Southeast Asia’s e-commerce to reach new heights, driven by digital payments and cross-border commerce growth

- By 2028, digital payments will make up 94 % of e-commerce transactions in SEA

- Intra-SEA cross-border business set to hit$ 14.6B by 2028, growing 2.8 days from 2023

The latest report by market intelligence firm IDC, commissioned by global payments platform 2C2P and Antom, reveals that Southeast Asia’s ( SEA’s ) e-commerce market is projected to reach US$ 325 billion ( RM1.44 trillion ) by 2028. This development is fuelled by the rapid implementation of electronic payments and local portability, unlocking greater possibilities in cross-border business for businesses.

This week’s report, How Southeast Asia Buys and Pays 2025, marks the third edition of the IDC InfoBrief since 2021. It surveyed 600 responders across six South Asian markets— Indonesia, the Philippines, Malaysia, Singapore, Thailand, and Vietnam—examining the evolving modern payment landscape both locally and within each country. As the country’s fifth-largest business, SEA’s excellent growth trajectory is essentially driven by its expanding e-commerce market, underpinned by increasing online payment adoption.

The document explores the state’s evolving digital payments environment and provides a market-specific study of payment trends. It also highlights how these changes are reshaping organization methods and laying the foundation for future growth prospects.

Important features from the statement:

A comprehensive understanding of SEA’s digital payment landscape is critical to tapping into this US$ 325 billion ( RM1.44 trillion ) economy. To maximise approach within regional markets, businesses must give customers their chosen transaction methods, enhancing the overall consumer experience and driving higher conversion rates.

]RM1 = US$ 0.22]

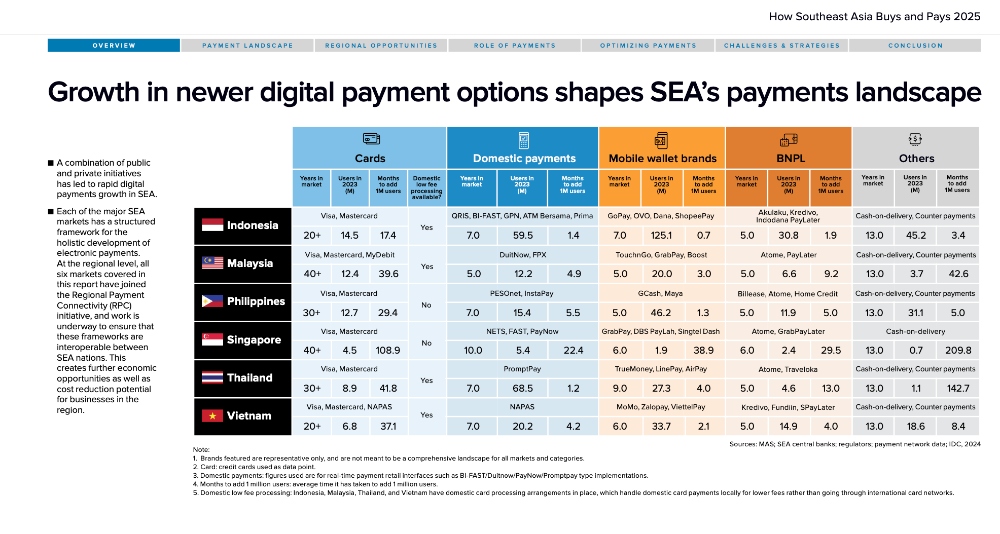

- Growth in ecommerce digital payments: By 2028, digital payments are expected to account for 94 % of total e-commerce payments in Southeast Asia. The most significant growth will be seen in domestic payments (97.9 % ) and mobile wallets ( 94.9 % ), which have expanded e-commerce reach in regions that traditionally relied less on cards.

- Surge in real-time payment (RTPs ): Speak are projected to grow rapidly, surpassing US$ 11 trillion by 2028. This pattern is now visible in Singapore, where Speak like PayNow are the second most supported payment method among surveyed stores in 2024. The fall of Gamification in Southeast Asia is largely driven by government efforts to reduce income reliance and promote strong, low-cost transaction solutions that benefit both customers and merchants.

- Dominance of smart cards and local bills: Mobile cards and local payments remain the most popular payment methods across Southeast Asia. In 2023, smart cards were the best choice in Indonesia, Malaysia, and Vietnam, while local bills dominated in Singapore and Thailand. This pattern continued in 2024, with smart cards ranking as the next most accepted payment method among surveyed stores in Singapore and the Philippines, and second in Indonesia and Thailand.

- There are also significant opportunities across SEA in intra-SEA cross border commerce.  ,

- Opportunities in cross-border commerce: Intra-SEA cross-border commerce is projected to reach$ 14.6 billion by 2028, a 2.8 times growth from 2023. Notably, except for Vietnam and Indonesia, average cross-border transaction values per customer surpass domestic values in SEA markets, highlighting significant opportunities for businesses operating in the region.  ,

- Driving cross-border commerce with regional payment connectivity ( RPC ): Cross-border commerce is further supported by initiatives such as regional payment connectivity ( RPC ), which includes all six SEA markets. This collaboration aims to streamline inter-country payments, enhancing efficiency and reducing transaction costs.

- Higher returns in cross-border commerce: For 62 % of surveyed SEA merchants who sold their services and products across borders, such transactions were, on average, 21 % higher than domestic transactions. Merchants stand to reap significant rewards by looking beyond their shores and building up their capacity to cater to neighbouring markets.

- Untapped potential of intra-SEA trade: Despite its promising growth, intra-SEA trade remains underutilised, accounting for only a small fraction of total cross-border commerce in each market. To fully capitalise on this, merchants must gain a deeper understanding of the distinctive operating environments in each market while leveraging shared advantages. By strategically addressing these factors, businesses can unlock the full potential of intra-regional trade and drive sustainable growth.

Agnes Chua, managing director of Business and Product Development of 2C2P,  , stated,” Southeast Asia’s e-commerce landscape is evolving at a breathtaking pace. Merchants recognise the immense opportunities this growth brings them in driving e-commerce revenue, but also acknowledge the increasing complexity it brings to their operations. This includes common challenges such as customer support and issue resolution, payment gateway integration and technology issues” . ,

” At 2C2P, we empower businesses to navigate these challenges with confidence by delivering payment solutions that simplify operations, enhance cross-border capabilities, and drive growth in the region’s rapidly expanding digital economy so merchants can quickly unlock new opportunities and thrive in this dynamic environment”, she added.

Gary Liu, general manager of Antom, Ant International, said,” Southeast Asia is rapidly emerging as a global hub for digital commerce and innovation. As businesses expand across borders, seamless and efficient transactions are essential for maintaining competitiveness. At Antom, we see payments not just as infrastructure but as a catalyst for business growth” . ,

” By working with 2C2P and other businesses within Ant International’s ecosystem, we empower merchants with unified payment and digitisation solutions covering the full payment lifecycle while also exploring opportunities in global account services, financing, and treasury management to further support their expansion. Through close collaboration with local regulators and industry partners, we aim to unlock new opportunities for businesses of all sizes, helping them thrive in Southeast Asia’s evolving digital economy”, he added.

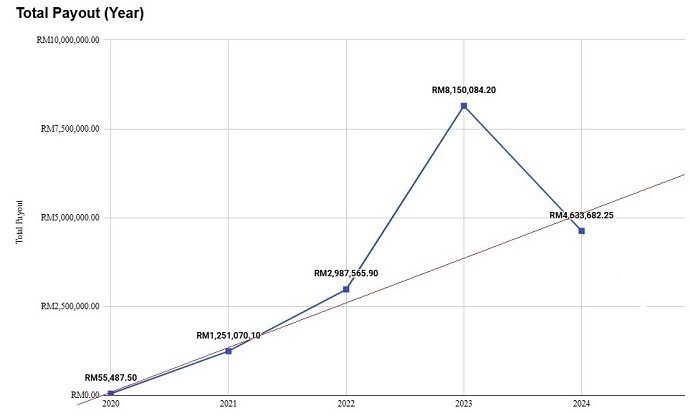

,” This problem wasn’t fresh, I only suffered through it”, said Tiffany Khoo, a leading scholar who left a legitimate career at Bank Negara Malaysia in late 2019 to become Human manager at iHEAL Health Sdn Bhd, a little medical centre in Kuala Lumpur, run by her father.

,” This problem wasn’t fresh, I only suffered through it”, said Tiffany Khoo, a leading scholar who left a legitimate career at Bank Negara Malaysia in late 2019 to become Human manager at iHEAL Health Sdn Bhd, a little medical centre in Kuala Lumpur, run by her father.

.jpg)