In a remark that was republished by Asia Times on January 27, Noah Smith asserts that “reshoring US economy is achievable and happening.” His argument is based on flagrant misrepresentation of the facts.

Some of his mistakes depend on cherry-picking the day range – for example, a table that shows cell production up 20 % since 2018. But US battery production is down 20 % from 2014, if one looks at a long-term chart ( below ). That’s certainly a success story. Nevermind that the Federal Reserve index’s peak for manufacturing output in 2007 was 106, which is now only 99.

When the Biden Administration made the announcement about its CHIPS Act subsidies, which Smith describes as a significant advance for British manufacturing, there were shortages of labor and materials when building device processing plants began. An unheard-against production increase resulted in a 37 % increase in the Producer Price Index for new plant construction in a single year. At the same time, the number of vacant construction positions nearly doubled.

Smith is relieved that the US’s solar panels manufacturing capacity reached 27, 000 megawatts in 2024, which indicates that the US is” just way behind China.” How far behind? Smith doesn’t state. I may: China may make 890, 000 megawatts of solar panels – 33 times the US number.

The mistake in Smith’s panegyric to US business is how heavily America depends on imported capital goods, which are used to make other goods.

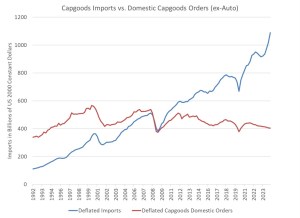

At only$ 400 billion annually, US imports of capital goods exceed private orders by almost three days. Both figures are deflated to January 2000 using the government’s price index for cover commodities exports and private investment products, both. Both set exclude trucks. Whatever the US is producing, it produces it generally with imported investment products.

Of course, the US imports a lot of electronics, whose prices have fallen by half since 2000, and it exports machinery, whose price has doubled ( the US exports about half as much capital goods as it imports ). It’s hard to get an apples-to-apples evaluation of local cover products purchases and cover products imports. But the developments however are striking: US cover goods exports jumped after Covid, rising by 60 % from 2020 through 2024.

Yes, Taiwan’s TSMC, which built a grow in Arizona, which is staffed primarily by workers and technicians from Taiwan, was able to create more computer chips inland because TSMC couldn’t get enough qualified workers in the country. That’s the kind of achievement that makes failure seemed interesting by comparison.

The reality is that America’s dependency on foreign countries is rapidly increasing. In the last ten years, the entire business output has remained essentially unchanged, while capital goods imports have almost doubled. It will require more to re-shore American industries than to publish economy blogs with hot weather.