s poorest communities – often smallholder farmers who depend on forests to eke out subsistence livelihoods.

“I think there’s been a growing disappointment with REDD+ projects,” said Professor Ida Theilade, a forestry expert with the University of Copenhagen. She’s studied Cambodia for more than 20 years and has, in the past, done consulting for carbon credit projects in other countries. “It’s very hard to find those success stories, those really big stars in the sky.”

The recent Verra suspension has pulled that critical spotlight squarely on the Southern Cardamom REDD+ project.

Verra stated it was investigating the situation in Southern Cardamom further, but didn’t comment beyond that. Human Rights Watch also did not disclose their report to the Globe.

Though minimal details from the group’s study have been made public, its researchers had reportedly documented rights violations carried out against local people by public officials and conservation rangers in the development of the REDD+ project.

Even just a hint of these preliminary findings was immediately familiar to many in Cambodia.

Though the forests under its watch remain some of the thickest in the country, Wildlife Alliance has long been accused of heavy-handed enforcement of environmental restrictions with often-impoverished local villagers. The not-yet-public Human Rights Watch report likely taps into this history.

Suwanna Gauntlett, Wildlife Alliance CEO and founder, denies abuses, saying her organisation is working to support rural livelihoods while safeguarding protected areas. She places the group’s role in Cambodia in a longer arc of conservation in the Kingdom, tracing back to the group’s earliest days in 2000 – operating in a near-lawless environment to fight land-grabbing, human-caused forest fires and widespread poaching.

“We used to be the good guys doing good stuff, and now we’re the villains,” said Gauntlett, reflecting on the spotlight cast on her group by Human Rights Watch. “I don’t know how comfortable I feel in my new role.”

On the ground

The Southern Cardamom REDD+ project seemed to provide a ready case study for bigger questions facing climate financing in Cambodia. So as part of a broader investigation of greenwashing conducted in partnership with the Earth Journalism Network, reporters from the Southeast Asia Globe and the U.K.-based outlet SourceMaterial, spent about a week total travelling through the Southern Cardamom zone over two separate trips.

With regular check-ins and surveillance from local police, reporters spoke with more than 30 people in communities around the area. These interviews ranged from villagers and local officials to Wildlife Alliance employees.

What they found was – a mixed bag.

“On the whole, we’re happy with REDD+,” said Chhan Kong, 41, a fisherman and rice farmer living in the village of Teuk La’ak. “[But] the rangers can be harsh and aggressive.”

When he and others ventured into the protected area to make camp and fish – a permitted activity – Kong said they ran the risk of having their camping equipment confiscated or destroyed by rangers.

This was a common thread in many interviews, and locals also told reporters they felt compelled to run at the sight of rangers lest they run afoul of restrictions. Those caught breaking the rules could be sent to court, villagers said.

Maybe the most notable recent incident in the REDD+ zone that the Globe heard of involved a then-62-year-old woman who was briefly detained by rangers about two years ago. Presumably on the way to their station, the rangers let her go with no further action after other community members went to advocate for her release.

Still frightened and confused, she told reporters the rangers had picked her up for cutting a small tree near her farm.

As with her case, the single-most common appeal was for greater communication and cooperation, especially for farmers, fisherfolk and others around the boundaries and enforcement of protected areas. A Wildlife Alliance field official who spoke with reporters said there was signage to mark these edges and showed them a detailed map, but acknowledged it wasn’t distributed to local people.

Hoeng Pov, a Chorng community representative in Areng Valley, said even commune officials often lacked key information about the project.

“We really want to know about accountability – how much [do they earn] from selling carbon, how much do they pay for organisations who do this project and for the communities as well?” he mused to reporters. “Some organisations haven’t addressed people’s concerns, they only talk about their project. [And] after they got money from this project they haven’t let us know how the money was divided.”

Though questions remained, almost everyone reporters spoke with agreed on the importance of protecting the forest.

Besides the carbon-sucking benefits that trees and other plant life provide on their own, cutting them down also has massive impacts on the climate – deforestation contributes as much as 20% to global carbon emissions.

According to the nonprofit Global Forest Watch , Cambodia has lost about 31% of its tree cover since 2000, amounting to about 1.57 gigatons of carbon emissions.

At the same time, its forays into carbon crediting have produced mixed results.

Of its four Verra-registered REDD+ projects, two have experienced severe deforestation. One of these is in the province of Oddar Meanchey and the other is called Tumring, located on the edge of the country’s once-vast, now-vanishing Prey Lang forest.

Regarded as the largest lowland evergreen forest remaining in mainland Southeast Asia, even the protected areas of Prey Lang are steadily dissolving under industrial-scale logging operations.

Tumring was developed in partnership with the South Korean government, but primarily overseen by the Cambodian Forestry Administration. The forester Theialde said satellite imagery has shown dramatic loss of tree cover at the project site, and it’s unclear if it’s actually selling credits.

Oddar Meanchey, Cambodia’s first foray into carbon crediting, has suffered a similar fate. With backing from the U.N. Development Program, the project initially found commitments from organisations such as Disney and Virgin Airlines to buy credits. But the corporate backers cancelled after it became apparent that local officials and military units had asserted their own claims to officially protected land.

Meanwhile, Cambodia’s second-largest REDD+ project – managed by the Wildlife Conservation Society (WCS) at the Keo Seima Wildlife Sanctuary in the northern province of Mondulkiri – is generally considered a success.

Colin Moore, the Southeast Asia regional REDD+ coordinator for WCS, said revenues from the credits sold from the project have been a game-changer for the group’s work on the site.

“It’s really allowed us to scale our activities on the ground,” said Moore. “We’ve only very recently entered a world where you can do more than just fund a bare-bones conservation programme in these landscapes.”

Moore said WCS works with Everland, a company based in the U.S., to market and sell the credits from REDD+ projects to buyers around the world. Everland also does the same for the Southern Cardamom project.

When credits are sold from Keo Seima, a portion of their sales revenue goes to Everland or other fees, but the rest of the proceeds are split between WCS Cambodia and the Environment Ministry. Moore said the breakdown is 20% for the ministry, 80% for the project itself, deposited into an account managed by WCS.

That latter pool of money goes into funding conservation projects within Keo Seima, including personnel costs and programming related to rural livelihood development, community land titling and more.

Both Moore and Wildlife Alliance declined to say how much in total funding their credit sales have made over the life of the project so far. Local media has quoted government officials stating the Environment Ministry itself has raised $11.6 million in carbon credit sales since 2016, which would be only a portion of the total revenues.

Moore said the successes of the Keo Seima and Southern Cardamom REDD+ projects were the “proof of concept” before the Cambodian government’s current push to develop more credit programmes. A boost in global interest in financing such projects since 2021 – the first year of the Paris Climate Accords commitment period – also helped drive interest, he added.

“The existing projects that were here in Cambodia had been ticking along, eking by on some small sales here and there,” Moore said. “Only after 2021 did they start to make big sales, be able to move their inventory.”

Critiques and hopes

Conservation funding aside, critics of REDD+ have not found it a convincing model to mitigate climate change.

An extensive report from a carbon trading research centre at the University of California-Berkeley asserted last month that loose REDD+ assessments and quality control practices by Verra are leading to “over-crediting” and “exaggerated” claims about the impact of such projects.

As a result, they said, credits sold under the promise of directly offsetting specific amounts of carbon emissions likely represent only “a small fraction of their claimed climate benefit”. The researchers also wrote that REDD+ projects focus their enforcement efforts on rural, often-impoverished forest communities while remaining unable to address large-scale deforestation caused by more powerful economic interests.

“Our overall conclusion is that REDD+ is ill-suited to the generation of carbon credits for use as offsets,” the researchers wrote, adding that the current “market system creates a race to the bottom that is hard to emerge from.”

Those within the sector itself have a different view.

Everland President Joshua Tosteson freely admits the industry is imperfect but is adamant that its basic premise is a good one when done properly. He said he hadn’t read the Berkeley report in depth, but noted that he agreed with it that the Verra system allowed for a “wide variability right now in respect to how projects get set up in relation to the communities.”

“There isn’t really like what you might call a normative standard, a quality standard for how things ought to be done,” he said, adding that applied to things such as gaining free prior and informed consent and revenue sharing with local people.

That makes it hard to properly gauge how well projects actually address the underlying social and economic reasons for forest loss, Tosteson added.

Beyond that, he rejected the larger denunciations of the Berkeley report, ascribing some of its findings to a broader wariness of using market solutions to address deforestation or climate change issues. However, for a country such as Cambodia, he thought the financial incentive that REDD+ brought to conservation could help keep trees standing.

“The thing about REDD that I think people do not appreciate and understand is that money talks – and the fact that there has been financial success associated with forest conservation in these two places [Southern Cardamom and Keo Seima] is beginning to change the mind of the government,” he said. “It’s going to take a while, but this is definitely part of the trajectory that I think can get you to a different ethos at a national level.”

At Wildlife Alliance’s offices in Phnom Penh, Gauntlett and her organisation also stand by their work.

Besides using the revenues from carbon credit sales to fund protection of the REDD+ area, the group also listed a range of material investments in the rural communities of the Southern Cardamom project.

Besides helping start “community-based eco-tourism” centres, Gauntlett also said her group had shored up land tenure for residents in the REDD+ zone by facilitating the government processing of just under 5,000 “hard” land titles – a level of official recognition of ownership often difficult to secure in Cambodia – covering nearly 12,250 parcels of private land there. She expected the Ministry of Land Management to issue an additional 7,249 titles through 2024.

Gauntlett also listed infrastructure developments such as about 28 kilometres of new or rehabbed roads in the project zone, 94 solar-powered water wells, 77 toilets, two schools and a bridge. Wildlife Alliance also funded 16 full university scholarships for students to study and live in Phnom Penh, she said.

Reporters were able to see much of the hard infrastructure for themselves as they traveled through the project area. In the Areng Valley, one older resident said the newly installed toilet was the first she’d ever had.

While the Wildlife Alliance REDD+ programme officially started in 2015, Gauntlett said her organisation had first tried to establish the programme in 2008 – but was rejected by the Cambodian government.

“Finally when REDD started, it was pretty much already all done. It wasn’t a decision that came out of the blue like this,” she said. When asked why the government had initially been against it, Gauntlett was concise.

“Very simple. More money to be made through economic land concessions.”

‘An illusion’

Still, the incentives offered by climate finance will need to compete with more short-term motivations. Not everyone shares Gauntlett’s optimism that carbon credits are up to task.

The forester Theilade is among them. She mostly focuses on the vanishing Prey Lang forest and the community networks that have struggled to maintain it against powerful interests.

She was also involved in the early 2000s with helping the Cambodian government develop its “REDD+ Roadmap”, a planning process with World Bank funding that ostensibly evolved into the Kingdom’s current strategy.

Today, she occasionally reviews conservation proposals with carbon trading components, but she’s not working specifically with crediting schemes.

Theilade is also not involved with Wildlife Alliance or their work in Southern Cardamom but said she’d read about the organisation’s presence there. Though she gave some credit to them, she said Cambodia’s extensive patronage system leaves no quarter for good intentions – especially where forestland is concerned.

Such an outcome for Wildlife Alliance has already happened elsewhere in the country. Last year, its partners in the Forestry Administration conspired against the conservation group with local officials and prominent tycoons to clear-cut and parcel out a smaller forest that Wildlife Alliance had preserved just outside the Phnom Penh metro.

The conservation group had used that area, known as Phnom Tamao, as a sanctuary for rare and endangered animals. Though a rare surge of public discontent put a stop to development of the land, the forest itself was decimated.

Based on global prices for carbon on the offsets market, Theilade thought there was no way for credits to compete with other land uses associated with the patronage system – especially timber logged from protected areas.

Though she gently cautioned that she didn’t want to “sound too negative” about the work being done by some conservation groups to build out such schemes, Theilade just didn’t see it as a realistic option given the political weight against conservation.

“It has to be a government deciding, or a culture deciding, that these forests are worth something to us,” she said, describing the various ecological, social and spiritual benefits that forests provide in Cambodia. “That the government is going to conserve forests for some small carbon payments, I’m afraid, is an illusion.”

Continue Reading

China says US accusation of ‘risky’ aerial intercepts politically motivated

BEIJING: China’s defense ministry announced on Friday( Oct. 20) that a US Department of Defense statement accusing its military of” risky and coercive” aerial intercepts was an intentional smear on China with covert political goals. The government stated in a statement that” China is strongly related to it and hasContinue Reading

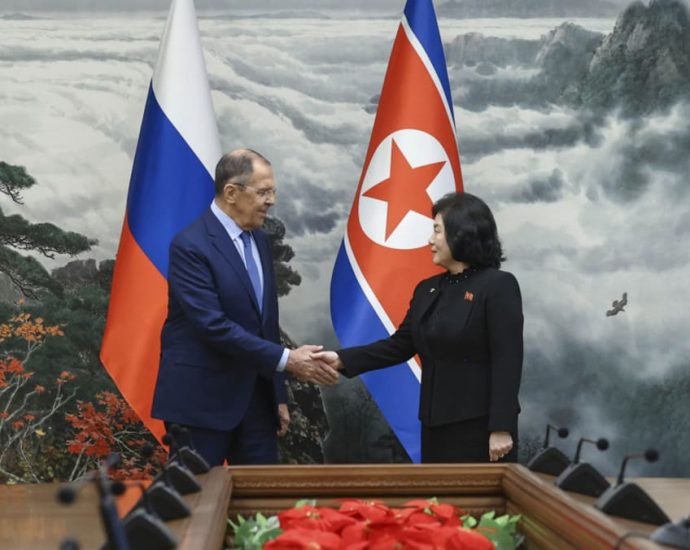

Russian foreign minister dismisses US claims of North Korea supplying munitions to Moscow

Russian and North Korean officials claimed that enhancing security ties between the two nations was discussed during Kim’s six-day visit to Russia last quarter, which also included a meeting with Putin, but they made no mention of any certain actions. According to the North’s standard Korean Central News Agency, LavrovContinue Reading

Navy to buy frigate instead of Chinese sub

The controversial underwater procurement, according to the defense minister, has only been suspended.

Chinese frigates will be ordered by the navy instead of Chinese submarines, according to defense minister Sutin Klungsang, as Thailand initially requested that they have German engines.

Mr. Sutin stated during a visit to army headquarters on Friday that the choice does not mean the underwater procurement has been canceled. The submarine job may be put on hold for a while rather than being scrapped. It will continue once the nation is prepared.

Germany forbids the use of German-made gasoline engines in Chinese military and defense equipment, despite the initial agreement for the S26T Yuan-class submarine being signed in 2017. Thailand expressed concern that Beijing’s proposed Chinese-made website would not be sufficient.

The Chinese area tried to convince the navy that its website may be up to the task during the ensuing rounds of negotiations. Adm Choengchai Chomchoengpaet, a former chief, announced last month that he would suggest that the cupboard review the approval of savages with Chinese-made engines after the navy eventually agreed.

However, the government insisted on using a European motor and requested that the military change its plan.

Two suggestions were made by the army. The first is to buy a frigate that is fend off submarines, and the second is an offshore patrol ship.

According to Mr. Sutin, the state and he decided to go with the ship option because it would cost 17 billion baht, or 1 billion.

The defense minister stated that while the submarine option will significantly reduce the navy’s capability when compared to a submarine project, it can still accept it.

According to him, Chinese President Xi Jinping and Prime Minister Li Qiang discussed the opportunity this week in Beijing, and the latter decided to take the Thai request into consideration.

Mr. Sutin expressed desire that China would find a solution regarding what it would do with the vehicle and said he was informed that the ordered submarine’s construction was only partially complete.

Since the navy’s 2017 signing of the procurement contract with state-owned China Shipbuilding & amp, Offshore International, the submarine deal has generated controversy. The agreement was not subject to acceptance from the Office of the Auditor General or the military-backed appointed government.

One of the issues with the deal, according to critics, was the type of website that would be used in the boats. The real question, they claimed, was whether a frigate would be more beneficial in Thailand’s deep territorial waters or whether it would make sense to use such savagery.