CelcomDigi in AI-driven autonomous network MoU with Ericsson

- Optimise system ops to remain delivering exceptional knowledge

- Integration of AI features to help system integration &, reform

CelcomDigi Bhd and Ericsson ( Malaysia ) Sdn Bhd signed a MoU yesterday to collaborate on advancing autonomous network operations. The program aims to employ AI-driven system analytics to optimise CelcomDigi’s system operations, enabling it to continue delivering better networking experience for its customers throughout Malaysia.

With rising 5G implementation, system difficulty continues to grow due to an increasing number of related devices and various use cases. To solve this, CelcomDigi and Ericsson will simultaneously observe the development of sophisticated, intent-driven intelligent systems.

Key elements of the partnership include:

- AI-driven technology – Utilising AI technologies to enhance system performance and optimise performance.

- 5G service confidence – Ensuring better, distinguished 5G services for businesses and consumers.

- Enhanced customer experience – Improving service quality and operational efficiency through autonomous solutions.

As part of the collaboration, Ericsson will bring its global expertise and industry-leading AI Intent-Based Operations ( IBO ) to accelerate the pace of developing the autonomous network operations. The integration of AI-driven autonomous capabilities will also support CelcomDigi’s ongoing network integration and modernisation efforts, building the nation’s leading digital network for Malaysian enterprises and consumers.

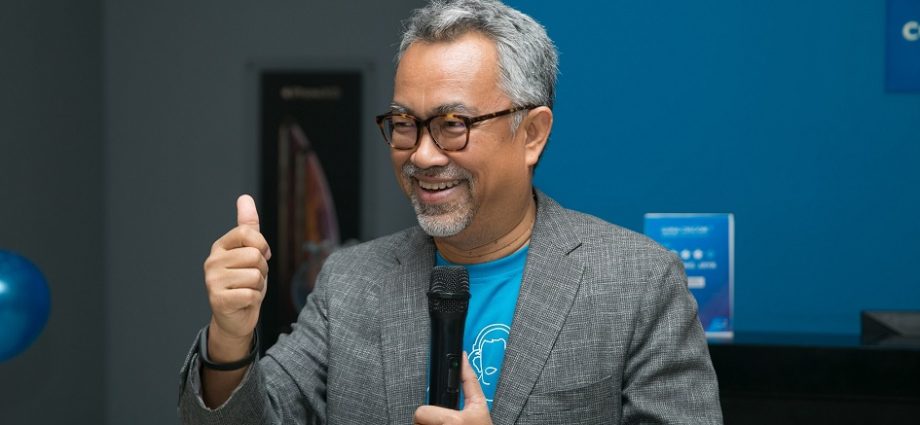

Idham Nawawi ( pic ), CelcomDigi’s CEO said,” Malaysia’s 5G adoption is accelerating, and thus it is critical that we evolve our network capabilities to manage increasing complexity while delivering a superior customer experience. As an extension of our ongoing partnership with Ericsson, we are taking steps towards intent-based autonomous networks, harnessing AI and automation to transform how networks operate, optimise performance, and improve sustainability”.

Idham Nawawi ( pic ), CelcomDigi’s CEO said,” Malaysia’s 5G adoption is accelerating, and thus it is critical that we evolve our network capabilities to manage increasing complexity while delivering a superior customer experience. As an extension of our ongoing partnership with Ericsson, we are taking steps towards intent-based autonomous networks, harnessing AI and automation to transform how networks operate, optimise performance, and improve sustainability”.

David Hägerbro President and CEO of Ericsson Malaysia, Sri Lanka, and Bangladesh, said,” We are particularly excited about the potential to leverage AI technologies in autonomous network operations, which will further improve efficiency and customer experience. The MoU aims to drive operational efficiency enhancements, boost service quality, and elevate user experiences. We aim to help CelcomDigi stay at the cutting-edge of digital innovation”.

By pioneering autonomous network operations, CelcomDigi and Ericsson aim to set new benchmarks in network efficiency, service differentiation, and customer satisfaction.

.jpg)

.jpg)