Evergrande, a Chinese company that owns land, and its leader, Hui Ka Yan, are accused of overdossing$ 78 billion in revenues in the two years that preceded the company’s default on its debts.

The country’s financial markets regulator has fined the company’s mainland business Hengda Real Estate 4.2bn yuan ($ 583.5m, £458.6m ).

Mr Hui likewise faces being banned for life from China’s financial industry.

The China Securities Regulatory Commission ( CSRC ) laid much of the blame on Mr Hui, who was once China’s richest man, for allegedly instructing to “falsely inflate” Hengda’s annual results in 2019 and 2020.

Evergrande did not respond to a BBC request for comment right away.

The CSRC announced its intention to investigate securities fraud and safeguard little investors with “teeth and antlers,” days after it vowed to do so.

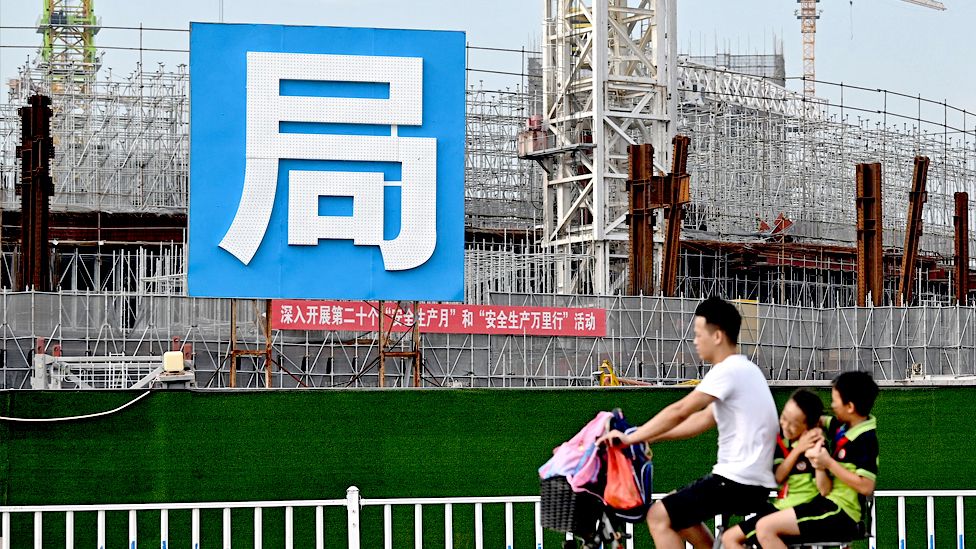

With more than$ 300 billion in debt, Evergrande has been the poster child of China’s housing crisis.

Evergrande’s entire financial health and potential reform methods have been appointed as liquidators.

That might involve reselling and seizing assets so that the profits can be used to pay off outstanding bills.

Although some would-be people in China are waiting for properties they have already paid for, the Chinese government may not want to see work stop on property developments there.

The industry, which accounts for roughly a third of the world’s second largest business, is experiencing significant impact due to issues in China’s home market.

Since 2021, when officials began to reduce the amount of money large real estate developers can borrow, the sector has been in a significant financial strain.

Numerous big home companies have since defaulted on their payments.

Official data released on Monday revealed that property investment in China decreased by 9 % between January and February.

The number of new construction goes decreased by 30 %, which is their worst drop in more than a year.

Related Issues

-

-

28 February

-

-

-

29 January

-

-

-

29 September 2023

-

-

-

29 January

-