The second edition of Asia Times ‘ biweekly economics and geopolitics newsletter, Global Risk- Reward Monitor, published this study. Subscribe to this site.

On April 2 in the afternoon, gold traded for the first time at roughly US$ 4,300 per ounce. We present a novel way to analyze the price of metal by dividing it into:

- An industrial metallic element

- A wall against dollar depreciation, and

- A political risk superior

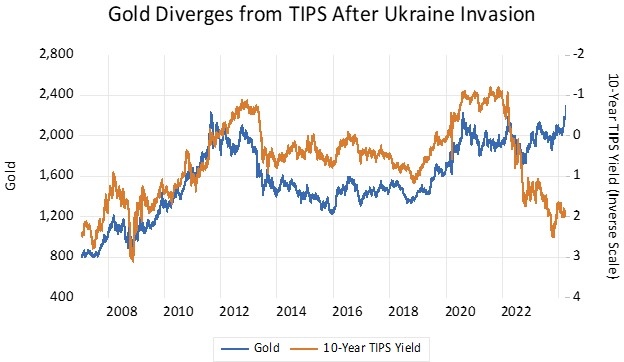

On some occasions, we’ve already noted that gold lost interest in its long-term connection with TIPS yields in February 2022, namely, following Russia’s invasion of Ukraine.

There is without a doubt a political risk premium involved. But aside from political risk, how significant is it, how has it changed, and what else is affecting gold?

Among other things, silver is an industrial steel. About 11 % of silver demand is absorbed by commercial applications.

Unsurprisingly, there is a strong, significant correlation between the cost of gold and other industrial metals ( the most obvious example is copper ).

The horizontal relationship between gold and copper usually changes, but it still shows up in the disperse graph below of post-date prices relationships.

Metal even behaves like a coin, most clearly like the Japanese yen.

Gold’s price increased as JPY depreciated against the US dollars, but there is a clear and consistent inverse relationship between the two.

Silver is primarily used as a hedge against the dollar, which is why the demand for gold is increased by the sudden dollar depreciation and the strengthening of alternative currencies. The connection between gold and the USD/USD is similar, though less regular.

All developed nations have problematic governmental policies. The rapid rise in its federal loan is not a relief for the United States.

Japan, whose federal loan reached 264 % of GDP in 2023, may help but continue to sell its debt, leaving the renminbi essentially poor.

Given the poor sector and mounting money constraints brought on by the Ukraine War, Germany’s Bundesbank is under stress to impose legal restrictions on how much debt can grow.

That is, all the world’s big created- market currencies have a lengthy- term architectural weakness. That indicates gold’s potential.

By regressing the gold rate in relation to all three of these factors, we can get a rough idea of the combined effects of TIPS provides, industrial metals, and dollar weakness on the silver value. By this measure, the political risk advanced – the remaining – is$ 525, or about 23 % of the silver price.

The remaining is what these three variables do not explain, and that is the best measure of the political risk premium we can come up with.

Notice that this residual increased considerably on two preceding occasions, once in 2011 during the Covid-19 illness and once more in 2011 during the same year’s European financial crisis.

From this, we can conclude that political risk is high and growing, or even higher than it is ever ever measured.

However, there are other causes for the price of gold, such as Japan’s and Europe’s lack of macroeconomic controls and strong business metal demand. Platinum is indicating a rise in danger, but not the end of the world.