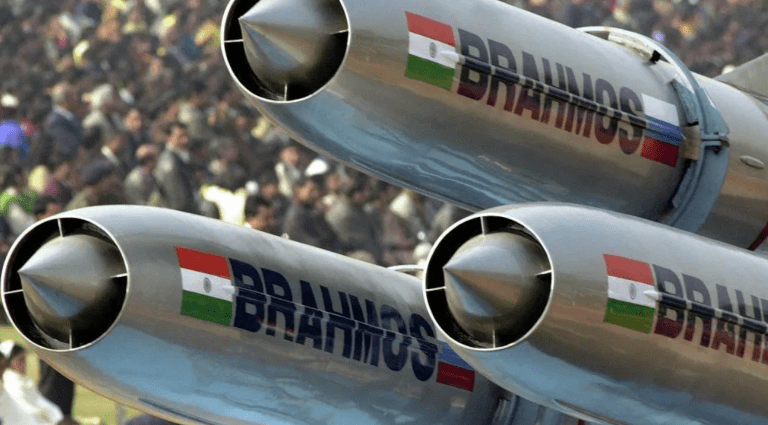

India is considering selling BrahMos missiles to Russia, a potential role reversal between the two long-time strategic allies who jointly developed the potent weapon.

Atul Dinkar Rane, BrahMos Aerospace CEO and managing director, said his company has been continuously looking at Russia as a potential market for the air-launched BrahMos supersonic cruise missile, claiming Russia has no equivalent currently in service, The Week quoted him as saying in a Q&A.

“If they had purchased it [before the Ukraine war], they would have had a lot of things to use in the current situation,” Rane said. “After the ongoing situation in Europe ends, we might get some orders from Russia, especially for the air-launched BrahMos,” he said.

Russia could potentially use the BrahMos like its P-800 Onyx missile, the BrahMos’ Soviet-era predecessor. While the P-800 Onyx is designed as an anti-ship missile, it has been used against ground targets in Syria and Ukraine.

While the Brahmos and Onyx have similar performance characteristics, institutional problems in Russia’s defense industry caused by underfunding, corruption and Western sanctions could eventually push Russia to acquire the BrahMos from India.

Should Russia choose to use BrahMos in Ukraine, the West would have no similar weapons to counter the missile. Western cruise missiles such as Storm Shadow are subsonic designs that capitalize on stealth, maneuverability and terrain-hugging flight to penetrate air defenses.

While the Brahmos might not have any strategic effect on the course of the Ukraine war, like many of Russia’s much-touted “superweapons”, it might push the West to supply Ukraine with even more advanced weapons. These could include additional air defense systems or short-range ballistic missiles (SRBM) such as the MGM-140 Army Tactical Missile System (ATACMS).

The possible poor performance of Russia’s much-hyped Kinzhal missile in Ukraine, witnessed in multiple interceptions, could cause Russia to buy the BrahMos from India.

In a May 2023 article for the Modern War Institute, Peter Mitchell critically likens the Kinzhal to a giant lawn dart loaded with explosives, as the missile uses a solid-fuel rocket motor that most likely cannot be throttled or slowed down in flight.

Mitchell notes that the Kinzhal glides in a ballistic arc to its target once the rocket motor has burned out, making sustained hypersonic flight to its target unlikely.

He says air resistance to the target, meager control surfaces and the missile’s sheer mass inhibit its ability to perform evasive maneuvers to avoid interception.

India and Russia’s strategic partnership would play a key role in any future BrahMos missile sales to the latter.

Asia Times noted in April 2022 that while India is a significant military power with the world’s second-largest army, fourth-largest air force and seventh-largest navy, it is also one of the largest arms importers. India currently imports 70% of its military equipment, with 60% coming from Russia.

Russia’s heavy material losses in Ukraine raise the possibility that Russia may redirect some of India’s weapons orders to replace its battle losses. Western sanctions on Russia’s defense industry have also raised doubts about the viability and reliability of Russia as India’s long-term arms supplier.

This month Moscow Times reported that Russian defense firms have been buying back equipment they produced and sold to certain Asian customers.

For instance, Russian tank manufacturer Uralvagonzavod imported US$24 million of its products from Myanmar’s military since December 2022, including 6,000 sighting telescopes and 200 cameras for installation in tanks that could be used to modernize Russia’s old T-72s now in storage.

The Moscow Times report also says that a Russian missile manufacturer in August and November purchased $150,000 worth of night-vision sights on anti-aircraft missiles from the Indian Ministry of Defense (MOD). While customs data shows the parts were returned because they were defective, there are no reports of the items being sent back to India.

Bloomberg reported in April 2023 that Indian payments worth more than $2 billion for Russian weapons have been stuck for a year. Bloomberg says Russia has stopped supplying credit for $10 billion worth of S-400 missile defense system spare parts that have yet to be delivered.

It also mentions that India cannot make payments in US dollars due to concerns about secondary US sanctions, while Russia refuses to accept Indian rupee due to its exchange rate volatility.

However, Defense News reported in May 2023 that India and Russia have agreed to resolve delayed payments on defense contracts while formalizing a plan for local production in India of certain Russian equipment and spare parts.

Defense News mentions that India’s MOD will make payments using the Financial Messaging System of the Bank of Russia (SPFS), an alternative to the SWIFT system that several governments have barred Russia from using in punitive response to its Ukraine invasion.

The report also notes that Russian original equipment manufacturers will set up joint ventures with Indian private defense industries to produce spare parts, systems and subassembly material locally and perform maintenance, upgrades and overhauls to keep India’s Russia-sourced military equipment operational.

Russia has been burning through its surface-to-surface missile stocks in the ongoing Ukraine war, prompting substantial efforts to replenish its arsenal.

Asia Times reported in June 2023 that Russia has been firing cruise missiles mere weeks after their production, with recovered Kh-29 air-to-surface missile remains in March 2023 showing that the missile was manufactured in the fourth quarter of 2022. The remains of one Kh-101 retrieved in November 2022 indicate it was manufactured just a month before.

Despite that high expenditure, Ian Williams notes in a June 2023 article for the Center for Strategic and International Studies (CSIS) that, despite Western sanctions, Russia can still manufacture 60 cruise missiles, five Iskander ballistic missiles and two Kinzhal missiles per month, with Western-made microchips in those missiles finding their way to Russia via friendly third parties such as China.

Although there have been reports that Iran, another of Russia’s strategic partners and comrade-in-sanctions, has made plans to supply short-range ballistic missiles (SRBM), it appears to be tarrying on the decision.

Asia Times noted in June 2023 that Iran may still be gauging the possible international reaction if it supplies Fateh-110 and Zolfaghar SRBMs to Russia, which could trigger international sanctions under UN Security Council (UNSC) Resolution 2231, which is due to expire in October this year.

Iran is already heavily sanctioned and China may shy from overtly assisting Russia’s war effort to avoid possible Western sanctions.

Russia may thus see India as an ideal intermediary for manufacturing or acquiring sensitive components and weapons like the BrahMos to keep its war machine turning over during the Ukraine war.