America’s companies, including defence, contracted tens of thousands of key elements to China during the past 20 times. US manufacturers do n’t produce capacitors, accumulators, pumps, compressors, switching equipment and other essential equipment for US electrical utilities.

When produced in large quantities, none of these are expensive or difficult to make. However, it may cost a lot to rebuild business ability for a wide range of crucial inputs. America is vulnerable to Chinese retribution in the event of a business battle because of its significant dependence on Chinese exports.

The US Congress Select Committee on China wants to remove China’s Most Popular Nation buying standing, which could lead to levies of 100 %, while President-elect Donald Trump has proposed 60 % tariffs on Chinese imports.

China’s exports to the US peaked at over 10 % of its GDP ( in US dollars ) in 2005, but have fallen to just over 2 % of GDP today. If business relations with the US tear, which side did incur more? It’s difficult to reckon with all the elements, but the United States well might also come up worse.

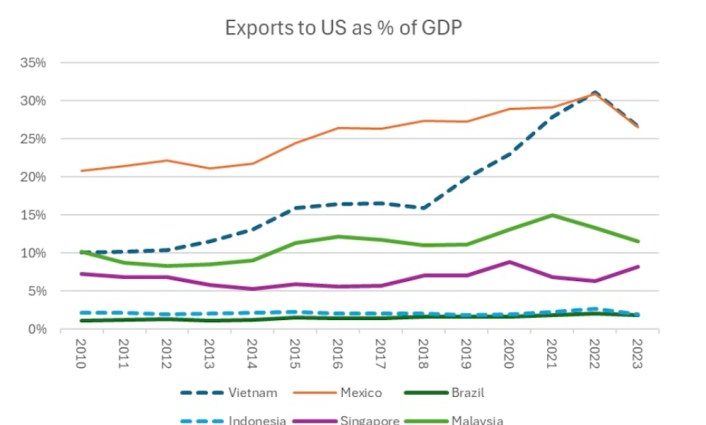

The Great Re-Shoring charade, April 6, 2023, was the first study to show that China had routed a significant portion of its export to the US via next places.

The International Monetary Fund, the World Bank, the Bank for International Settlements, and Senator Marco Rubio‘s business have since released encouraging data. Vietnam and Mexico currently export 25 % of their GDP to the US. As noted, China exports little over 2 %.

America’s failing to scale up production of munitions for Ukraine should be a reminder to politicians. In February 2024, the US produced only 30, 000 155mm shell a quarter, or three days of Russian use. The Pentagon says it hopes to increase this amount to 70, 000, or a year’s fair, by early 2025.

The United States ca n’t gear up to produce artillery shells, a century-old technology. By ten or ten, the artillery tank barrier is one hundred times the number of ways to visualize the effects of specific Chinese trade bans.

Some experts have expressed worry about America’s exports of medicine from China, particularly medicines. A trade war in healthcare is doubtful, though, because China is also a big supplier of British medicine, for example cancer medicines.

The Chinese may have stopped producing rare earth in the US, as well as its new trade licensing laws for the minerals used in semiconductors, such as gallium, tungsten, and graphite. A careful threshold of important industrial components that targets fragile industries would be more worrying.

Offer chains for critical system are severe and self-inflicted, according to the author. The US and its supporters have allowed themselves to become captive to Chinese cartels that control creation of electronic parts, high-powered magnetism, printed circuit boards, computers, drones, rare world metals, wind turbines, solar cells, cellular phones and lithium batteries … In fact, nearly every aspect of the technology-based digital smart grid is dependent on Chinese-made components”, Brien Sheahan, a former major US regulatory standard, wrote in April 2023.

Output has also been outsourced to China by the US defence sector. Greg Hayes, the CEO of Raytheon, stated in an interview with the Financial Times on June 19 that coupling is difficult because his company has” many thousand suppliers in China.” We may de-risk but no decouple”, adding that he believed this to be the situation” for everyone” in US production.

Hayes added,” Think about the$ 500bn of trade that goes from China to the US every year. More than 95 percent of unusual world materials or metal come from, or are processed in, China. There is no option. It may take us some, many years to regain that capacity, whether internally or in other helpful nations, if we had to leave China.

Raytheon makes Tomahawk cruise weapons, Maverick air-to-surface weapons, Javelin anti-tank weapons and other cornerstones of the American army.

US orders for manufacturing equipment have n’t increased in 20 years, according to the Producer Price Index for private capital equipment, which is adjusted for inflation. The ten years that followed the 2008 crisis, which saw a quick recovery, have stagnated.

Additionally, there are serious shortages of experienced manufacturing workers in the US. When manufacturing exercise (using the Federal Reserve’s index ) peaked in 2007, just 85, 000 stock work went empty. Now there are 500, 000 empty manufacturer jobs. The shortage of qualified workers, according to manufacturers and their industry associations, is the main obstacle to their work.

To start up a generation line, you need tradesmen. The United States has merely 270, 000 tradesmen, compared to 470, 000 in 2000.

The issue may be solved by wiggle production, which uses highly automated production and system regulates. However, the United States is still developing. America has just 285 industrial robots installed per 10, 000 staff, compared to 392 in China and 1, 012 in South Korea.

The United States could fund essential production with crash training programs for business workers, employ the Defense Department budget to fund these issues, and use all available resources for American industry to address these issues. But a quarter-century of industrial outsourcing, workforce shrinkage and underinvestment in capital equipment ca n’t be undone in a matter of weeks or months.

Following David P Goldman on X at @davidpgoldman