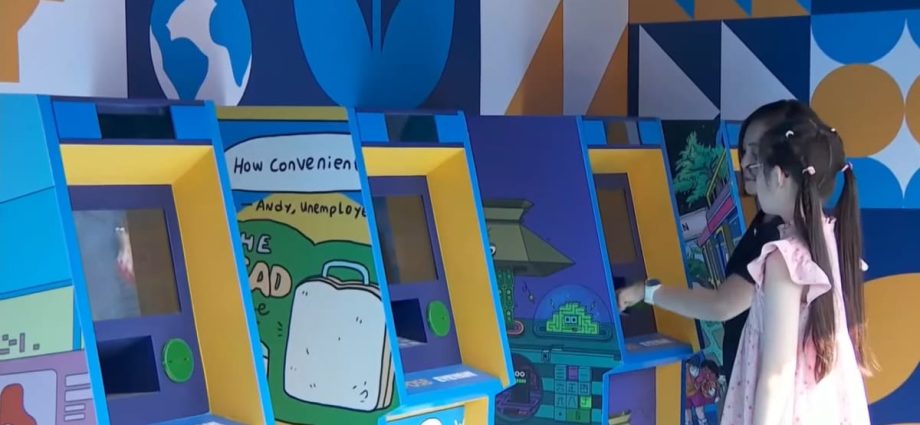

Ms Evelyn Choo, manager at Hougang Sheng Hong Student Care Centre, said: “The children actually have to go through scenarios and also make choices, gaining a deeper understanding of their personal finances, and also learning about the opportunity costs.”

For instance, they have to decide whether to spend S$2 (US$1.49) on a cold drink or medicine for their grandparents.

However, some children forget what they learnt after a month, said Ms Choo. Parents could get involved by helping to reinforce these concepts at home daily, she added.

Moving forward, UOB also wants to ensure children continue receiving more relevant information.

Ms Lilian Chong, UOB’s head of group brand and corporate social responsibility, noted that given the rising number of scams related to digital payments, children need to know how to identify any potential scams and be alert to the threats.

It will also be training its own staff to conduct financial literacy workshops.