Paynet Digital Campus 3.0 breaks records with 24 million cashless transactions

- Initiative included 25 people and 5 private institutions

- Disbursed US$ 231, 000 in 2024 to support school online transaction activities

Payments Network Malaysia Sdn Bhd ( PayNet ), a national payments network and central financial institution provider, has had success with its PayNet Digital Campus 3.0 ( PDC3.0) campaign, which has generated 24 million digital payments across Malaysia’s participating higher education institutions.

The action, involving 30 institutions—25 public colleges and five personal higher education institutions marks a major growth from its forerunner. PayNet stated that it disbursed a total of US$ 231, 000 ( RM1.02 million ) in sponsorship funds to participating universities between August and September 2024 to support digital payment initiatives.

UiTM Cawangan Perak came in first with 66 transactions per capita in the category of public universities ( UA), followed by UiTM Cawangan Sabah and UiTM Cawangan Johor. In the Private Institution ( IPTS ) category, Universiti Teknologi Petronas emerged as the champion, with Asia Pacific University taking second place.

Additionally, student authorities received praise for their creative electronic payment campaigns. In the UA Student Council group, UiTM Cawangan Johor clinched the best position, while Universiti Teknologi Malaysia and UiTM Cawangan Perak placed second and third, both. Universiti Teknologi Petronas led the IPTS Student Council type, followed by Asia Pacific University and Universiti Tunku Abdul Rahman.

For surpassing one million purchases during the campaign, Universiti Putra Malaysia, Universiti Malaya, Universiti Sultan Zainal Abidin, Universiti Malaysia Sabah, Universiti Kebangsaan Malaysia, and Universiti Teknologi Malaysia were given special recognition awards, which show they are extremely committed to promoting the implementation of electronic payments in their school communities.

Farhan Ahmad, party CEO of PayNet,” The extraordinary growth in transactions and participating institutions underscores the strong speed toward Malaysia’s digital change in the learning market.” By supporting digital schools, we are also fostering greater financial inclusion while also preparing students for a modern potential. Empowering learners with modern monetary skills ensures that all learners, regardless of background, you join in and profit from Malaysia’s growing digital economy. At the same time, we are creating safer, more effective learning conditions by reducing rely on money deals”.

PDC3.0 continued the popular” Shark Tank”-inspired file from the past, where student councils presented their adoption campaigns for online payments to get funding. The successful efforts were finally carried out between October and December 2024. PDC3.0 delivered excellent outcomes, with the highest-performing organization recording 1.5 million purchases. The programme achieved a peak transaction rate of 66 transactions per student, while the most cost-efficient campaign reduced costs to just US$ 0.0113 ( RM0.05 ) per transaction.

The program is in line with Bank Negara Malaysia’s Financial Sector Blueprint 2022-2026, which aims to promote a digital payments culture and encourage e-payment implementation. With over one million individuals at higher education institutions, the program serves as a critical catalyst for fostering a” cashless-first” thinking through student council independence.

Speaking at the event, Prof. Dr Azlinda Azman, producer standard of Higher Education at the Ministry of Higher Education, highlighted the project’s part in Malaysia’s digital transformation. By encouraging a cashless-first tradition, we are even modernizing college ecosystems and training students in key financial literacy and digital skills that will help them prepare for the upcoming economy.

This program supports Malaysia’s devotion to integrating technologies into education, and it is in line with the country’s” Digital Economy Blueprint,” which promotes a society that is empowered by smooth online transactions. I encourage more universities to take advantage of this opportunity and advance our country’s transition toward a digital and online diverse Malaysia, he said during his presentation address.

At the occasion, PayNet even unveiled the third edition of the project, PayNet Digital Campus 4.0 ( PDC4.0), which retains the successful construction of its predecessor. Higher education institutions with scholar populations greater than 3 000 are now eligible for enrollment.

” The Malaysian training sector’s next step in accelerating digital conversion is PayNet Digital Campus 4.0,” says the company’s CEO. By giving universities the support and tools they need to implement digital policies, we are even modernizing campus transactions and creating a generation of online empowered leaders. As we expand this action, we look forward to seeing yet greater advancement from students in driving Malaysia’s development into a completely digital nation”, said Firdaus Ghani, PayNet’s top director, Government Digitalisation Division.

.jpeg)

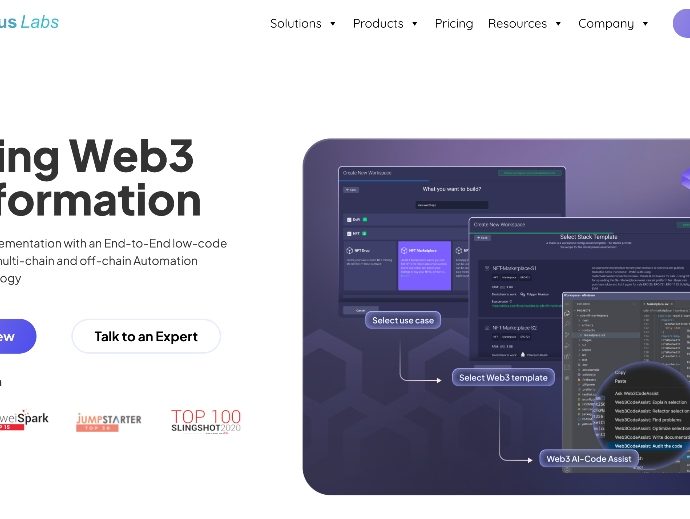

Pei-Han Chuang ( pic ), founder and CEO of Morpheus Labs, said: “Ficus’s investment is pivotal in fuelling our growth and expanding our capabilities in the Web3 space. With their help, we are also expanding into important markets like Malaysia and Indonesia, where a fresh, tech-savvy community is driving online implementation.

Pei-Han Chuang ( pic ), founder and CEO of Morpheus Labs, said: “Ficus’s investment is pivotal in fuelling our growth and expanding our capabilities in the Web3 space. With their help, we are also expanding into important markets like Malaysia and Indonesia, where a fresh, tech-savvy community is driving online implementation.