As a rule of thumb, financial institutions, followed by telcos, will be expected to bear the full losses incurred from such digitally enabled phishing scams, should they fail to discharge their respective prescribed duties, said MAS and IMDA in a joint press statement on Wednesday.

“Financial institutions stand first in line, given that they hold greater responsibility as custodians of consumers’ money.

“Telcos stand second in line, as they play a secondary role in fostering security of digital payments by facilitating SMS delivery.”

Still, while the proposed framework is intended to strengthen financial institutions’ and telcos’ accountability to consumers, it will not absolve customers of their own duty to be vigilant.

“If financial institutions and telcos have fulfilled their duties, the Shared Responsibility Framework will not require payouts to be made to consumers,” said MAS and IMDA.

“A discerning and vigilant public remains the first line of defence against scams.

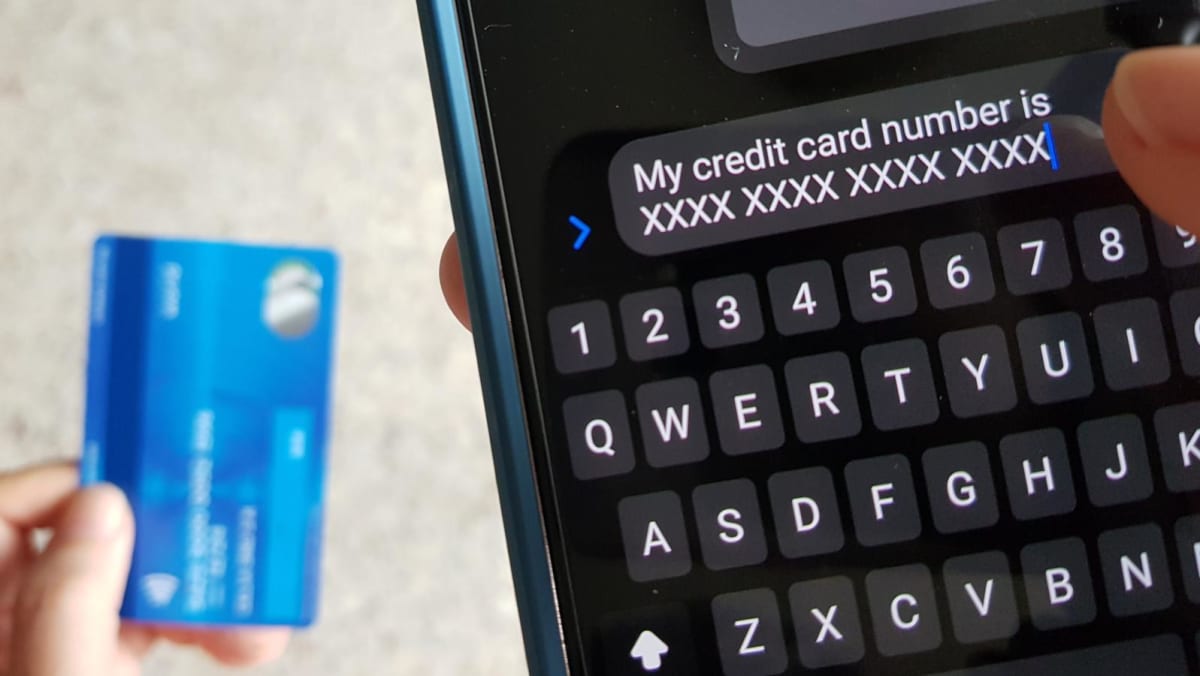

“Individuals have a responsibility to mitigate the occurrence of scams by practising proper cyber hygiene and not giving away their credentials to a third party under any circumstance,” the authorities added.

This article was originally published in TODAY.