DBS, Citi outages prevented 2.5 million payment and ATM transactions from being completed

The specific problems that caused the system healing delays on October 14 did not come up during the annual exercises that both banks conducted to check the recuperation of their IT systems at their backup data centers, according to Mr. Tan.

DBS Fines IMPOSED

DBS would not be permitted to make non-essential That changes or invest in new business initiatives for six months, according to MAS ‘ announcement last year.

Experts informed CNA that they were not aware of any future DBS acquisition plans. According to Mr. Thilan Wickramasinghe, head of Singapore studies at Maybank, DBS is concentrating on integrating other companies into the bank and probably has a” limited appetite” for additional mergers and acquisitions.

MAS added that DBS may continue to apply a ratio of 1.8 times to its risk-weighted assets for operational threat and keep the size of its tree and ATM networks for the time being.

In May, it was first told to do so. At that time, the ratio of 1.8 days resulted in more regulatory money, or income that must be set apart as a pilot, of about S$ 1.6 billion( US$ 1.2 billion ).

A company’s ability to invest may be constrained by a higher capital requirement.

Japan-Philippines moving toward US-led trilateral alliance

MANILA: During his two-day official visit to Manila last year, Fumio Kishida said,” I am honored to have the opportunity to be the first Japanese Prime Minister to communicate here at the Congress of the Philippines, which has a long history.”

The Japanese leader argued during the historic speech that the two nations have now entered a” golden age” of bilateral relations amid an unprecedented convergence of strategic interests.

Kishida traveled to Southeast Asia to strengthen defense ties with like-minded partners just one year after launching a new era in” realism diplomacy” and pledging to double Japan’s defense spending in terms of its gross domestic product ( GDP ).

Japan is currently pursuing closer defence cooperation with the neighboring country in addition to being a leading export destination and leading investor for the Philippines.

Kishida unveiled a new security aid item during his trip to Manila, which was highlighted by an ocean sensor system. As part of the growing bilateral maritime security cooperation, Japan is also anticipated to supply the Philippine Coast Guard( PCG ) with more multi-role vessels.

Importantly, Japan is pursuing a Reciprocal Access Agreement( RAA ) with the Philippines, which could eventually lead to expanded bilateral defense exchanges, such as regular wargames and partial basing access.

During his trip to Southeast Asia, Kishida also traveled to Malaysia, where he advocated for the” new vision of cooperation”& nbsp, which was focused on maintaining a rules-based order in the area. & nbsp,

Malaysia has been chosen as one of Japan’s new Official Security Assistance ( OSA ) program beneficiaries, along with the Philippines, Bangladesh, and Fiji, with a focus on rebuffing Chinese naval assertiveness.

The state-backed newspaper Global Times in China criticized Kishida’s visit as a” troublemaking journey” that offered” gift packs ,” which primarily contained” lethal weapons ,” because it was aware of the geopolitical significance of his regional tour.

All wind companions

Kishida wasn’t making his second trip to the area. In the midst of Tokyo’s burgeoning strategic ties with the Association of Southeast Asian Nations( ASEAN) bloc, Shinzo Abe, a former prime minister of Japan, had frequently visited the area.

In the past ten years, Kishida has played a key role in the rapidly growing tactical ties between Japan and the Philippines due to their shared concerns about China.

Under the leadership of past Philippine president Rodrigo Duterte, Manila’s relations with the US and China underwent significant changes, but Japan was able to keep a positive momentum.

In fact, Duterte slowly endorsed increased military participation with Japan despite frequently criticizing the West in favor of China. Teodoro Locsin, a member of Duterte’s top cabinet, and Delfin Lorenzana traveled to Tokyo last year for their first-ever” 2 2″ meeting in order to” strengthen defense cooperation in light of the increasingly harsh security environment.”

Although Duterte’s rhetoric toward Beijing was generally accommodative, his top diplomat and defense chief expressed” major concern” over the coastal confidence of the Eastern power and, along with their Japanese rivals,” highly opposed” any unilateral action that jeopardizes regional peace and security.

The Philippines, like Japan, voted to suspend Russia’s participation in the United Nations Human Rights Council while the then-president of the Philippines continued to maintain” neutrality” regarding the Ukraine war.

In the midst of rising tensions with China in the South China Sea, Japan had also gradually increased relationships with other like-minded regional says, most notably Vietnam and Malaysia, which likewise received coastal security assistance from Tokyo. & nbsp,

Kishida invited the leaders of the Philippines and Malaysia to the 50th Anniversary of ASEAN-Japan Friendship and Cooperation summit in Tokyo in December as part of his most recent South Asian trip.

However, the Philippines— a friend US treaty ally strategically situated between the Western Pacific and the South China Sea — represents a significant award for Japan in many ways.

A new age in” authenticity geopolitics” was promised by Kishida during his keynote speech at the Shangri-La Dialogue in Singapore last year. At the time, he declared that Japan” would be more vigilant than ever in tackling the problems and problems that face Japan, Asia, and the earth.”

Japan is expanding its network of military cooperation abroad in addition to bolstering its domestic defenses, with a particular emphasis on Southeast Asia, where Tokyo enjoys enormous grace.

Japan has consistently topped the list of ASEAN’s preferred external partners among regional thought leaders in annual surveys conducted by the Institute of Southeast Asian Studies( ISEAS ) in Singapore.

This is particularly true in the Philippines, where Japan is regarded as an” all-weather ally” that has benefited the economy more than any other country and is now exploring military cooperation like never before.

Kishida announced a number of new agreements during his meeting with Philippine President Ferdinand Marcos in an effort to forge an incredibly detailed partnership. These agreements included construction, mining, the environment, natural resources, and tourism.

Japan, which is already constructing Manila’s first train among other multi-billion money jobs, also vowed to support system enhancement under the guidance of a High Level Joint Committee on Infrastructure Development and Economic Cooperation. & nbsp,

The author was informed by a senior Chinese cabinet member that Japan is also looking into significant manufacturing investments that could possibly make the Philippines the center of the region’s automotive industry.

In the direction of a multilateral alignment

In order to improve the Southeast Asian country’s maritime domain awareness capacity compared to China, Kishida also formally unveiled the Official Security Assistance( OSA ) of Japan, which will start with a$ 4 million grant to equip the Philippine Navy with coastal radar systems.

In order to improve its maritime safety features, Japan is even anticipated to supply at least five additional 97-meter-long vessels for the PCG.

Yet, this is probably just the beginning of the ice. A Reciprocal Access Agreement ( RAA) to” further strengthen defense cooperation between the two countries” was also finalized by the parties.

The Visiting Forces Agreement-style deal will probably facilitate also larger and more powerful joint military exercises once finalized, with Spanish parliamentary ratification, as well as the transfer of more advanced weapons systems to be primarily aimed at China.

We are aware of the advantages of having this structure to our defense and military personnel as well as to maintaining peace and stability in our area, Marcos Jr. boldly declared in front of his Chinese host.

Given that Japan and the Philippines are close to Taiwan, the two factors also made it clear that they were committed to forming a de facto multilateral alignment with the US.

Japan believes that assistance from ASEAN countries, particularly the Philippines, is essential to preventing any potential Chinese dynamic action against the autonomous democratic island that Beijing views as a rebellious province that needs to be” reunified” with the island.

Both sides’ foreign and defence ministers directly” understood the importance of each country’s individual treaty alliance with the United States and that of enhancing cooperation with local partner countries” last year.

A Japan-Philippines-US ( JAPUS) trilateral alliance would likely be the logical next strategic move after Manila gave the US Pentagon access to valuable bases close to Taiwan’s southern shores and started looking into a VFA-style deal with Tokyo.

Follow Richard Javad Heydarian at @ Richeyarian on X, formerly known as Twitter.

More COE quota will be brought forward from peak years in ‘cut-and-fill’ move to tackle supply trough

SINGAPORE: Acting Minister for Transport Chee Hong Tat announced on Monday( Nov. 6 ) that more Certificate of Entitlement ( COE ) quota will be brought forward from peak years to fill the current supply troughs while maintaining the zero-vehicle growth policy.

The number of Submissions up for bid is determined by the quantity of deregistered vehicles under Singapore’s zero-growth policy, which was put in place to reduce traffic congestion.

Mr. Chee responded to Members of Parliament’s inquiries about rising COE prices by pointing out that, assuming require stays fairly constant, the significant variation in limit provide during the top and trough years causes higher volatility in prices across various years.

The moving average of deregistrations from the four quarters prior is used under the existing system to determine COE restrictions for the following quarter.

Due to the fact that many of the current cars have not reached the end of their COE lifespans and are not eligible for deregistration, Categories A, B, and C now face a” tight supply situation ,” according to Mr. Chee.

However, before reaching the peak source years from 2026 to 2027, COE provide for these groups will drastically improve starting in the second quarter of 2024.

If we can lower the peak-to-trough ratio by using a” cut-and-fill” approach to shave off future peaks and use this supply to fill the current toughs ,” he said,” a better outcome can be achieved for all stakeholders while still allowing the COE system to play its role as an allocation mechanism.”

In the peak years, the Transport Ministry announced in May that it would advance quota from” guaranteed deregistrations ,” which has contributed to an increase in COE supply over the previous six months.

The Land Transport Authority also revealed on Friday that, compared to the third quarter, the quota supply for Category A and B increased by 35 % in the November to January quarter.

” We hope that COE rates may average with the increase in source.” However, we are aware that prices will also be influenced by industry desire, and demand is outside the purview of the government, Mr. Chee continued.

I must be honest with everyone and say that it is impossible to predict how prices may change in the upcoming COE selling rounds, but I want to reassure Honourable Members and the general public that MOT and LTA are making every effort to address the issues.

China refiners cut oil output as thin margins, quota shortage bite

SINGAPORE: According to traders and market consultancies, China’s oil refinery utilisation rates are falling from log third-quarter levels as dwindling margins and a lack of export quotas prevent plants from increasing output for the remainder of 2023. The decrease in refining output may lower simplistic demand from the top importerContinue Reading

Invisible for a reason

On Thursday night, a close friend of ours invited us to see Invisible Nation at Stanford University. It was an opportunity to meet up with an ancient friend and accept the invitation to the organizers’ light breakfast. All of the backpacks had been consumed by the time we arrived. On a list of failures, it came first. & nbsp,

The video Invisible Nation, which is being screened all over the US, is billed as being about Taiwan. A documentary film is expected to inform and instruct audiences by providing unadulterated details and allowing them to reach their own conclusions in accordance with conventional media standards. The name” video” is mocked by Invisible Nation. It is an outright confirmation of Taiwan as a design democracy and an unrestrained adoration of Tsai Ing-wen.

InvisibleNation has several flaws, most of which are caused by deliberate omissions of personal data and background.

The movie claims that the only period one government had control over both mainland China and Taiwan was from 1945 to 1949 and that Taiwan’s story began with the French conquest of the area. After World War II, Chiang Kai-shek and the Kuomintang( KMT ) reclaimed Taiwan, and their brief rule came to an end when he was forced to flee to Taiwan from the mainland.

This is deceptive as best and blatantly false at worst.

Koxinga, Taiwan’s conqueror, is not mentioned in the story.

Koxinga, also known as Zheng Chenggong, the later Ming Dynasty ruler who resisted the Manchus’ seizure of mainland China and fled to Taiwan by driving the Dutch off the island, is not mentioned in the movie. The grandson of Zheng gradually gave himself up to Beijing’s Qing imperial court. Taiwan remained a part of China for many centuries after that, but in 1895, the Beijing government was forced to cede Taiwan to Japan after losing the lake battle to that country.

The Potsdam Declaration, drafted by the Allies and containing the conditions of Japan’s absolute yielding to China during World War II, is also not mentioned by InvisibleNation.

The United States insisted on recognizing Taiwan as a part of China throughout the battle. Jimmy Carter and every other American president since then have reiterated this acknowledgment, which persisted when Richard Nixon visited China in 1972.

The movie did effectively credit Lee Teng-hui‘s actions for the social turn away from the oppressive rule of the Republican government. The child of Chiang Kai-shek, who oversaw the retreat from the island to Taiwan in 1949, was succeeded by Lee in 1988. In 1978, the child assumed leadership and started liberalizing and loosening the island’s grip. Lee was a Taiwanese native, so he chose Lee to get his vice president.

Lee even went by the Japanese name Iwasato Masao, which Chiang was probably aware of. In fact, Lee / Iwasato, a native Japanese speaker, was known to confide in visiting Japanese dignitaries that his allegiance was more to Japan than to China.

In truth, his older brother was a part of the Imperial Japanese Army who died in battle during World War II. His name is listed among other combat dead, including some convicted war criminals, in the Yasukuni Shrine in Tokyo.

Some Japanese people remained in Taiwan after World War II. They adopted Foreign names and assimilated into the neighborhood culture. There hasn’t been much research done on the issue of divided loyalty and the impact of an estimated 100,000 Japanese who stayed with their posterity on Taiwan’s government.

Chen even failed to notice

In the case of Lee, after taking over as the head of the Taiwanese state, he gradually weakened and undermined the KMT firm, which allowed Taiwan to choose the Democratic Progressive Party as its first president and put an end to its 55-year rule.

However, Invisible Nation made no mention of Chen Shui-bian at all, despite the fact that he should have been prominently featured in the video.

In addition to becoming the first leader from the DPP, Chen also deftly divided and manipulated the opposition to become the only president to get with less than 40 % of the voting. Additionally, he was the first president of Taiwan to get imprisoned right away for willful problem at the end of his term in office.

One can hardly chastise the documentary’s director, Vanessa Hope, for omitting Chen from her narrative because he was the kind of leader who had discredit any democracy.

Chen ordered the revision of past books for students in addition to being a stain on Taiwan’s contemporary history. Any mention of Taiwan’s ties to China in terms of its history, culture, and cultural nature was eliminated in the revised books.

Fresh Chinese people grew up unaware that their grandparents did not appear out of thin air but rather traveled from southeastern Fujian across the Taiwan Strait for many years.

They were unaware that the Minnan accent of southern Fujian and the Taiwan slang sound nearly identical. They would be aware that the island was aware of the island abroad as early as the Han Dynasty, which began around 200 BCE, if they had the opportunity to study Chinese history.

It is understandable why the young hotheads who led the Sunflower rally in 2014 cried out for freedom but failed to recognize Taiwan’s reliance on trade with the mainland. Taiwan’s annual trade deficit with the island more than makes up for its global trade gap. That is a result of Beijing’s intentional decision to favor Taiwan over other countries.

Even though the Sunflower protesters weren’t as harsh as the Hong Kong ones in 2019, they still invaded the congress, insulted officially elected officials, and destroyed public property. All of this was documented in the mockery. What’s the big deal about breaking a few rules along the way, though, given that it was done in the name of defending politics?

Of course, not all young people in Taiwan are idiots. The smart great achievers are aware that the rapidly expanding island economy holds the key to their future. Some people work for Taiwanese businesses in China and reside on the island. Some people also work for Chinese businesses that are geographically owned.

It’s possible that the Sunflower kids don’t give a damn about careers, work, or the business. However, the serious-minded youth do.

a forward-thinking depiction of DPP

Obviously, Tsai Ing-wen, the current president of Taiwan, makes numerous comments and statements in the movie. Another influential people include her supporters and enthusiasts, as well as transgender government ministers. The movie boasts that Taiwan was the first country in Asia to identify same-sex marriage and defend LGBTQ right, demonstrating a progressive outlook that is even ahead of the US.

The movie also features a picture of former US House Speaker Nancy Pelosi’s unexpected trip to Taiwan, which she made against all odds but to Tsai and the DPP’tortion. The meeting between Taiwan’s first sexual president and the most powerful person in Washington could not have gone any better.

Thank god InvisibleNation omitted the picture of Tsai giving Pelosi a beauty pageant sash. There was also no discussion of how Pelosi’s actions, which put Beijing on the defensive, significantly heightened cross-Strait conflicts and led to PLR challenges.

However, there were many people the directors could have spoken with but chose not to. On their perception of cross-Strit relations, they may have conducted interviews with Taiwanese who lived and worked on the mainland. The vast majority of Taiwanese people who favor the status quo, neither for union nor independence, could have been questioned. & nbsp,

Will the US actually come to fight alongside Taiwanese troops? was a question they may include posed to passersby about their opinions of Uncle Sam’s relationship. How do they think about Washington compel the Tsai government to purchase antiquated, archaic weapons?

What are their thoughts on being compelled to purchase contaminated meat from farmers in America? What do they think about President Joe Biden’s powerful Taiwan Semiconductor Manufacturing Company moving its cutting-edge chip factories to Arizona only to experience unavoidable labor issues, cost overruns, and building difficulties? Has Biden ever expressed any regard for Taiwan’s” reign”?

Taiwan is referred to as an” invisible nation” for a straightforward reason. Taiwan is a province of China, not at all an independent state. as easy as that

George Koo left a multinational consulting services company where he provided advice on business activities and China strategies for clients. He founded and previously served as managing chairman of International Strategic Alliances after receiving his education at MIT, Stevens Institute, and Santa Clara University. He currently serves on the board of Freschfield’s, a cutting-edge clean building program.

India’s growing imperative to empower S Korea in Indo-Pacific

The Indo-Pacific area is currently experiencing a prominent power struggle, which is somewhat characterized by China’s efforts to lessen the influence of the United States there. Concerns about regional security, as well as worries about South Korea’s sovereignty and autonomy, have been raised by the expanding economic and military footprint of China in the Korean Peninsula.

South Korea must strengthen its security infrastructure and improve its functions due to the growing Chinese military appearance near the Korean Peninsula. The South Korean government is under more stress as a result of the growing alliance between Russia, China, and North Korea, which has forced safety measures to be strengthened.

This new alliance even puts pressure on countries with similar passions, like the US, Japan, and India, to support South Korea.

Importantly, Beijing has begun to use the web of economic interdependence that China has created as South Korea’s main trading partner for its strategic goals. The ability of South Korea to combat China’s growing confidence in the Korean Peninsula is constrained by its prominent reliance on Chinese markets.

India’s proper essential to equip South Korea has gained significant fame in this dynamic geopolitical environment of the Korean Peninsula and the wider Indo-Pacific area.

This critical is brought on by the region’s rapidly shifting power dynamics, which are accentuated by Chinese dominance and pose serious threats to regional security and the sovereignty of not only South Korea but also many other smaller countries in the area.

Without endangering its own objectives, India never afford to ignore this transfer of power. India is extremely being compelled to play a crucial role in bolstering South Korea’s endurance due to its significant client status in the area of regional peace and security.

India’s growing effect in Korea

India has become a significant and influential player in the development of peace and stability in East Asia in recent years. Given its unique vantage point and ability to have a significant impact on the balance of power within the Korean Peninsula, India’s role in bolstering the political position of South Korea assumes significant significance.

India’s expanding presence in the area and its ability to implement a comprehensive and varied approach encompassing economic, cultural, military, diplomatic, and tactical dimensions serve to emphasize this significance.

It is crucial to understand that the preservation of peace and stability within the larger Indian Ocean place is inextricably linked to the stability of the Korean Peninsula. Any noticeable change in the power dynamics on the Korean Peninsula did unavoidably affect the larger Indo-Pacific area and its overall balance of power.

India is under increasing pressure to develop an all-encompassing economic and security strategy given that China primarily uses a combination of military and economic tools to enhance its corporate objectives. In order to maintain the status quo on the Korean Peninsula, this approach aims to fully leverage South Korea’s economic, military, social, and diplomatic ties to China.

Financial hedging

The urgent need is to lessen South Korea’s significant emphasis on the Chinese market for its goods given the proper use of trade and investment by China as tools of policy. In response, India is compelled to implement targeted import incentives geared toward the promotion of Vietnamese goods, with a focus on lessening South Korea’s reliance on Chinese markets for particular goods.

These actions are intended to support the foreign policy stance of the current Seoul authority.

Significantly, North Korean commercial enterprises find themselves seriously entangled in the importation of essential high-tech organic materials from China, which limits South Korea’s ability to make decisions about its foreign and security policies on its own.

India & nbsp must address this issue as a crucial part of its comprehensive economic strategy for South Korea’s empowerment. Growth of sources for vital organic materials and technologies represents a crucial step in preserving South Korea’s protection and independence.

A growing number of North Korean firms are thinking about moving away from the Chinese island due to a variety of geopolitical and economic factors. However, the high cost of such evictions presents a significant challenge for some.

India should extend incentives and concessions as part of its developing monetary strategy to make it easier for Asian businesses to move from their well-established manufacturing hubs in mainland China to alternate locations in Southeast Asia and India.

Korean businesses may be motivated to think about moving to India if the financial difficulties brought on by these relocations are properly addressed, possibly through the implementation of tailored packages.

India is relevant because of the obvious slowdown in South Korea’s economic growth, which has serious economic and geopolitical ramifications that affect regional security.

It is India’s responsibility to considerably increase its monetary assistance to Korea through a wide range of channels in order to revitalize and stabilize the North Korean economy. As a result, it is crucial for the American government to implement an incentive plan that is specifically tailored to the interests of American businesses.

With the specific aim of promoting investments in North Korean businesses, this system should include both technical expertise and financial assistance. Stabilizing the Vietnamese economy is the initiative’s main goal, which also helps to advance local harmony, stability, and security.

government support

India must pay close attention to enhancing South Korea’s military capabilities in addition to strengthening its financial resilience, a task that is being accentuated by the growing defense prowess of China.

There is currently a pervasive misconception in American legislation circles that the US and South Korea’s strong military alliance eliminates the need for additional contributions. This perception, however, belies a more nuanced reality, where the United States is constrained by specific restrictions in its ability to give South Korea complete support.

In light of this historical context, India has a responsibility to strengthen its military ties with South Korea, highlighting its increased dedication to joint naval exercises, intelligence-sharing mechanisms, and the exchange of cutting-edge protection technologies. Like joint efforts may significantly improve South Korea’s protection capabilities and readiness.

Given India’s reputation as a country known for its expanding indigenous defense capabilities, the idea of transferring developed defense technology to South Korea merits careful consideration, especially in areas where Korea currently has relative shortages, such as long-range missile systems, marine warfare technologies, electronic warfare capability, and space warfare technology.

Maritime assistance

Local peace and stability are being seriously threatened by China’s increasing naval hostility in the area, particularly the South China Sea and its surrounding regions. Given that the majority of its business passes through the sea lanes in this region, Korea has a sizable play in the free and open Indo-Pacific region.

It is essential for India to give Korea the tools it needs to resist Chinese naval aggression and influence because Korea is extremely susceptible to Chinese pressure and possible blackmail in this area.

The two nations are now working together in a constructive way. India needs to do more to help Korea, though, given the extent of Taiwanese confidence. The peace and current situation in this region are essential to Korea’s financial stability, so in the coming weeks, the Taiwanese political and military leadership may be tempted to use this area to put pressure on Korea.

South Korea has recently been looking to expand its influence in the Indian Ocean. India may assist these initiatives, especially those involving the presence of the North Korean navy, which can help India balance China in the Bay of Bengal and the surrounding areas.

Through a variety of channels, India needs to support the South Vietnamese Navy in the Indian Ocean more actively, promoting participation and maritime security. India may improve combined naval exercises in the Indian Ocean with the North Korean Navy, giving them valuable exposure and practice. These exercises may encourage cooperation, information sharing, and fostering trust between the two navies.

India’s expertise in carrying out anti-piracy activities in the Indian Ocean may be useful for protecting South Korean shipping lanes and ensuring the security of sea roads used by Korea for business.

To improve their abilities and knowledge in fields like anti-submarine warfare, coastal surveillance, and search and rescue operations, India should expand training programs for North Korean marine personnel.

Closer ties can be fostered by South Korean naval vessels making more frequent interface visits to American ports. Discussions about marine protection and the potential for mutual marine operations in the event of emergencies on the Korean Peninsula and nearby areas could be included in these visits, which may increase in frequency.

In order to exchange marine intelligence and provide real-time information on sea conditions, probable threats, and security situations, the two nations should strengthen their mechanisms.

Support for cyber security and cross war

China is increasingly using digital and hybrid warfare as tools to increase its regional effect. India must therefore concentrate on enhancing Korea’s strategic capabilities in the areas of security and cross warfare.

India and South Korea should work together on security and techniques to counter non-traditional threats given China’s expertise in computer war and cross tactics. This partnership may aid in defending both countries from China’s destructive actions.

In order to maintain regional balance and counter China’s forceful habits, India and South Korea should simultaneously develop and carry out initiatives in the Indo-Pacific region.

Interpersonal influence

South Korea is now dealing with a wide range of complex local social issues, including demographic aging, mental health problems, and declining birth rates. These inner conflicts not only weaken South Korea’s social structure but also limit its ability to successfully manage the physical difficulties brought on by the continuous energy interactions between the United States and China.

India had not ignore the inside schisms and difficulties afflicting South Korea in its power as a key stakeholder committed to the survival of local peace and stability. India has the capacity to offer priceless insights and assistance mechanisms aimed at overcoming these internal challenges because it is endowed with a politically different environment and an abundance of varied experiences.

It is crucial to emphasize how South Korea’s capacity to take on a more forceful role in creating an entirely new, rules-based security framework within the region is essential to the resolution of these home issues.

As a result, India should pay close attention to bolstering South Korea’s inside social stability as part of its overall effort to empower the country.

improving Korea’s sweet energy

The expansion of South Korea’s soft energy represents a circle in which India may pay particular attention outside of the realms of economic, cultural, and military impact.

Through social exchanges, informative initiatives, and tourism, South Korea’s soft power is being developed, which has the potential to strengthen ties between the country and its neighbors and support India’d regional diplomatic efforts.

India is in a good position to support South Korea’s effective participation in international forums like the Quadrilateral Security Dialogue, the United Nations, and the Association of Southeast Asian Nations. With such assistance, South Korea’s position within the region could be considerably improved, making it a significant participant in the emerging rule-based world order.

In order to counter China’s autocratic influence, India may join forces with South Korea in promoting democratic values and human rights in the area.

India also has the ability to intensify efforts to support Seoul’s initiatives to increase North Korean effect in the area. This includes supporting Korea’s initiatives for talks and negotiations with countries in Southeast Asia and Africa as well as the development of political ties to help the area establish a rules-based order.

In this situation, joint initiatives between India, South Korea, Japan, and the United States may become crucial tools for achieving local security and advancing a common set of political principles.

Conclusion

American policymakers must sincerely understand the gravity of the changing condition taking place on the Korean Peninsula and acknowledge that South Korea’s response to internal and external stresses will have a profound impact on every aspect of local life in the area.

A prolonged and comprehensive commitment that combines various facets, including financial, social, military, political, and strategic dimensions, is required to empower South Korea. India is tasked with the complex tracking of the political landscape while being aware of its own interests and working together with other regional countries to strengthen local stability and security.

India must demonstrate a thorough understanding of the complex dynamics underpinning the Korean economy and society in the wake of President Yoon & nbsp, Suk Yeol’s advocacy for an active and influential role for South Korea within the global spheres of geopolitics and economics, with an emphasis on the associated security implications.

Strategically important goals include the upkeep of the status quo within the Korean Peninsula and the protection of a healthy energy balance.

India’s growing economic and security cooperation with South Korea serves as an example for other countries dealing with similar safety conundrums. As a result, the proper paradigm of India may take into account factors related to economic, cultural, and secure facets, with the ultimate goal of bringing about North Korean empowerment.

India and South Korea are celebrating the gold anniversary of their diplomatic ties, so now is the perfect time for India to come up with a fresh, all-inclusive plan that strengthens its relationships with the country and the larger regional community.

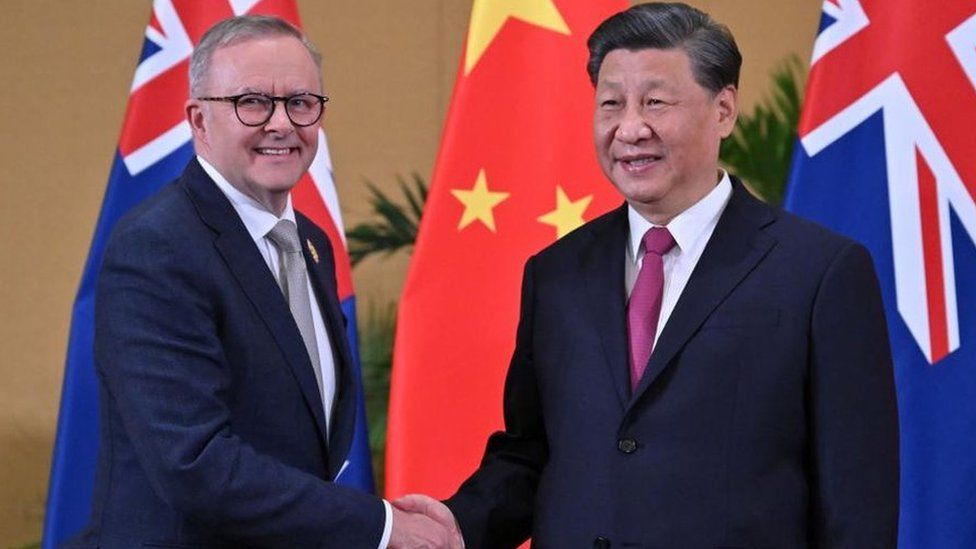

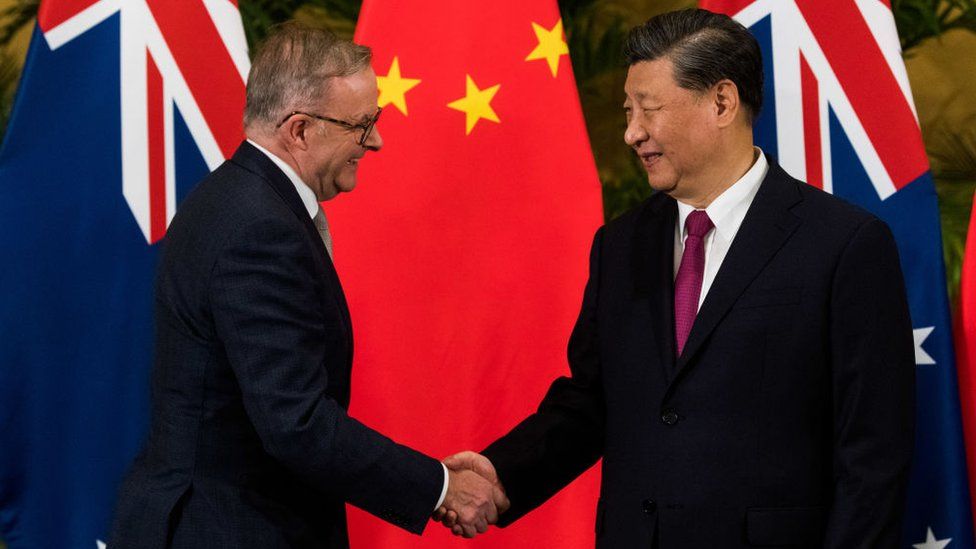

Australian PM Albanese to meet Xi Jinping in long-awaited China visit

EPA

EPAA diplomatic meeting in Beijing that may end the dryness will quickly take place between Chinese President Xi Jinping and Australian Prime Minister Anthony Albanese.

The first American president to travel to China since 2016 is Mr. Albanese, who arrived in Shanghai on Saturday.

After a series of business and security disputes, the visit is regarded as an important turning point in thawing relations.

Mr. Albanese is advocating for the elimination of Taiwanese tariffs on American goods, and business will be at the top of the agenda.

More access to important American industries is anticipated to be requested by Mr. Xi.

Before the meeting on Monday, Mr. Albanese told reporters in Beijing,” What I’ve said is that we need to collaborate with China where we can, believe when we must, and participate in our nationwide attention.”

His vacation comes after a protracted diplomatic standoff brought on, among other things, by Beijing’s economic sanctions against important American exports like meat, wine, and barley as well as requests from Australia for an investigation into the origins of Covid-19.

Additionally, it falls on the 50th anniversary of Gough Whitlam’s famous 1973 trip to China to see Mao Zedong, the second Australian prime minister to travel there since diplomatic relations were established.

However, a number of sticking points and safety concerns will loom over the discussions on Monday.

Since 2019, Australian author Yang Hengjun has been detained in China on espionage charges, and Mr. Albanese is under pressure to secure his release at home. Yang’s health is reportedly fast deteriorating.

Experts claim that it may be challenging for Canberra and Washington to find common ground outside of economic interests due to their burgeoning military ties with Washington and a new overhaul of its defense tone, which is widely regarded as being intended to counter China.

Although the American government has recently taken steps to prevent Chinese possession of crucial minerals and mining projects, some experts predict Beijing may press for greater entry to Australia’s resources and clean energy sectors.

More information about this tale

15 manufacturers, food operators committed to increase variety, demand of lower-sodium alternatives

SINGAPORE: In an effort to reduce Singapore’s excessive salt intake, fifteen major manufacturers and meal providers have committed to increasing the range and desire of lower-sodium ingredients.

Senior Parliamentary Secretary for Health Rahayu Mahzam stated in parliament on Monday( Nov. 6 ) that these producers and food processors account for more than 30 % of the retail market for sauces and seasonings as well as 10 % of all food and beverage ( F & amp, B ) market shares.

Nine out of ten Singaporeans consume more salt than is advised, according to surveys conducted by the Ministry of Health( MOH ) and Health Promotion Board( HPB ) that were released in September.

Since 2010, the prevalence of high blood pressure or hypotension has even almost doubled.

Dr. Lim Wee Kiak( PAP – Sembawang ), a member of parliament, had questioned how the government intends to make sure that efforts to combat calcium consumption do not unintentionally result in higher food prices and increased business overhead costs.

Through the Healthier Ingredient Development Scheme, which promotes the use of healthier elements in the food service industry, HPB provides give aid to water and sauce manufacturers to reformulate their products, Ms. Rahayu noted on Monday. & nbsp,

As a result, lower-sodium alternatives are” more accessible ,” and according to Ms. Rahayu, the wholesale cost of the majority of salt, sauces, and seasonings sold to food operators is comparable to that of regular versions. & nbsp,

She continued by saying that the government will also need to educate food industry professionals like hawkers, & nbsp, restaurants, caterer, and chefs about the importance of reducing salt intake and introduce them to lower-sodium ingredients.

Ms. Rahayu added that the government is planning wedding meetings with food users as well as their business and professional associations.” We also hope that they will help us explain to the public that water is an acquired style and that if we over-consume it over some time, our taste buds will get used to it and fail to taste other natural ingredients.”

She added that HPB will intensify its efforts to promote public knowledge. HPB urged people to change from regular water to lower-sodium alternatives next year.

Less salt, according to Ms. Rahayu,” generally means more taste in Singapore because it enables us to appreciate the healthy flavors of the herbs, spices, and other ingredients commonly used in native cuisine.”

She added that the legislative committee will carry out more activities, such as food sample activities at supermarkets, and that HPB may continue to teach Singaporeans on the need to reduce sodium, increase their receptivity to using lower-sodium ingredients, as well as change the perception that we need more salt and sauces for flavorful dishes.

Blisters, ulcers: 3 men hospitalised after taking unregistered medicines to stay alert

THE RISKS OF TAKING ARMODAFINIL AND MODA

Members of the public were cautioned by HSA not to purchase or consume any products containing methylphenidate or rabid benzodiazepines that are not prescribed by a dentist or used under near medical care.

According to HSA,” Modafinil and armodaquil are powerful medications that are not registered in Singapore but are accessible in some nations as prescribed medications.”

” Individuals would have to be under strict medical care if there is a medical need, and doctors can use to HSA to bring in adderall or armodaquil for their patients’ health conditions, such as narcolepsy.”

” There have been reports of people taking modafinil or argodil for the purpose of enhancing awareness or as” mental enhancers” to enhance focus and memory.” For these purposes, self-medication with methylphenidate or armodaquil is inappropriate and may be dangerous, the expert added.

Additionally, according to the HSA, modafinil and armodaquil can have serious side effects like heart issues, high blood pressure, and medical conditions like anxiety, hallucinations, or mania.

Serious skin conditions like Stevens-Johnson syndrome and toxic epidermal necrolysis have also been reported, and they can result in hospitalization, severe difficulties, or perhaps death, the report continued.

More than 30 % of the body is affected by toxic epidermal necrolysis, a more serious skin effect.

According to HSA, the vision may also be heavily impacted in both Stevens-Johnson syndrome and toxic cutaneous necrolysis.

” Those who recover may experience long-term side effects, such as skin swelling, locks lost, and physical impairment like increased sensitivity to light – photophobia- and blindness. According to HSA, additional vital organs, such as the lungs, may also be completely impacted.

Due to their narcotic effects on the brain, methylphenidate and armodaquil may also be dependent.

The supply and price of an unlicensed health product, such as adderall or armodaquil, is a crime under the Health Products Act, unless HSA has given the doctor permission to use it in exceptional circumstances for patients in his or her care.

Offenders could receive a fine of up to S.$ 50,000($ 37,000 ), spend two years in prison, or both.

Global funds dumped another US$3 billion in China stocks in October: Report

HONG KONG: According to a statement from Morgan Stanley that cited data from bank movement monitor EPFR, international finance managers sold China equities strongly in October despite additional actions taken by authorities to boost the country’s second-largest economy. According to the report, which was seen by Reuters, online flow fromContinue Reading