Someone has to talk Donald Trump down off the ledge.

In a February 12 Fox News interview, the once and maybe future president was asked if he really wanted to slap a 60% tariff on imports from China. “No, I would say maybe it’s going to be more than that,” Trump answered.

Of course, it won’t happen. The US can’t put a 60% tariff on imports from China, any more than Trump can fly off the Trump Tower roof. The consequences of trying either stunt, though, would be similar.

When Ronald Reagan was president, imports of capital goods came to about one-tenth of total US spending on business equipment. By 2023, imports had risen to a jaw-dropping 63% of all US spending on business equipment. The US imports more capital goods than consumer goods.

China is no longer America’s biggest source of imports. Mexico is now in first place, mainly because it imports Chinese components, assembles them, and ships them to the US. But the US imports vast amounts of capital goods from China: the circuit boards that run everything from tow trucks to toasters, electric generating and switching equipment for utilities, industrial turbines and, of course, raw materials hard to source elsewhere, like rare earth metals – you name it.

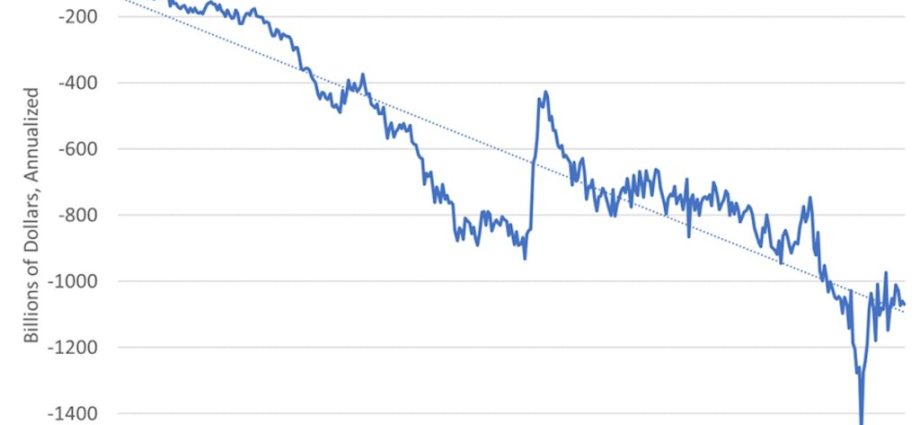

Trump wants the US to shrink its trade deficit, which has widened steadily for the past thirty years. Eventually, it will have to; the US sells its assets to foreigners to make up the difference in what it earns and pays in commerce, and it has run up a net foreign investment position of nearly $20 trillion.

But the shock treatment he proposes would push American businesses off a cliff. A huge tariff on Chinese goods wouldn’t prompt American businesses to invest and produce the same goods at home. Before American firms could produce anything, they would have to buy capital goods, which mainly come from imports, especially from China. Other countries could make up some of the difference, but China accounts for a third of the world’s manufacturing production, and there aren’t enough resources outside China to compensate.

Not only civilian business, but the US defense industry would crater as well. As the Financial Times reported on June 19, 2023: Greg Hayes, chief executive of Raytheon, said the company had “several thousand suppliers in China and decoupling … is impossible.”

“We can de-risk but not decouple,” Hayes told the Financial Times in an interview, adding that he believed this to be the case “for everybody.”

“Think about the $500bn of trade that goes from China to the US every year. More than 95 percent of rare earth materials or metals come from or are processed in China. There is no alternative,” said Hayes. “If we had to pull out of China, it would take us many, many years to re-establish that capability either domestically or in other friendly countries.”

After the 2000-2001 recession, American business discovered “capital light” investing. We made expensive software while Asia made the low-margin hardware – first Japan, then South Korea and Taiwan and then China.

Our capital stock of manufacturing equipment hasn’t grown since 2001, according to Federal Reserve estimates. We’re about $1 trillion short in capital equipment investment at current prices compared with the long-term trend. That’s five years’ worth of total investment in capital equipment at current rates.

Rebuilding American manufacturing would take years with the strongest encouragement by the US government. It couldn’t be done without imports, because the US capital goods industry is hollowed out and American manufacturers depend on imports. That’s a matter of arithmetic. Trump is right to say that the US economy is sick, but his cure would kill the patient.

Restoring American manufacturing, as I wrote in a short book published by the Claremont Institute, requires big changes in the tax code, environmental regulation, worker training and federal support for high-tech R&D. It requires selective subsidies. With an all-in effort, the US could make a big dent in its import dependency in five years. It can be done, but not the way Trump proposes to do it.