In March 2023, the Iranian government claimed to have discovered a massive lithium deposit, in the magnitude of 8.5 million tons. China is the largest consumer of lithium, which it mostly imports from Australia, the world’s biggest exporter of lithium. In 2020, it was responsible for almost half of the lithium available in the world.

More than 90% of Australia’s lithium is exported to China, filling 85% of the latter’s need. In the first half of 2023, Australia’s revenue from selling lithium concentrate to China exceeded US$7 billion.

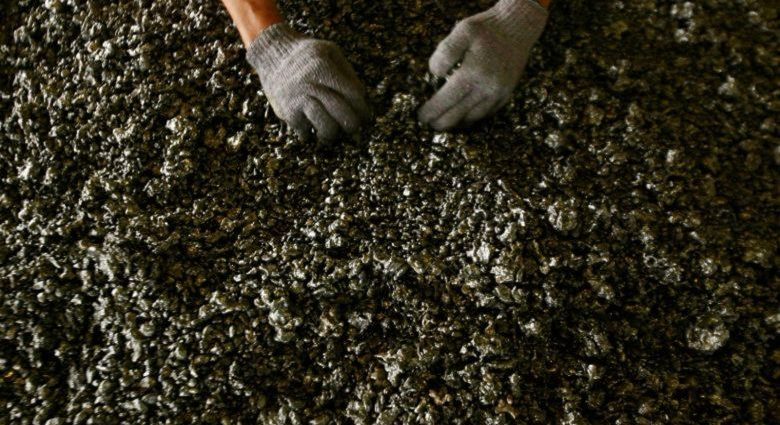

Lithium is a key component of electric vehicle (EV) batteries and given China’s drive to become the world’s leading EV producer, its demand for lithium will only increase – Australia’s lithium export revenue was estimated to more than triple over 2022–2023.

But Iran’s lithium discovery might challenge Australia’s dominance in the Chinese market. China is the largest export destination of both Iran and Australia.

In 2022, Australia sent more than one-fourth of its exports to China, valued at $104 billion. Iran has been an important supplier of crude oil to China, sending more than 750 thousand barrels per day, over one-quarter of its production.

As the world’s car industry rapidly transitions to EVs, the demand for lithium as a key ingredient of EV batteries surges — the demand for batteries was responsible for almost 80% of all lithium use in 2022. This has implications for other countries that aspire to play key roles in the industry, such as the world’s largest producer of nickel, Indonesia.

In 2019, Indonesian President Joko ‘Jokowi’ Widodo issued a regulation on the acceleration of an EV program in Indonesia.

In 2020, the Ministry of Industry issued its National Industry Development Plan, which states that the priority for the automotive industry for the period of 2020 to 2035 is the development of EV and its components.

The plan includes making battery-based EVs at least 20% of total vehicles produced in 2025. According to the plan, Indonesia aims to be in the top five global EV battery producers by 2040.

In line with this ambition, Indonesia established joint ventures with South Korea’s Hyundai and China’s Shanghai General Motors Wuling. The government appointed the Indonesia Battery Corporation to serve as a hub of EV battery manufacturing, taking advantage of Indonesia’s rich nickel deposit.

However, Indonesia lacks other ingredients to produce EV batteries, most notably lithium. Unsurprisingly, the prospect of Australia and Indonesia joining forces in producing EV batteries became one of the talking points during Jokowi’s visit to Australia in July 2023.

But there has not been any concrete realization of the plan after the signing of a memorandum of understanding between the Indonesian Chamber of Commerce and Industry and the Western Australian government.

Just like Indonesia, Australia is pursuing a downstream processing industrialization strategy. This also applies to lithium, as stated in the Critical Minerals Strategy.

Australia might be trying to be careful not to antagonize the United States in its beef against China, considering that China’s investment in nickel processing in Indonesia is significant – since 2013 China has been the largest source of foreign direct investment in Indonesia’s mineral sector.

While Iran’s discovery of lithium reserves might open the opportunity to expedite Australia–Indonesia EV battery cooperation and help reduce Australia’s dependence on China, domestic politics that include tensions between economic and environmental objectives in each country may complicate trade cooperation. For its part, Indonesia is very aggressively implementing industrial policy.

As noted, to address the slowing industrial growth Jokowi has been pursuing downstreaming, most notably nickel, as a means of increasing domestic value added.

By banning the export of raw commodities, the policy aims to incentivize the development of downstream sectors. There has been a significant increase in the exports of nickel derivatives following the export ban of nickel ores.

But the policy lowers domestic prices of nickel ores, discouraging mining exploration, though it increases the profitability of downstream users, many of which are foreign-owned – especially by Chinese investors.

In the few instances where Indonesia is a substantial global supplier with international market power, the withdrawal of Indonesian supply may push up global prices and therefore benefit other exporters.

While such a strategy increases the export earnings of a downstream sector, the value added to the national economy and the direct employment effects are not as high as claimed.

Even if the pursuit of downstreaming in both Australia and Indonesia waned, it is important not to limit cooperation to a bilateral endeavor alone, as EV batteries need much more than just nickel and lithium.

The EV battery industry should be integrated with an internationally-oriented automotive industry. Industrial policies like downstreaming run counter to the goal of joining global value chains.

Arianto Patunru is a member of the ANU Indonesia Project at the Arndt-Corden Department of Economics, Crawford School of Public Policy, The Australian National University.

This article was originally published by East Asia Forum and is republished under a Creative Commons license.