Shares of Chinese firms listed in the US have slumped on concerns that President Xi Jinping will continue with his ideology-driven approach at the cost of economic growth.

Chinese technology giants Alibaba and Baidu fell by over 12% in New York.

Investors fear the world’s second largest economy will be held back by its tough coronavirus restrictions.

One analyst said Beijing was in a “tug-of-war” between measures to boost growth and its zero-Covid policies.

On Monday, shares in technology giant Alibaba closed 12.5% lower on the New York Stock Exchange, after hitting a 52-week low earlier in the day.

Internet company Baidu lost 12.6%, while e-commerce platform Pinduoduo plunged by almost 25%.

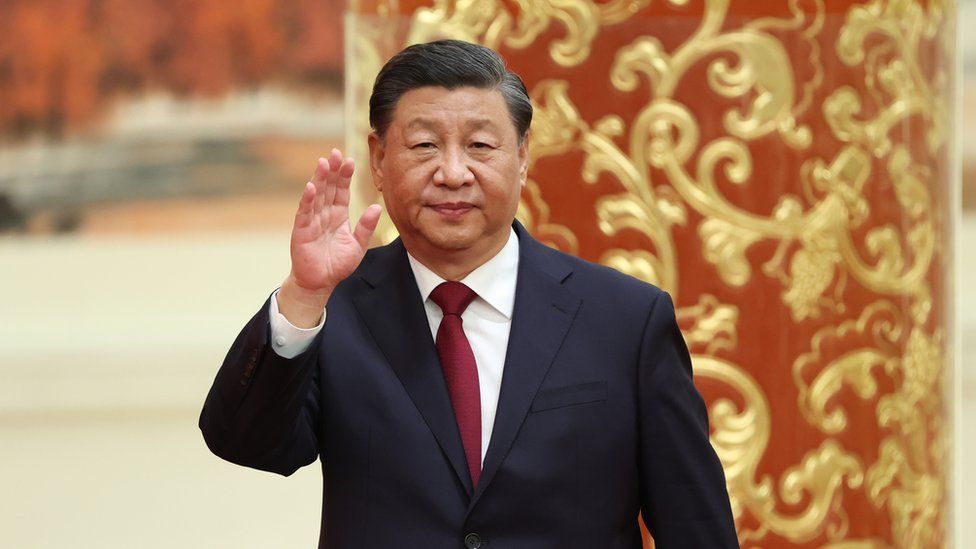

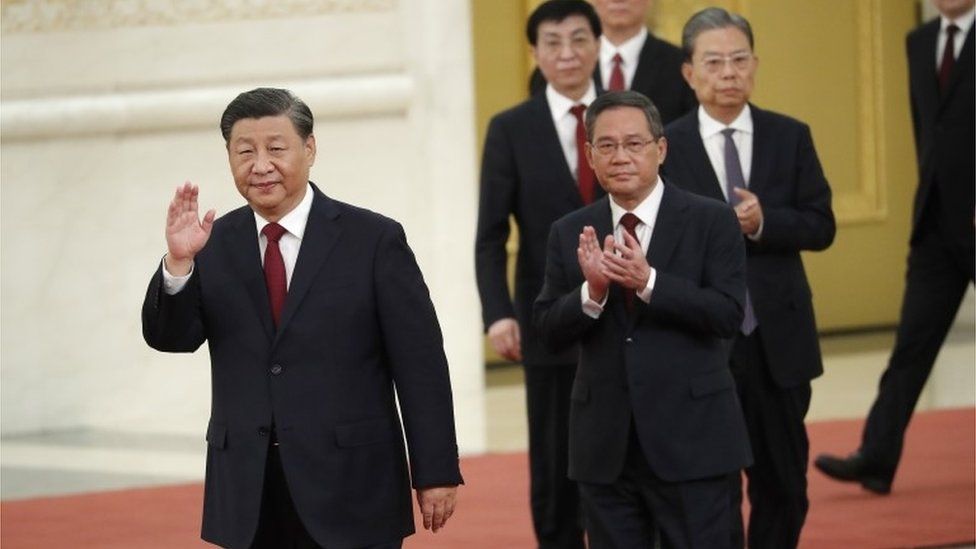

It comes after China’s ruling Communist Party wrapped up its twice-a-decade congress on Sunday.

During the week-long event President Xi, who secured a historic third term in charge, offered no timeline for the easing of the country’s strict measures to slow the spread of the coronavirus.

The zero Covid policies have seen some of China’s biggest cities being put into lockdown, including the financial, manufacturing and shipping hub of Shanghai.

China’s economy is facing “policy stimulus and multiple growth headwinds including Covid restrictions, a property market downturn and slowing exports,” Minyue Liu from BNP Paribas Asset Management told the BBC.

“We expect the [Chinese] government to face continued domestic pressure on its zero-Covid policy,” she said.

Although official figures published on Monday showed that the economy grew at a better-than-expected rate between July and September, “there were still signs of stress as consumption has remained weak due to ongoing Covid-19 flare ups and property weakness,” Erin Xin, Greater China economist at HSBC said in a note to investors.

“With the lack of clarity, people are assuming the direction that we have seen would be even stronger. That’s what led to the selling and the worsening expectations of the Chinese economy moving forward,” Trinh Nguyen, senior economist at Natixis told the BBC.

On Tuesday, stock markets in Hong Kong and mainland China regained some ground after sliding the previous day.

Hong Kong’s benchmark Hang Seng index lost more than 6% on Monday, while the the Shanghai Composite closed 2% lower.

You may also be interested in:

This video can not be played

To play this video you need to enable JavaScript in your browser.

-

-

20 hours ago

-

-

-

1 day ago

-