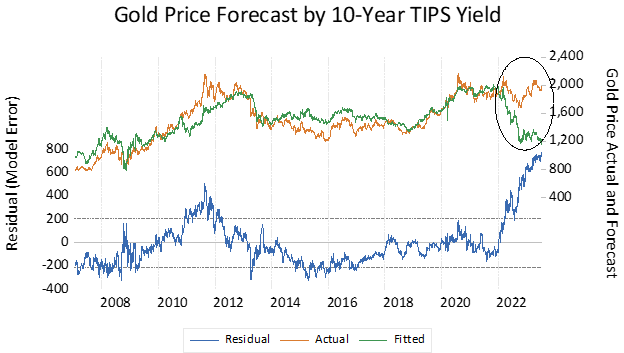

Gold and TIPS have a similar portfolio function, to hedge against unexpected inflation or dollar depreciation. The trouble is that buying inflation insurance from the US federal government is like buying shipwreck insurance from the purser of the Titanic. After the massive expansion of US government debt during the COVID epidemic, TIPS and gold diverged. The divergence reached an all-time record July 20 (gold is $778 higher than the TIPS yield would predict). The price of disaster insurance against the US dollar keeps rising.