The US Bureau of Labor Statistics reported September 11 that” core” inflation ( excluding energy and food prices ) rose 3 % year-on-year.

Yet, nobody believes the display. Most middle-class families say that the same basket of essentials —house, car, food, utilities—costs 10 % more than it did a year ago.

Inflation tops the worry list of American voters, with 62 % saying it’s a “very big problem”, according to a recent Pew Survey. Too much money chasing very few products causes inflation, compounded by the Biden administration’s fiscal money.

If Biden had adhered to the long-term pattern, US national spending would have been roughly US$ 5 trillion. Biden instead offered an additional$ 3 trillion handout in 2021 as a result of a 20 % increase in overall spending over the trend line.

That’s where the income came from to fight the items.

When Vice President Kamala Harris proposed a$ 6, 000 child tax credit, a$ 25, 000 home-buying credit and a$ 50, 000 small business credit at the September 10 debate with Donald Trump, the former president might have accused her of playing Santa Claus with an empty sled.

The more freebies for popular divisions, the faster prices will rise. Americans are currently in worse shape than they were in 2021, and if the saving spree continues, their condition will worsen.

Potato chips might not count for much in a middle-class family’s budget, but they now cost$ 6.25 for a one-pound bag, compared to just$ 4.94 when Joe Biden took office in 2021, an increase of 27 %.

A loaf of bread costs$ 1.95, compared to$ 1.50 in 2021. Medium fries at McDonald’s now cost$ 4.19, up 134 % since 2019, and a McChicken sandwich costs$ 3.89, a 202 % increase over the same period.

The cost of owning a new car rose by$ 115 in 2024 to$ 1, 024 a month, according to the American Automobile Association. That’s a one-year increase of 13 %, including the cost of financing and insurance.

If you kept your junk, you paid dearly for auto components to keep it running. A car battery costs 15 %-20 % more this year than last, according to a PBS survey. Car insurance costs 26 % more in 2024 than a year ago and 40 % more than before the pandemic.

In June 2024, Americans paid 16.4 cents per kilowatt hour of electricity, a 29 % increase in a single season. So how does the Bureau of Labor Statistics manage to calculate prices at only 3 %?

According to Lawrence Summers, former US Treasury Secretary, and a group of economists, it calculates inflation incorrectly. For one thing, it does n’t count interest costs.

In the above table produced by Summers and his coworkers, prices is at its highest point in 2022.

Because we ca n’t believe the figures coming out of Washington, we are unsure of the correct inflation rate. But 10 % is a fair guess, based on what middle-class people pay out every month.

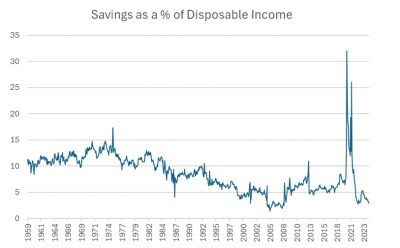

The private savings charge, which is currently only 2.9 % of disposable income, is a reliable indicator of the problems of US households. That is the lowest in history, aside from a brief period in the middle of the 2000s when Americans aggressively borrowed against what they believed were rising home prices. At the end of the quarter, communities have little left.

Credit card debt is another indicator of how much families are under stress. Since Biden took office, that’s up 40 %, to$ 1.4 trillion from$ 1 trillion. Americans who ca n’t make ends meet use their plastic.

Americans are aware of their suffering, and it’s unlikely that a second attempt at shifting from Trump to Harris may improve things.

Observe David P Goldman on X at @davidpgoldman