ADDITIONAL Goes BY Bankers, MAS

As part of their anti-scam efforts, the Monetary Authority of Singapore and bankers will” gradually introduce more measures” to fight malware-related scams, according to the authorities on Wednesday.

When OCBC detected potentially risky apps downloaded from unofficial portals in August, it became the first bank & nbsp in Singapore to prevent some customers from using its internet banking and mobile banking app.

According to OCBC at the time, this was a novel security measure put in place to safeguard users from malware.

Some users expressed disapproval of the walk, claiming that OCBC’s safety measure had flagged apps like the online payment system Alipay.

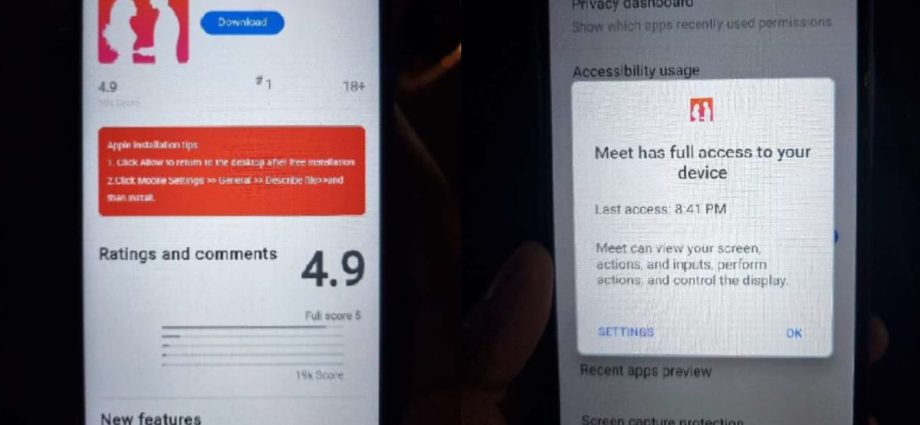

According to the officers, the security measure addresses the risk of downloading apps from websites other than the standard app stores. Malware-related schemes are frequently committed using programs downloaded from suspicious or third-party websites.

The authorities noted that” like applications may contain ransomware and can result in personal data, such as banks credentials, being stolen.”

These extra anti-malware measures are required to protect customers from malware-related scams, even though there may be some degree of added trouble for customers.

In response to the rise in malware-related scams, more authentication measures were even implemented in June to better protect CPF members. Those who use their Singpass to log into their accounts may now be subject to confront confirmation.