SINGAPORE: If Citibank’s mobile app detects dangerous permission settings on other apps, a new anti-scam feature will restrict users’ access.

The security update, according to an email sent to Citi Mobile App users on Friday( Sep 15 ), is a part of ongoing efforts by Citibank to provide an environment that is safe and secure for banking. & nbsp,

According to Citi, the measure to safeguard users’ online banking information will limit access to the banking app if it finds” any apps or tools with risky permission settings attempting to access the & nbsp, Citi & npsb, Mobile ® and blp. App.”

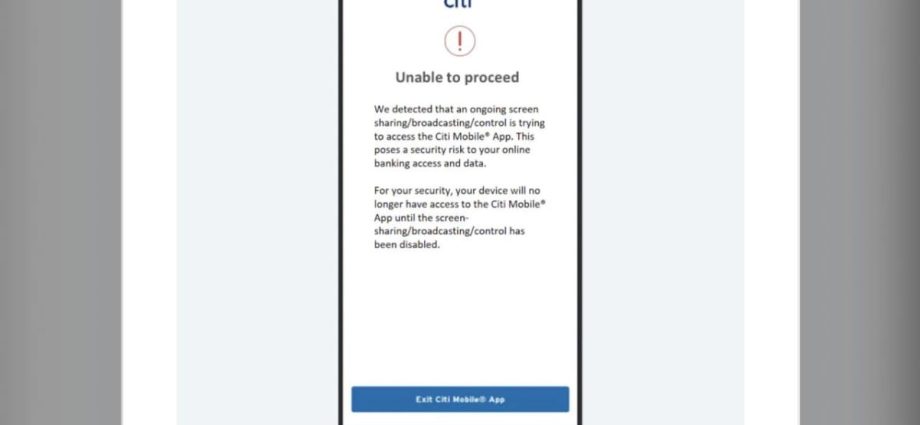

When consumers attempt to access the application, an inaccuracy screen will appear.

You must turn off any risky permission settings on the other app / tool in order to continue accessing the & nbsp, Citi & tnpsb, Mobile ® & nfspen, App, it was added.

According to Citi, this includes preventing display sharing or radio on another apps or tools.

” Once such risky permission settings have been turned off, you are free to continue using the & nbsp, Citi & crt, Mobile ®, andnpsc, App” and your access to them will be unrestricted.

It noted that con artists are using more and more sophisticated strategies to trick consumers into downloading malware or destructive apps onto their devices.

Scammers can remotely access your gadget after installing a malignant app and steal sensitive data, such as personal data and bank credentials, in order to carry out fraudulent financial transactions.

For more details, CNA has gotten in touch with Citi.

Similar functionality was introduced by OCBC in August, & nbsp, which forbids users from logging onto their telephone if it detects possibly hazardous programs downloaded from illegal sites. Online banking users are also included in OCBC’s safety update.

Their OCBC online banking services were not accessible to those who had high-risk software installed on their mobile devices.

However, after the security release went into effect, OCBC consumers posted their worries on the company’s social media. & nbsp,

Some users claimed that OCBC’s security feature had flagged apps like the well-known Chinese video sharing platform Douyin, the online payment system Alipay, and the LG bright appliance control app.

To get their banking services, the lender advised users to install them from the standard app stores.