Global VC investment remains muted, falling to US$77.4bil across 7,783 deals in Q2â23

KPMG Private Enterprise’s Venture Pulse shows AI startups still hot

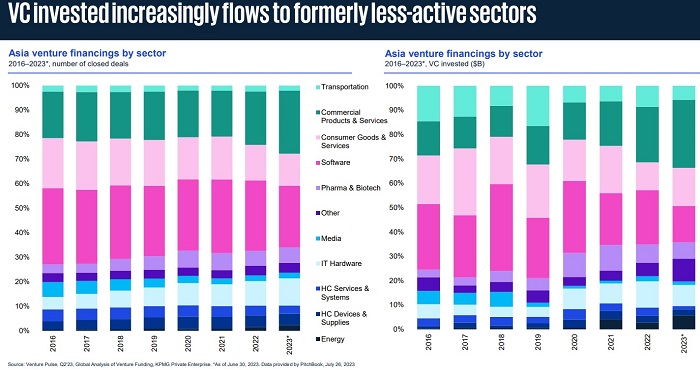

VC deals in Asia drop from US$22.9bil across 3.1k deals to US$20.1bil

Chock full of data professional services firm KPMG issued its Venture Pulse Q2’23 report of the state of global venture capital investment with the headline figure showing that VC funding…Continue Reading