China’s Naura rising to the chip-making equipment challenge – Asia Times

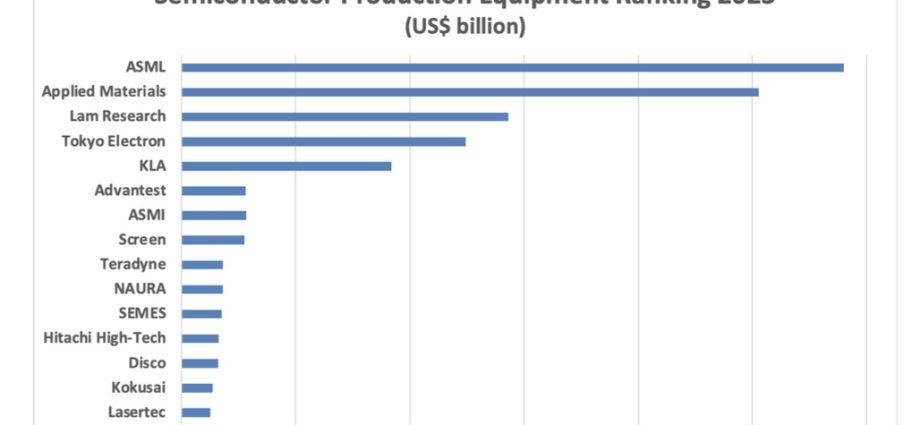

According to Shanghai-based technology consulting company CINNO Research, Naura Technology, China’s top producer of semiconductor production technology, has moved up to 6th position in the world ranking.

Simply ASML, Applied Materials, Lam Research, Tokyo Electron, and KLA currently lead Naura in terms of overall sales.

The CINNO Ranking for 2024 feels like this:

- Netherlands ASML

- Applied Materials ( USA )

- Lam Research ( USA )

- Tokyo Electron ( Japan )

- KLA ( USA )

- NAURA ( China )

- Screen ( Japan )

- Advantest ( Japan )

- ASM International ( Netherlands )

- Disco ( Japan )

Naura has gained popularity as a result of the rapid expansion of the Chinese semiconductor sector, which last year made up more than 40 % of the world’s production technology need.

Naura released preliminary high and low sales estimates for 2024 that were on average 29.7 billion yuan, or US$ 4.1 billion at the current exchange rate, up 36 % from 2023, in January.

Financial benefits that have been finalized and are perfect are expected to be released in April. The sales of Naura have increased by a whopping ten times in the last three decades and are now 7.5 times higher than they were in 2019.

Naura was ranked 8th in 2023 by CINNO, but a more thorough examination by TechInsights, which looked at both sales of semiconductor production equipment and not just the overall sales, placed it in 10th location.

Around 60 % of Naura’s overall sales were made up of semiconductor production equipment in that year.

According to the data available so much, Naura placed 8th and not 6th place, which would suggest a similar difference existed in 2024. However, it is now one of the most well-known businesses in the sector, outperforming its rivals.

The first and second layers of the market are very different, but it seems that Naura has the ability to overtake KLA by the end of the decade.

Naura gained notoriety during a time when the US state treated her fairly. The Chinese agency’s merger of Akrion Systems, a Pennsylvania-based manufacturer of silicon chip area planning tools, was approved by the Committee on Foreign Investment in the United States in January 2018.

Beijing Naura Magnetoelectric Technology, a company of the US Commerce Department, was added to the Unconfirmed List in October 2022, but Beijing was removed after conversations with control.

Companies are placed on the Unconfirmed Record when the BIS is unable to “verify their bona fides because an end-use verify could not be properly completed,” in this case, for breaches of export restrictions to the People’s Republic of China.  ,

However, the Biden administration’s last mass sanction of tech exports to China and related sites in Singapore, South Korea, and Japan was Naura, which the BIS  added to its Entity List in December 2025. It is one of 140 organizations that the US government has “determined to be acting against the US’s national surveillance and foreign policy passions.”

According to the BIS,” The Entity List” “identifies companies for which there is reasonable cause to believe, based on specific and articulable details, that have been, are, or pose a significant risk of being or becoming involved in activities contrary to the United States ‘ national security or international coverage interests.”

However, Naura is not particularly worried, stating that “at the moment, 90 % of the company’s income comes from the home market and less than 10 % from the international markets, so this effect is expected to be minor.”

For the silicon, flat panel display, and renewable industries, as well as for the production of lithium-ion batteries, capacitors, resistors, glass devices, power source, and micro modules, Naura’s product line now includes testimony, etching, cleaning, heat treatment, UV curing, and crystal growth equipment.

Additionally, it reportedly intends to add photoresist coating and developing to its portfolio of semiconductor equipment, possibly by acquiring a sizable stake in and eventually acquiring Kingsemi, the only Chinese manufacturer of this equipment.

About 90 % of the market for coater/developer equipment is held by Tokyo Electron, with Japan’s Screen Holdings accounting for the majority of the rest.

In deposition, etching, and cleaning equipment, Naura competes with Tokyo Electron and Screen. In addition to Lam Research and Applied Materials, it is up against in deposition and etch, but those two companies have been hampered in China by a US government order that forbids American companies from servicing the equipment they have sold there.

Numerous other Chinese manufacturers of semiconductor production equipment are attempting to enter the supply chain. Advanced Micro-Fabrication Equipment ( AMEC ), the second-largest, specializes in deposition and etch.

With sales of about$ 1.2 billion in 2024, AMEC is likely to rank between 15th and 20th in the global ranking. However, sales increased by an estimated 45 % last year, making it move up quickly.

The entire Chinese semiconductor industry is purchasing whatever equipment they can from Naura, AMEC, and other domestic suppliers, including SMIC, Hua Hong, and other Chinese foundries, YMTC, and other Chinese makers of memory ICs.

Western and Japanese businesses and market research firms have been anticipating a decline in Chinese equipment demand for about a year, but they have so far proven to be incorrect and are likely still doing so.

The sales of Chinese semiconductor equipment makers should continue to grow as long as there is market share to take from imports that are subject to US-led sanctions.

Follow this writer on , X: @ScottFo83517667

.jpg)

.jpg) ” We are in an incredible new era of digital labour where every business will be transformed by autonomous agents that augment human work, revolutionising productivity and enabling every company to scale without limits”, said Marc Benioff ( pic ), chair and CEO of Salesforce. He added that Singapore is at the forefront of this shift, and as the largest provider of digital labour through its Agentforce platform, Salesforce is thrilled to expand its work with the business community and its long-time partners in the region to drive innovation, productivity, and growth.

” We are in an incredible new era of digital labour where every business will be transformed by autonomous agents that augment human work, revolutionising productivity and enabling every company to scale without limits”, said Marc Benioff ( pic ), chair and CEO of Salesforce. He added that Singapore is at the forefront of this shift, and as the largest provider of digital labour through its Agentforce platform, Salesforce is thrilled to expand its work with the business community and its long-time partners in the region to drive innovation, productivity, and growth.