PERSONAL VIGILANCE AND TECHNOLOGICAL SAFEGUARDS

Above all, it’s vital for the individual to come to terms with the losses and stark truths. Yes, they should accept that they made mistakes but also recognise that the vicious cycle of self-blame and sadness won’t aid in progression. This is a pivotal step in the healing journey.

How long the ensuing emotional distress lasts differs from person to person – some could grapple with the pain for months or even years. This is shaped by their support networks, coping strategies, and the magnitude of their financial setbacks.

At a roundtable on combating scams in May, I voiced my apprehensions and scepticism about the true feasibility of preventing scams. Relying solely on public education isn’t sufficient. Everyone, including experts in the field, remains susceptible, particularly amid hectic schedules, multi-tasking, and moments of human oversight.

The government also acknowledged on Oct 25, in its consultation paper on how the scam losses will be shared, that preventing scams is not only the responsibility of consumers but also of industry stakeholders. Financial institutions act as “gatekeeper against the outflow of monies due to scams”, while telcos are infrastructure providers for SMS.

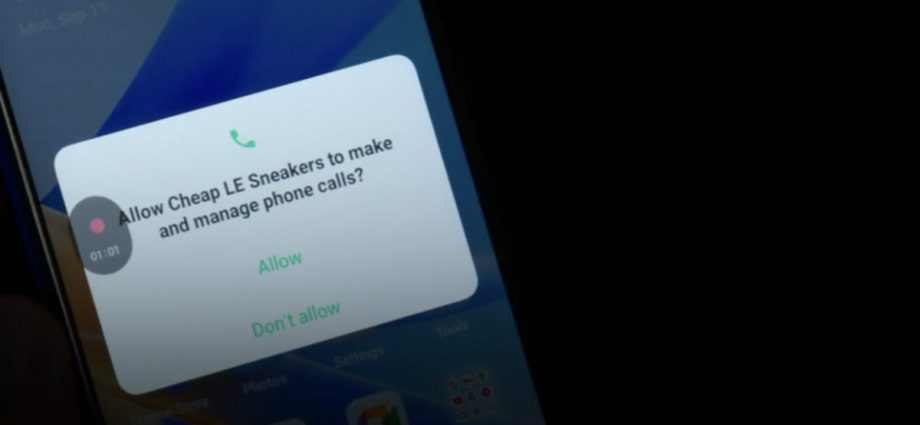

Vigilance may be the best defence against scams, but scammers are relentless and getting more sophisticated. Technology also grants scammers expansive access to vast audiences, thereby increasing potential victims.