- On monitor to obtain yearly value saving of US$ 158–180 million

- One-off merger adjustments cut FY2024 EBIT by 13.4 % and PAT by 11.4 %  ,

.jpg)

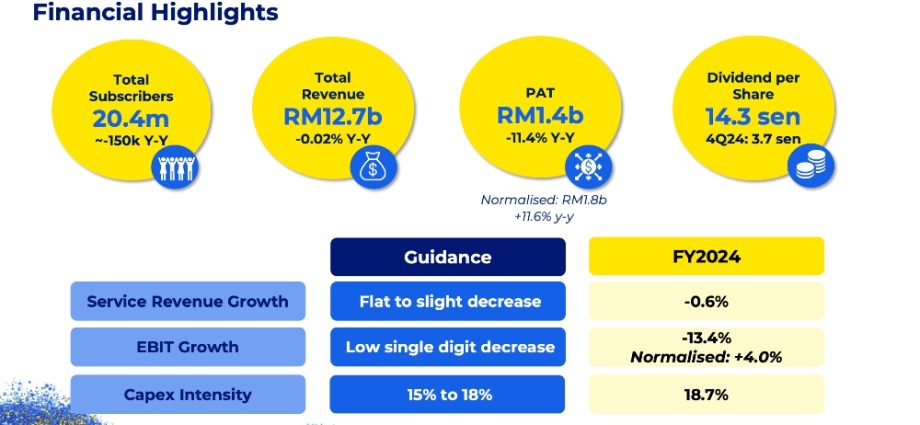

CelcomDigi Berhad has released its fourth-quarter and full-year results for the financial year 2024 ( FY2024 ), which show strong financial and operational performance while carrying out an extensive integration program in its second year as a merged company. The company stated that it has progressed forward of strategy in merging and transforming its community, IT, financial, customer experience, and operating model, laying a solid foundation for long-term lucrative growth.

Second-year inclusion and transformation away of plan, collaboration targets on-track

In 2024, CelcomDigi accelerated its networking integration and reform, completing about 75 % of the program. Additionally, it safely completed the initial stage of harmonising its customer relationship management and billing systems. Revenue productivity and customer experience have increased as a result of the opening of 48 novel retail locations. Secondly, the business recently updated its goods lineage, which is now governed by a single CelcomDigi company, across all customer and enterprise segments.

As a result of these cost efficiencies, CelcomDigi remains on track to achieve annual cost savings of US$ 158 million ( RM700 million ) to US$ 180 million ( RM800 million ) post-2027.

]RM1 = US$ 0.22]

Developing opportunities for profitable and sustainable development

In the first three months of FY2024, CelcomDigi maintained a steady topline with solid underlying profitability and disciplined cost management and synergy realization.

One-off merger-related financial adjustments led to a 13.4 % decline in reported EBIT and an 11.4 % drop in PAT for FY2024. However, excluding these non-recurring adjustments, normalised EBIT grew by 4.0 % to RM2, 797 million, while normalised PAT increased by 11.6 % to RM1, 748 million, driven by cost optimisation and synergy savings.

Earnings growth in Postpaid, Home &, Fibre, and Enterprise options offset declines in Prepaid and Enterprise smart. FY2024 services revenue stood at RM10, 792 million, marking a slight 0.6 % decrease in the second year of connectivity.

Postpaid revenue grew 2.6 % year-on-year to RM4, 181 million, supported by a subscriber increase of 374K, while Prepaid revenue declined by 3.4 % to RM4, 416 million, with subscriber losses (-23K Q-Q) slowing, indicating signs of stabilisation.

Home &, Fabric profit surged 34.4 % year-on-year to RM185 million, with 76K new clients, outpacing business growth. Enterprise Solutions also recorded an 8.8 % increase, while Enterprise Mobile improved 5.2 % quarter-on-quarter, reflecting stronger adoption of corporate offerings.

CelcomDigi finished the year with an increased integrated Profitability of RM42 and an estimated 20.4 million subscribers. The business declared a third time income of 3.7 senator per share, bringing the FY2024 total to 14.3 sen per share, in line with its green dividend commitment.

Future progress and efficiency are provided by change initiatives.

We accomplished important milestones in our next season of post-merger connectivity, capturing synergies as planned while maintaining fiscal discipline to give solid financial and operating performance, according to CEO Idham Nawawi. In accordance with our FY2024 direction, this execution allowed us to create value for shareholders.

He added,” With a solid foundation in place, we will focus on strengthening business management, driving long-term profitable progress, and enhancing customer value through product innovation and online services. We aim to be one of the most cost-effective operators in the world by improving our operating model and improving our costs.

” We will continue to invest in digital services and AI-driven capabilities to redefine customer experiences.” These initiatives will sustain our market leadership, drive our telco-tech ambition, and support Malaysia’s development into a 5G-AI-powered digital society”, Idham said.

Financial and operational highlights

- Consumer: Postpaid continuing growth momentum, while Prepaid base stabilised with retention activities

- Postpaid subscribers grew 83K Q-Q and 374K Y-Y in Q4 FY2024, reaching 5.79 million subscribers, driven by the company’s efforts in offering attractive packages and competitive pricing. Q4 2024 revenue was RM1, 063 million, 1.6 % Q-Q and 3.9 % Y-Y, reflecting market trend with growing mid-value customer base, coupled with outbound roamers during the year-end festive period.

- Prepaid subscribers decreased -23K Q-Q, -621K Y-Y to 12.86 million subscribers, driven by targeted retention campaigns. Revenue in Q4 was RM1, 088 million, -0.7 % Q-Q, -5.1 % Y-Y, impacted by lower activations arising from dual-SIM consolidation and a strategic decision to reduce reliance on one-time rotational SIM segment. Average revenue per user ( ARPU) remained stable at RM28 despite price competition.

- Home &, Fibre: Persistent and solid growth in subscribers and revenue, with industry leading subscriber additions

- Subscribers grew 29K Q-Q, 76K Y-Y, totaling 188K subscribers, driven by competitive offerings and channel push.

- Revenue was RM56 million, 14.3 % Q-Q, 48.3 % Y-Y, in tandem with the growth of subscribers. ARPU reduced to RM107 due to one-off finance re-classification.

- Enterprise: Improved performance in Enterprise Solutions

- Enterprise revenue improved 4.3 % Q-Q driven by increase in Mobile, M2M, ICT Solutions and Bulk SMS, but declined -1.7 % Y-Y in Q4 FY2024 to RM307 million, mainly affected by the decline in mobile revenue.

- Fixed connectivity and ICT solutions are key factors in the growth of the corporate sector.

FY2025 financial guidance

For 2025 or beyond, CelcomDigi anticipates a more robust and sustainable outlook. The guidance for FY2025 is as follows: