In the December third, Australia’s economy expanded at the fastest rate in two years thanks to stronger exports and consumer spending.

According to today’s national addresses report from the Australian Bureau of Statistics, the market increased by 0.6 % in the third. It attributed this to “modest growth ]… broadly across the economy [… supported by an increase in exports ]”.

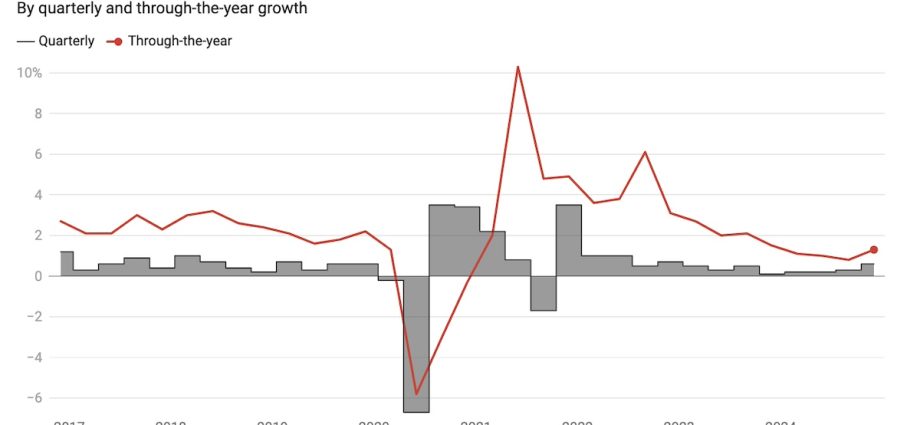

For the year to December 2024, annual gross domestic product ( GDP ) growth was 1.3 %. That’s no particularly high in traditional terms, but it’s still as good as we’ve seen since late 2022. The Australian economy’s long-term average growth rate is closer to 2.7 %.

It will give some ease to the Labor government because it is one of the final significant financial information before the upcoming national election.

The per person crisis has ended

The fact that GDP per head of community is not declining is another enabling mark. It only increased by 0.1 %, but at least it is positive.

The per capita rate has decreased seven straight apartments. What some refer to as a “per head recession” is the conclusion of today’s report, which means that when the economy expands more slowly than population, we really reverse in terms of production per person.

More money was spent by families on equipment, tools, clothing, hotels, cafes and restaurants, wellness care, and power. Use increased by 0.4 %, which increased economic development.

Households also saved more, with the ratio of saving to income rising from 3.6 % to 3.8 %, which is the highest level in nine quarters. How did homes manage to save money even when they made more purchases? The answer is that pay are rising even more quickly.

In both the public and private sectors, overall employee compensation increased by 2 %. Additionally, the settlement figure shows a 0.7 % increase in the number of hours worked.

Government spending and exports of goods and service were other factors that contributed to the quarter’s good economic growth. Agriculture saw a strong performance (up 7.3 % ) as a result of increased grain production in response to favorable weather conditions and meat exports to the United States.

However, GDP does not adequately account for crucial aspects of well-being.

It omits points like the atmosphere and paid work, which we value. GDP is increased by investing in recovery from a crisis, but GDP is unchanged if disaster rarely occurs.

While he was still working for the Treasury, American mathematician David Gruen outlined the GDP restrictions in a conversation in 2010. Both researchers and academics are aware of those restrictions.

Crisis is the only way to increase GDP, but it results in job losses and financial collapse. Ultimately, this most recent release is a good set of numbers for Australia.

improving prospect

The financial growth trend appears favorable.

The December quarter improved by 0.3 % and 0.2 % from the June quarter, respectively. As anticipated, the September fourth resulted in a turning point.

We presently appear to be heading in the right direction for expansion. Remember, the December fourth occurred before the Reserve Bank cut interest rates in February. Not just lease recipients but also business borrowers will benefit from falling interest rates.

The low in prices has given rise to the possibility of further interest price reductions.

However, while the rate of inflation is dropping, this does not imply that rates are dropping. They simply are rising more quietly than they were. An example of prices is included in the inflation figure.

Some goods or services have higher than average value increases, while others have lower. Individuals tend to focus on price increases rather than price increases that remain constant or drop. In summary, these figures might not significantly affect the president’s chances of winning. Individuals will still be concerned about the cost of living.

Trump issue

If electors pay attention to global politics, they are aware that the current economic gloom might not last.

Donald Trump, the president of the United States, has imposed 25 % tariffs on imports from Canada and Mexico and doubled the 10 % to 20 % tariff on Chinese imports. The damaged nations are enthused about retribution.

There is a negative impact from the US taxes on China, even if the US doesn’t impose tariffs on American goods ( which is still a chance, but American officials are working hard to stop it ).

We rely on China to be our main trading partner. If its market declines, but will ours. Currently, China has responded to the risk of taxes with a new stimulus package.

If trade war spread to different nations, that would be even more alarming. Insularity and protectionism hurt economies. spread frequently, it may cause a global recession.

Even though the December third national accounts provide encouraging signs of economic recovery and for the future, international events beyond Australia’s power may but undermine our optimistic outlooks.

Stephen Bartos is an economics professor at the University of Canberra.

The Conversation has republished this essay under a Creative Commons license. Read the text of the content.