Nvidia, the maker of artificial intelligence ( AI ) chips, reported that its revenues for the three months leading up to July exceeded the previous year’s record of$ 30 billion ( £24.7 billion ).

However, the agency’s shares fell by more than 6 % in New York after the announcement.

Nvidia’s stock market value increased by more than$ 3tn, making it one of the biggest beneficiaries of the AI boom.

The agency’s shares have risen by more than 160 % this year alone.

According to Matt Britzman, top equity analyst at Hargreaves Lansdown, “it’s less about merely beating estimates then, as markets expect them to become shattered, and the size of the defeat today looks to have disappointed a little.”

The company’s pricing, which has increased tenfold in value in less than two years thanks to its supremacy of the AI device market, is driving the sky-high expectations.

Profits for the period soared, with operating income rising 174 % from the same time last year to$ 18.6bn.

Nvidia overtook researchers ‘ objectives for both sales and profits for the seventh consecutive quarter.

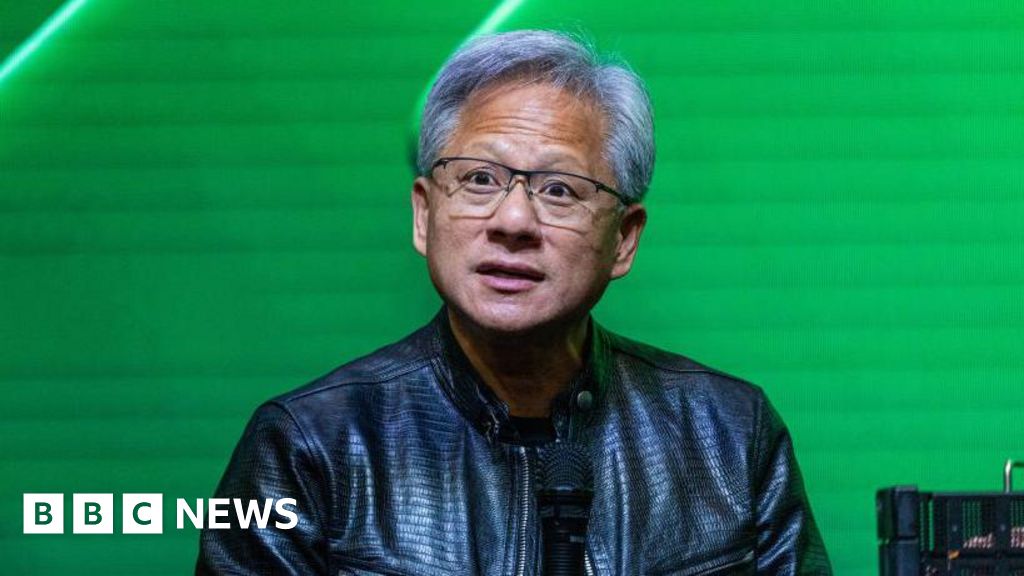

” Generative AI will revolutionise every market”, said Nvidia chief executive Jensen Huang.

The outcomes have grown to a weekly event that causes Wall Street to go through a flurry of stock purchases and sales.

A “watch party” had been planned in Manhattan, according to the Wall Street Journal, while Mr Huang, famed for his signature leather jacket, has been dubbed the “Taylor Swift of tech”.

Alvin Nguyen, senior researcher at Forrester, told the BBC both Nvidia and Mr Huang have become the” face of AI”.

This has helped the company thus much, but it could also hurt its assessment if AI fails to deliver, according to Mr. Nguyen, despite the fact that businesses have invested billions of dollars in the technology.

” A thousand use cases for AI is not enough. You need a million”.

Mr Nguyen even said Nvidia’s first-mover benefit means it has market-leading materials, which its users have spent years using and has a” program ecosystem”.

He said that competitors, such as Intel, was” device ahead” at Nvidia’s market share if they developed a better solution, though he said this would take time.