A jump in federal transfer payments, that is, cash outlays to individuals, unleashed the inflation of the 2020s.

The Trump administration provided emergency subsidies to individuals during the Covid-19 collapse of 2020, but the incoming Biden administration doubled down on subsidies, even after the economy was in full recovery.

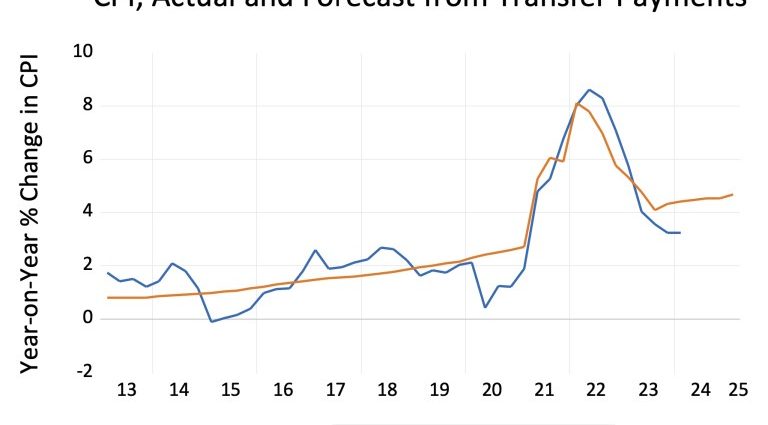

In 2022 (“Supply-side inflation and its cures”) I showed that fiscal largesse, not monetary ease, drove the inflation of the past several years. Fast forward to 2024, the Biden administration’s fiscal policy continues to drive inflation and the hangover probably will last through 2025.

For the decade prior to the Covid-19 pandemic, transfer payments rose in a straight line, in keeping with the size of the economy.

Not only did Biden throw an additional US$2.5 trillion into consumer pockets but his administration kept transfer payments about 20% above the long-term trend line.

That produced a collision between turbo-charged spending power and limited production capacity. Prices rose faster than at any time in the past 40 years.

The shock to consumer demand kept inflation going with lags. Prices rise and employees demand pay increases to compensate, and businesses in turn raise prices to pay for the additional labor costs.

Rents go up but the impact isn’t felt until leases are renewed. A boost to demand affects prices over 12 quarters, that is, three years.

The blue bars in the chart below show the correlation between each quarter’s change in transfer payments and year-on-year change in the US Consumer Price Index (CPI) in subsequent quarters.

The impact of increased transfer payments on prices, analysis shows, peaks after about six quarters.

Using the lagged relationship between transfer payments and inflation, we can explain about 85% of year-on-year changes in the CPI with changes in transfer payments. This relationship stands up to the usual statistical tire-kicking.

Other possible explanatory variables such as credit growth don’t improve the forecast.

Because transfer payments are still rising after the historical trend, this simple model of inflation projects more rather than less inflation over the next year.

Follow David P. Goldman on X at @davidpgoldman