At COP28, a chance for the West to make amends

The West often engages in moral grandstanding when addressing critical global issues like climate change, emphasizing the need for action and accountability. But when it comes to taking responsibility for historic carbon emissions, the developed world often falls short of its obligations.

This disparity between rhetoric and action has significant implications, particularly for vulnerable nations. The Loss and Damages Fund, a significant achievement of the COP27 summit last year in Egypt, highlights this disconnect.

The increasing severity, breadth, and regularity of climate calamities has disproportionately affected developing countries, as evidenced by the Global Climate Risk Index 2021. Of the 10 most affected territories and countries between 2000 and 2019, all were in the developing world.

The Gr9up of 77 and China played a pivotal role in including finance for loss and damages at COP27. The emphasis was on framing this mechanism as a global commitment rather than liability or compensation. The result was collective acknowledgment of the asymmetric impacts of climate change and a step toward rectifying these imbalances.

However, the path to operationalizing the fund is fraught with obstacles. The impasse at an October meeting on the topic cast doubt over the process, particularly concerning the fund’s practical implementation.

Fortunately, a breakthrough was achieved at a follow-up meeting in Abu Dhabi this month. The text adopted there will form the basis of a final decision at COP28 in Dubai in December. Even before that meeting starts, the deal on loss and damages already has the potential to become one of the meeting’s greatest achievements.

Yet even amid progress, the adopted text reveals three issues that hint at how difficult it will be to implement the fund. The success of COP28 in addressing these issues will be a test of the international community’s commitment to equitable climate action.

The first point of contention concerns identification of fund contributors. Developing nations advocate for financial commitments from developed countries, while the United States and Europe assert that emerging economies, notably China and Gulf nations such as Saudi Arabia, should share financial responsibilities equitably.

During preparatory meetings for COP28, the Saudi delegation reportedly referred to historical “failures on obligations and gaps in action” by Western nations during and after the Industrial Revolution, an opinion shared by many leaders in developing countries.

The West has a history of falling short in funding climate action. A 2009 promise to mobilize US$100 billion annually for developing countries by 2020 was never met. It’s high time the West matches its rhetoric with financial commitment. COP28 is the place to deliver.

While the developing world is open to funding from non-governmental sources like the private sector and humanitarian groups, the primary responsibility lies with Western governments. Failure to step up could mean either the loss and damages fund remains non-operational, or its scale is too small to impact climate-change mitigation and adaptation significantly.

The second key challenge for COP28 is pinpointing which nations should benefit from the fund. At COP27, the definition of “particularly vulnerable” sparked debate – a matter still unresolved. COP28 must clarify this. It’s a complex issue; assessing loss and damages goes beyond simple economic factors to include losses that are less tangible and harder to measure, like those from gradual environmental changes.

There’s also a gap between what affected communities experience and the data collected by governments and organizations. Localized impacts may seem more pressing than the broader climate context, complicating the creation of effective responses.

The third challenge revolves around the location and administration of the fund. Western countries, particularly the US and the European Union, favored housing the fund within the World Bank, an idea that developing countries have strongly opposed.

Opposition was rooted in concerns that the World Bank’s loan-based financing model was unsuitable for debt-burdened developing countries, and that the bank’s decision-making process was too heavily influenced by its major donors, particularly the US. Moreover, high administrative fees associated with the World Bank have further fueled resistance.

Despite these reservations, developing countries made a substantial concession by agreeing to an interim arrangement where the fund would be housed in the World Bank for four years, under conditions that included direct access to grants and inclusivity of non-World Bank member states. But if the rest of the demands of the developing world are not met, they can easily do away with this concession.

Thus COP28 faces a crucial task in making the Loss and Damages Fund operational. If successful, next month in Dubai will mark a significant victory for the Global South and those communities bearing the brunt of the West’s historical emissions. This momentous step could pivot the scales toward a fairer climate future.

This article was provided by Syndication Bureau, which holds copyright.

Quake damage found at 2 more hospitals in Chiang Mai

PUBLISHED : 19 Nov 2023 at 12:02

Damage was found at two more hospitals in Chiang Mai province as Sakhon Nakhon Hospital remains partially closed for cracks after a 6.4-magnitude earthquake in neighbouring Myanmar on Friday, according to the public health minister.

Minister Dr Cholnan Srikaew said on Sunday that officials reported cracks at San Kamphaeng hospital in San Kamphaeng district and Chai Prakarn Hospital in Chai Prakarn district on Saturday.

The cracks did not have any structural impact, so the hospitals continued with their services, he said.

According to the minister, cracks appeared and ceiling tiles fell at San Kamphaeng Hospital. Meanwhile, many cracks were found in an old outpatient building at Chai Prakan Hospital.

Earlier, officials reported damage from the quake at 14 hospitals in Chiang Mai and Chiang Rai provinces in the North and Sakon Nakhon province in the Northeast.

Fifteen affected hospitals continued to offer services as usual and only Sakon Nakhon Hospital in Sakon Nakhon province remained partially closed pending technical examinations.

The 6.4-magnitude quake hit Myanmar’s Shan state about 100 kilometres northwest of Chiang Rai, Thailand’s northernmost province, at 8.37am on Friday. It was felt in many provinces around the kingdom, including Bangkok.

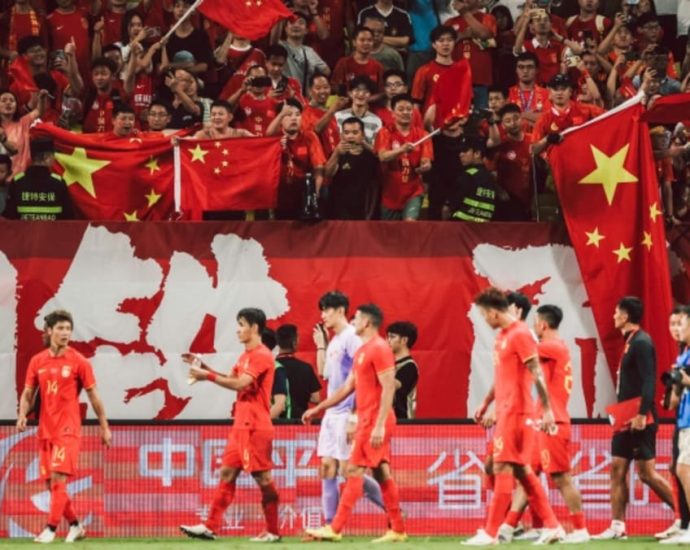

Xi says ‘not so sure’ of Chinese football team’s abilities

SAN FRANCISCO: Chinese President Xi Jinping has said he is “not so sure” of the abilities of the national men’s football team, despite their recent victory over Thailand. Xi made the rare off-the-cuff remark in an informal conversation with Thai Prime Minister Srettha Thavisin, according to a video posted onContinue Reading

Japanese troops drill on island seen as vulnerable to China

TOKUNOSHIMA: Japanese marines in amphibious assault vehicles stormed an island beach at the edge of the East China Sea on Sunday (Nov 19) in a simulated attack to dislodge invaders from territory that Tokyo worries is vulnerable to attack from China. As tensions run high with neighbours China, Russia andContinue Reading

Cricket politics: India’s Modi basks in World Cup success

AHMEDABAD: As Prime Minister Narendra Modi cheers India in the blockbuster climax of the Cricket World Cup on Sunday (Nov 19), commentators say he is also seeking to capitalise on the wildly popular sport to burnish his appeal ahead of elections next year. For tournament organisers and for Modi –Continue Reading

APEC over, Taiwan reports renewed Chinese military activity

TAIPEI: Taiwan reported renewed Chinese military activity around the island on Sunday (Nov 19), with nine aircraft crossing the sensitive median line of the Taiwan Strait and warships carrying out “combat readiness patrols”. Taiwan, which China claims as its own territory, has complained for the past four years of regularContinue Reading

Public now split on govt handout, but most oppose funding plan: poll

PUBLISHED : 19 Nov 2023 at 10:32

A majority of Thai people do not agree with the government’s plan to fund the digital wallet scheme with a 500-billion-baht loan although they still support the 10,000-baht handout, according to the result of an opinion survey by the National Institute of Development Administration, or Nida Poll.

The poll was conducted on Nov 13-16 by telephone interviews with 1,310 people aged 18 and over of various levels of education, occupations and incomes throughout the country to compile their opinion after Prime Minister Srettha Thavisin delivered a statement outlining the handout programme in detail on Nov 10.

Under the programme, the 10,000-baht handout will be offered to Thais aged 16 and older who earn less than 70,000 baht per month and/or have under 500,000 baht in bank deposits. Based on these criteria, an estimated 50 million people will be eligible — down from the 56 million intended to receive the amount originally.

Of the respondents, 79.85% said they were eligible for the handout, 11.68% were not sure about their eligibility and 8.47% thought they were not eligible.

When those not eligible and not sure about their eligibility (264) were asked whether they felt disappointed, 68.18% said not at all; 11.36% weren’t particularly disappointed; 8.71% were disappointed; 7.58% were very disappointed; and 4.17% did not know or were not interested.

Asked whether they agreed with the criteria set for eligibility, a majority – 66.33% – agreed: 40.53% wholeheartedly and 25.80% to some extent. On the other side, 20,30% totally disagreed and 12.67% to some extent. The rest, 0.69%, did not know or were not interested.

Asked about the stipulation that they can spend the 10,000-baht handout to buy only food, drinks and consumer goods, 50.69% disagreed and 49.16% agreed, while 0.15% had no answer or were not interested.

Asked about the government’s plan to propose a bill to seek a 500-billion-baht loan to fund the programme, 50.69% strongly disagreed with it and another 18.70% also disagreed, but less vehemently. On the other side, 14.89% were in moderate agreement with it and 13.35% strongly supported it. The rest, 2.37%, did not know or were not interested.

Finally, when asked what they thought about the government’s 10,000-baht digital money handout policy after listening to Mr Srettha’s statement, 51.08% agreed with it and 48.16 disagreed. The rest, 0.76%, had no answer or were not interested.

Most disagree with govt’s B500 bln loan bill plan: Nida Poll

PUBLISHED : 19 Nov 2023 at 10:32

A majority of people do not agree with the government’s plan to propose a bill to seek a 500-billion-baht loan to fund the digital wallet scheme although they support the 10,000-baht handout, according to the result of an opinion survey by National Institute of Development Administration, or Nida Poll.

The poll was conducted on Nov 13-16 by telephone interviews with 1,310 people aged 18 and over of various levels of education, occupations and incomes throughout the country to compile their opinion after Prime Minister Srettha Thavisin deliver a statement outlining the handout programme in detail on Nov 10.

Under the programme, the 10,000-baht handout will be offered to Thais aged 16 and older who earn less than 70,000 baht per month and/or have under 500,000 baht in bank deposits. Based on these criteria, an estimated 50 million people will be eligible — down from the 56 million intended originally.

Of the respondents, 79.85% said they were eligible for the handout, 11.68% not sure about their eligibility and 8.47% not eligible.

Of those who were not eligible and not sure about their eligibility (264), when asked whether they felt disappointed, 68.18% said not at all; 11.36% not quite disappointed; 8.71% disappointed; 7.58% much disappointed; and 4.17% had no answer or were not interested.

Asked whether they agreed with the criteria set for eligibility, a majority, 66.33%, agreed – 40.53% very much and 25.80% moderately. On the other side, 20,30% totally disagreed and 12.67% disagreed. The rest, 0.69%, had no answer or were not interested.

Asked about the condition that they can spend the 10,000-baht handout to buy only food, drinks and consumer goods only, 50.69% disagreed and 49.16% agreed with it, while 0.15% had no answer or were not interested.

Asked about the government’s plan to propose a bill to seek a 500-billion-baht loan to fund the programme, 50.69% totally disagreed and 18.70% disagreed. On the other side, 14.89% agreed with it and 13.35% said it was highly agreeable. The rest, 2.37%, had no answer or were not interested.

Finally, when asked what they thought about the government’s 10,000-baht digital money handout policy after listening to Mr Srettha’s statement, 51.08% agreed with it and 48.16 disagreed. The rest, 0.76%, had no answer or were not interested.

Public split on govt handout, but most oppose funding plan: poll

PUBLISHED : 19 Nov 2023 at 10:32

A majority of Thai people do not agree with the government’s plan to fund the digital wallet scheme with a 500-billion-baht loan although they still support the 10,000-baht handout, according to the result of an opinion survey by the National Institute of Development Administration, or Nida Poll.

The poll was conducted on Nov 13-16 by telephone interviews with 1,310 people aged 18 and over of various levels of education, occupations and incomes throughout the country to compile their opinion after Prime Minister Srettha Thavisin delivered a statement outlining the handout programme in detail on Nov 10.

Under the programme, the 10,000-baht handout will be offered to Thais aged 16 and older who earn less than 70,000 baht per month and/or have under 500,000 baht in bank deposits. Based on these criteria, an estimated 50 million people will be eligible — down from the 56 million intended to receive the amount originally.

Of the respondents, 79.85% said they were eligible for the handout, 11.68% were not sure about their eligibility and 8.47% thought they were not eligible.

When those not eligible and not sure about their eligibility (264) were asked whether they felt disappointed, 68.18% said not at all; 11.36% weren’t particularly disappointed; 8.71% were disappointed; 7.58% were very disappointed; and 4.17% did not know or were not interested.

Asked whether they agreed with the criteria set for eligibility, a majority – 66.33% – agreed: 40.53% wholeheartedly and 25.80% to some extent. On the other side, 20,30% totally disagreed and 12.67% to some extent. The rest, 0.69%, did not know or were not interested.

Asked about the stipulation that they can spend the 10,000-baht handout to buy only food, drinks and consumer goods, 50.69% disagreed and 49.16% agreed, while 0.15% had no answer or were not interested.

Asked about the government’s plan to propose a bill to seek a 500-billion-baht loan to fund the programme, 50.69% strongly disagreed with it and another 18.70% also disagreed, but less vehemently. On the other side, 14.89% were in moderate agreement with it and 13.35% strongly supported it. The rest, 2.37%, did not know or were not interested.

Finally, when asked what they thought about the government’s 10,000-baht digital money handout policy after listening to Mr Srettha’s statement, 51.08% agreed with it and 48.16 disagreed. The rest, 0.76%, had no answer or were not interested.

Trump vows to kill Asia trade deal being pursued by Biden if elected

FORT DODGE, Iowa: Donald Trump, the frontrunner for the Republican presidential nomination, said on Saturday (Nov 18) that he would kill off a Pacific trade pact being advanced by US President Joe Biden if he were to win the 2024 election and return to the White House. Speaking to supportersContinue Reading