Japanese businesses have a long history of falling behind in the electric vehicle( EV ) market, but plans to quicken vehicle assembly and the production of batteries, motors, and electronic components could quickly catch up.

Japan Inc. ‘ s action should increase the pressure on EV prices, hasten the switch away from internal combustion engines, and generally benefit consumers.

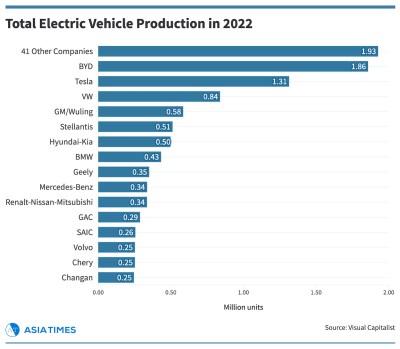

Toyota currently has the highest number of car sales of any other company in the world, while Honda and Nissan already hold strong positions in international rating. Nissan, however, is the only Japanese company that is listed among the top 15 EV producers thanks to the Renault – Nissan-Mitse Alliance.

With less than one-fifth the efficiency of industry leader BYD, the Alliance ranked 10th in 2022. Toyota and Honda may turn their sizable worldwide franchises and consumer popularity into significant EV market shares if they want to continue leading the auto industry.

Furthermore, neither should be incapable of reaching EV speeds.

Honda announced on April 26 that by 2040, all of its car models will be fuel cell electric vehicles ( EVs ). The company intends to produce more than two million Batteries annually by 2030 in order to achieve this goal. Many objectives include:

- In the US, two EV models that were co-developed with GM and one that used Honda’s inner electric vehicle platform were introduced in 2024 and 2025, respectively. GM’s acquisition of chargers and the creation of a joint venture with LG Energy Solution to produce chargers.

- 10 EV models will be introduced in China by 2027, and 100 % of the market will have sold by 2030. greater cooperation with power producer CATL.

- By 2026, four EV models will be available in Japan, along with home and social paying services. purchase of batteries from Envision AESC, a Japanese-founded business that is now 80 % owned by Nissan and 20 % by China’s ENvision Group.

- For entry in the next half of the century, solid-state batteries were being developed. Continue working with US battery R & amp, D company SES.

Honda, GS Yuasa, and Japan’s Ministry of Economy, Trade and Industry ( METI ) announced joint plans on April 28 to invest 434 billion yen( US$ 3.2 billion ) in a new lithium-ion battery factory in Japan, with government subsidies covering more than 35 % of the cost.

The start of construction is expected in 2027. The Chinese government declared chargers to be a tactical device in December of last year.

Honda and North Korean steel producer POSCO announced plans to work together on the present and recycling of battery materials as well as the mass production of EV motor steel earlier this month.

In the meantime, Toyota intends to launch 10 different battery-powered EV models and increase monthly supply from 1.5 million models by 2026 to 3.5 million by 2030.

Within the same time frame, Prime Planet Energy & amp, Solutions, the company’s battery supplier in Japan, intends to increase production. Prime Planet produces batteries for Tesla and is owned by Toyota 51 % and Panasonic 49 %, respectively. Toyota in China receives chargers from CTL and BYD.

In the financial year ending March 2023, 27 % of Toyota’s unit prices were hybrid vehicles, but the majority of them were full hybrids, which continue to use internal combustion engines.

Some plug-in hybrid used a device as their primary source of power. The information underlying the EV Unit Production map above includes plug-in hybrids and battery-powered electric vehicles, but not full ones.

( See The high, high cost of Toyota’s EV blunder by William Pesek for a more dubious view of its switch to electric vehicles. )

The price cuts by Tesla and the announcement of an EV with a cut-rate of$ 11,400 by BYD are proof that the auto industry has entered an age of value. However, the trend toward lower EV costs has been clear for a while.

The$ 4,500 Hongguang Mini EV from China and Suzuki Motor’s intention to introduce a 1 million yen minicar in Japan by 2025 both garnered attention in 2021. The Hongguang Mini was the wave of the future, according to Shigenobu Nagamori, president of EV machine manufacturer Nidec, who spoke to the media that same year.

The price market in EVs will be more intense, just like in home appliances, he predicted, with new competitors entering the market from outside the vehicle industry.

The psychological equivalent of a$ 10, 000 price point in the US is one million yen($ 7, 500 ). It was already a yardstick two years ago.

Falling price made it impossible for smaller and less wealthy manufacturers to develop their own vehicles, so Nidec entered the EV engine markets in 2018 with the intention of building up huge economies of scale and capturing a sizable portion of the market. The application of this strategy is well under way.

Nidec sold 949,000 of its E-Axle systems( electric traction motor and related components ) in the fiscal year that ended on March 31, 2023, with 86 % of them in China and 14 % in Europe. Over the past three decades, the number of ships has increased by nearly 20 years and by 2.8 years from the previous year.

Nidec anticipates selling 1.7 million elements and breaking even this fiscal years. It intends to sell more than 3 million elements in financial 2025 and 10 million by 2030. According to Nidec’s management, that would give the business a 26 % market share globally.

The competition for EV motors is undoubtedly crowded. Aisin, a Hitachi and Toyota advertising in Japan, Bosch, Continental, and Daimler in Germany, Borg-Warner and Dana in the US; BYD, Shaanxi Automobile and Hepu Power in China; and numerous other international rivals compete with Nidec.

Economy of scale is essential for survival as a result of the ongoing worldwide competition that has driven both EV and machine costs down. Nidec manufactures EV actuators in China and Europe and is constructing a shop in Mexico for this reason, as well as to be close to its customers and prevent trade resistance.

15 different models made by a dozen automakers, including Guangzhou Auto Group Co, Ltd ( GAC ) and its joint ventures with Toyota, Honda, Mitsubishi Motors, Geely, and Smart Automobile, have so far used Nidec’s EV motors and E-Axle systems.

Tunnel Magneto-Resist ( TMR ) sensor production will be doubled at the Asama Techno Factory in Nagano, according to plans made by Japanese electronic parts manufacturer TDK on April 27. The increase in production ought to start in the first half of 2025.

TMR sensors have increased precision, dependability, and lower power consumption thanks to the company’s core magnetic and thin-film technologies.

They are also used in robots and other commercial machinery and are highly sought after by the car business for e-axle and power wheel motor control, in braking systems, and as active sensors for power control.

Temperature and pressure detectors, accelerometers, device systems, rechargeable batteries, power supplies, and silent components are also provided by TDK to the automotive and other industries.

Due in large part to engine electricity, including ADAS and EV formation, which is increasing the number of parts per vehicle, TDK’s prices increased by 15 % in the fiscal year ended March 2023.

Due to its high reliance on smartphone demand and relatively low gear to the car industry, Murata, the largest exporter of batteries and other quiet parts in Japan and the entire world, reported a 7 % decline in sales in the year to March.

Follow this author on Twitter at @ ScottFo83517667.