Foxconn, Nvidia joining hands to forge AI industrial revolution

Taiwan’s Hon Hai Technology Group, widely known as Foxconn, and America’s Nvidia plan to join technological forces “to accelerate the AI industrial revolution.”

Foxconn, the world’s largest contract manufacturer, is the primary assembler of the Apple iPhone. California-based Nvidia is the world’s leading designer of the graphics processing units (GPUs) used in artificial intelligence applications.

Foxconn intends to use Nvidia technology to further the digitalization of manufacturing and inspection workflows, the development of AI-enhanced electric vehicles and robotics, and language-based generative AI services.

Both tech giants are in pursuit of new growth opportunities as Foxconn diversifies away from its traditional heavy dependence on Apple and Nvidia seeks new markets amid US government sanctions that have crippled its once-booming business in China.

However, Nvidia said this month it has developed three new sanctions-compliant AI chips, based on its flagship H100 product, for China’s markets.

Foxconn chairman and CEO Young Liu and Nvidia CEO Jensen Huang revealed their collaborative revolutionary plans on October 18 at the Hon Hai Tech Day event held in Taipei.

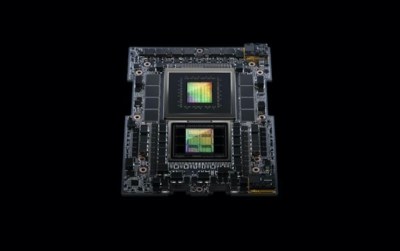

They reportedly plan to build factories supported by Nvidia GPU-based computing infrastructure designed to process, refine and transform large amounts of data into AI models that can identify patterns and make predictions. These new data centers will be based on Nvidia GH200 Grace Hopper Superchips and AI enterprise software.

The GH200 Grace Hopper system-on-chip (SoC) combines Nvidia’s Grace central processing unit (CPU) and Hopper GPU architectures with high-bandwidth memory to enable large-scale AI training, inference and high-performance computing.

Launched in August 2023, the GH200 was created to handle the most complex generative AI workloads including large language models, recommender systems (AI algorithms associated with machine learning) and vector databases (data stored as mathematical representations to facilitate machine learning).

Huang noted that “A new type of manufacturing has emerged… Foxconn, the world’s largest manufacturer, has the expertise and scale to build AI factories globally.”

Foxconn will also use Nvidia technology in other industrial and infrastructure solutions, the arguably most impressive of which is Foxconn’s Smart EV. Built on the Nvidia Drive Hyperion 9 platform for autonomous vehicles, it will be powered by Thor SoC computer, which enables automated and assisted driving, parking, driver and passenger monitoring, digital instruments and in-vehicle information and entertainment systems.

Scheduled to be introduced in 2027, Hyperion 9 will support level 3 conditional urban passenger car driving, characterized as hands-off, eyes-off but ready to resume control, and level 4 advanced highway driving, characterized as “brain-off”, no need to pay attention.

Foxconn has been working on EVs for several years. It has only a small presence in the industry today but has ambitious designs. By 2027, it aims for 10% of the global market for EV components and services. It has a test satellite in low Earth orbit and plans to integrate satellite communications with the Internet of Vehicles (IoV) in the not-too-distant future.

Foxconn Smart Manufacturing robotic systems will be built on the Nvidia Isaac autonomous mobile robot platform, which runs the gamut from training, simulation and building of autonomous robots to robot fleet management.

Foxconn Smart City will incorporate Nvidia Metropolis video analytics, which are designed to “make sense of the flood of data created by trillions of sensors” in traffic management, retail logistics, healthcare and other urban services.

The timing is seemingly right. Nvidia points out that “Advances in edge AI and simulation are enabling deployment of autonomous mobile robots that can travel several miles a day and industrial robots for assembling components, applying coatings, packaging and performing quality inspections.”

These robots are arriving just as demographic change creates a chronic shortage of workers in China and other advanced industrial nations.

Foxconn is already the largest manufacturer of Nvidia-based AI hardware, according to market research and electronics industry media sources. In addition to selling hardware to and building systems based on Nvidia technology for its customers, Foxconn plans to use the technology in its own factories to improve efficiency while saving time and money.

Outside Taiwan, Foxconn has manufacturing, design and R&D facilities in more than 20 countries and regions including China, India, Japan, Vietnam, Malaysia, Australia, Czech Republic, Slovakia, Hungary, the US, Mexico and Brazil. This, along with more than 40% of the global market for electronics manufacturing services, gives it a reach that its competitors will find difficult to match.

Foxconn Industrial Internet, a group subsidiary headquartered in Shenzhen, China, serves markets for smartphones and smart wearable devices, smart homes, cloud and edge computing, 5G and other network communication devices, EV and other new energy vehicle components, and the industrial internet. Established in 2015, Foxconn Industrial Internet has about 200,000 employees, almost as many as China tech giant Huawei.

Unlike Huawei, which is under US tech war-related sanctions, Foxconn is welcome in all of the world’s major markets. It has a factory in the US state of Wisconsin and runs one of the largest foreign-owned factories producing for export, known as maquiladoras, in Mexico.

In August 2023, Foxconn and the Chihuahua state government in Mexico announced a partnership aimed at increasing the state’s industrial capabilities by training workers for the information & communications and auto industries, optimizing supply chains, improving infrastructure, raising energy efficiency and furthering the development of renewable energy.

Foxconn has so far invested more than US$500 million in Chihuahua, which borders the US states of New Mexico and Texas. It has production facilities there, in Ciudad Juarez and also in Tijuana, south of San Diego.

Foxconn’s factory in Wisconsin, promoted heavily by former president Donald Trump, has been scaled back and is generally regarded as having been a politically motivated investment aimed at evading tariffs. Under the US-Mexico-Canada Agreement, formerly known as NAFTA, that can be done much more economically from Mexico.

Follow this writer on Twitter: @ScottFo83517667