Faiz Azmi appointed new SC Malaysia chairman as Awang Adek Hussin retires

- Since June 2022, Awang Adek has served for a two-year name.

- Faiz Azmi is a board member of the SC and previously served as the professional president of PwC.

Awang Adek Hussin will retire as chairman of the Securities Commission Malaysia (SC ) with effect from June 15th, 2024.  , He will be succeeded by Mohammad Faiz Azmi ( main pic ), former Executive Chairman of PwC Malaysia, who will assume the role on 16 June 2024.  ,  ,

Mohammad Faiz has been a part of the SC committee since August 15, 2023, and he has taken that position. Awang Adek ( pic ) thanked the government, including the Ministry of Finance, the capital market sector, and a number of stakeholders for the support they provided him during his two-year tenure, and expressed the hope that Mohammad Faiz will receive the same support.  ,

Mohammad Faiz has been a part of the SC committee since August 15, 2023, and he has taken that position. Awang Adek ( pic ) thanked the government, including the Ministry of Finance, the capital market sector, and a number of stakeholders for the support they provided him during his two-year tenure, and expressed the hope that Mohammad Faiz will receive the same support.  ,

Awang Adek made a significant contribution to the growth of the Indonesian investment sector, which the SC Board expressed its appreciation for.

.jpg)

Cradle Fund Sdn Bhd, as the focal point company for Malaysia’s business habitat, lauded the efforts, noting that it is a testament to the work and strategic initiatives undertaken to develop a conducive atmosphere for startups. Companies are viewed by Malaysia as a crucial component of spurring local innovation and technological progress. Cradle aims to bring together all habitat partners ‘ resources and experience. With a consistent commitment to cultivating a high- performing, inclusive, globalised, and sustainable ecosystem, Cradle envisions propelling Malaysia to the forefront of the global startup ecosystem”, said Norman Matthieu Vanhaecke ( pic ), Group CEO of Cradle.

Cradle Fund Sdn Bhd, as the focal point company for Malaysia’s business habitat, lauded the efforts, noting that it is a testament to the work and strategic initiatives undertaken to develop a conducive atmosphere for startups. Companies are viewed by Malaysia as a crucial component of spurring local innovation and technological progress. Cradle aims to bring together all habitat partners ‘ resources and experience. With a consistent commitment to cultivating a high- performing, inclusive, globalised, and sustainable ecosystem, Cradle envisions propelling Malaysia to the forefront of the global startup ecosystem”, said Norman Matthieu Vanhaecke ( pic ), Group CEO of Cradle.

MyCIF, established by the Ministry of Finance under Budget 2019, has been a key pressure in the financing environment, utilizing capital fundraising (ECF ) and peer- to- gaze ( P2P ) financing platforms to channel many- needed funds into MSMEs. Commenting on the report, SC Chairman Dr , Awang Adek Hussin ( pic ) highlighted MyCIF’s catalytic role, noting that the RM289 million invested last year has attracted nearly US$ 424 million ( RM2 billion ) in private investments.

MyCIF, established by the Ministry of Finance under Budget 2019, has been a key pressure in the financing environment, utilizing capital fundraising (ECF ) and peer- to- gaze ( P2P ) financing platforms to channel many- needed funds into MSMEs. Commenting on the report, SC Chairman Dr , Awang Adek Hussin ( pic ) highlighted MyCIF’s catalytic role, noting that the RM289 million invested last year has attracted nearly US$ 424 million ( RM2 billion ) in private investments.

Dr. John T. C. Lee, President and CEO of MKS, stated that” MKS has a happy history of inventions and discoveries that have shaped the evolution of the key industries we serve.” ” Penang has a strong semiconductor habitat thanks to its close proximity to our customers and suppliers and strong technology infrastructure. As we strive to continue to be a leader in a wide range of semiconductor production programs, our company’s expansion into Malaysia represents a significant step.

Dr. John T. C. Lee, President and CEO of MKS, stated that” MKS has a happy history of inventions and discoveries that have shaped the evolution of the key industries we serve.” ” Penang has a strong semiconductor habitat thanks to its close proximity to our customers and suppliers and strong technology infrastructure. As we strive to continue to be a leader in a wide range of semiconductor production programs, our company’s expansion into Malaysia represents a significant step.

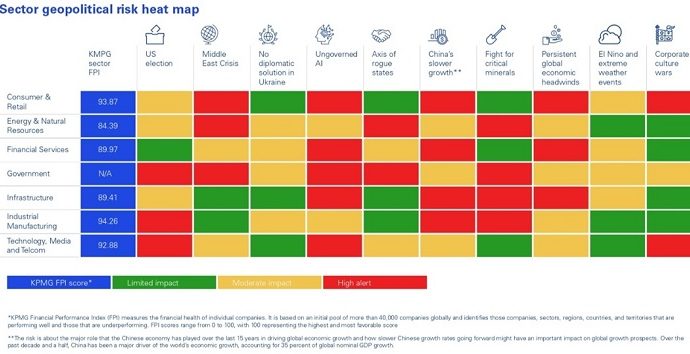

The rise of trade protectionionism, according to Johan Idris ( pic ), Managing Partner of KPMG in Malaysia, could have an impact on the export-oriented nation’s export-oriented economy, which accounts for 66.1 % of Malaysia’s GDP in 2023. He added that “recent global events have revealed the fragility of the global trade ecosystem and disruptions will continue to impact organizations unable to shore up ample defenses. Business leaders should develop adaptive capacity to increase operational resilience as a strategy. This can be accomplished by using a top-down policy mandate and bottom-up corporate capabilities approach.

The rise of trade protectionionism, according to Johan Idris ( pic ), Managing Partner of KPMG in Malaysia, could have an impact on the export-oriented nation’s export-oriented economy, which accounts for 66.1 % of Malaysia’s GDP in 2023. He added that “recent global events have revealed the fragility of the global trade ecosystem and disruptions will continue to impact organizations unable to shore up ample defenses. Business leaders should develop adaptive capacity to increase operational resilience as a strategy. This can be accomplished by using a top-down policy mandate and bottom-up corporate capabilities approach.

.jpeg)