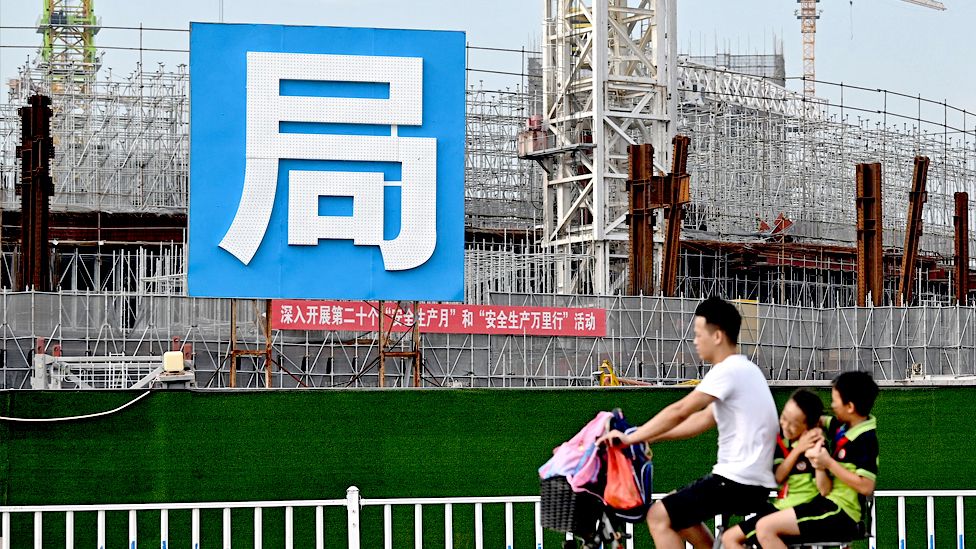

Shares of Evergrande, a Chinese real estate juggernaut that has been hit by the financial crises, have increased as investing in the company resumed after being suspended in Hong Kong.

On Tuesday, Evergrande shares increased by more than 40 % in early trading before closing at about 15 % higher.

In 2021, it declared default on its debt, causing a real estate problems in China.

When the town’s market was shut down for the National Day holiday on Monday, Evergrande stated in a statement to the Hong Kong Stock Exchange that” there is now no other in information in relation to that needs to be disclosed.”

When buying resumed in August following a more than 1.5-year hanging, Evergande’s shares fell by almost 80 %.

Since July 2020, the company’s stock market valuation has decreased by almost 99 %, and its shares are currently worth about HK$ 0.35($ 0.05,£ 0.04 ) each.

The company, which was once China’s top-selling real estate developer, has been struggling with debt totaling more than$ 300 billion(£ 248 billion ).

When Evergrande failed to make payments on its international obligations in late 2021, it caused jitters in the world financial marketplaces.

The company’s strategy to restructure agreements with its bondholders was further complicated by the growth.

Hui Ka Yan, the company’s founder and chairman, was” subject to mandatory procedures in accordance with the law due to suspicion of unlawful acts ,” it said a few days later.

Evergrande requested Book 15 debt protection in the US in August. While a foreign firm is working on restructuring its debt, Chapter 15 safeguards its US possessions.

According to some analysts, the most recent failures have raised the possibility that the business won’t be able to come to an agreement on a reform strategy with its creditors.

Evergrande will appear in court in Hong Kong to discuss a winding-up request that could potentially push it into bankruptcy. The reading, which was supposed to happen in July, will now happen on October 30.

Related Subjects

On this account, more

-

-

three days ago

-

-

-

4 weeks before

-

-

-

three days ago

-

-

-

4 weeks before

-

-

-

three days ago

-