Other incentives, including export credits (typically up to 85 per cent of a jet’s purchase price), may be extended to airlines willing to punt on the C919. Support in terms of maintenance, repair and overhaul, the construction of hangars and crew training are also included in the package.

That said, the C919 will still a hard sell outside of China’s domestic market. Air travellers may be wary of the “Made in China” label and COMAC has no track record to boost confidence, as a new and relatively unknown player.

Others say its weight – several tonnes heavier than the Airbus A320 and thus, less fuel-efficient – and limited range (5,500km vs about 6,500km for the A320 and Boeing 737 Max) make the C919 unattractive.

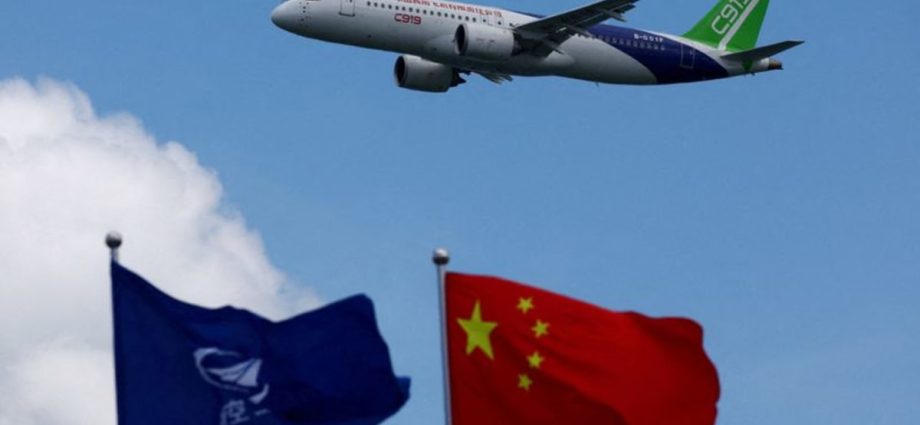

Christian Scherer, Airbus’ top salesman, told journalists after watching the C919 fly in Singapore that it “is not going to rock the boat”.

NOT IN THE GAME FOR MONEY, FOR NOW

But COMAC is not in the game to make money, at least not for now.

Its strategy is simple: Scale up at home, continue refining its planes, develop its own engines and exploit gaps in the market, at a time when Boeing is reeling from self-inflicted wounds.

While the US remains the world’s largest domestic aviation market, China is a close second and is projected to top the global market for aviation services by 2042, according to Airbus.