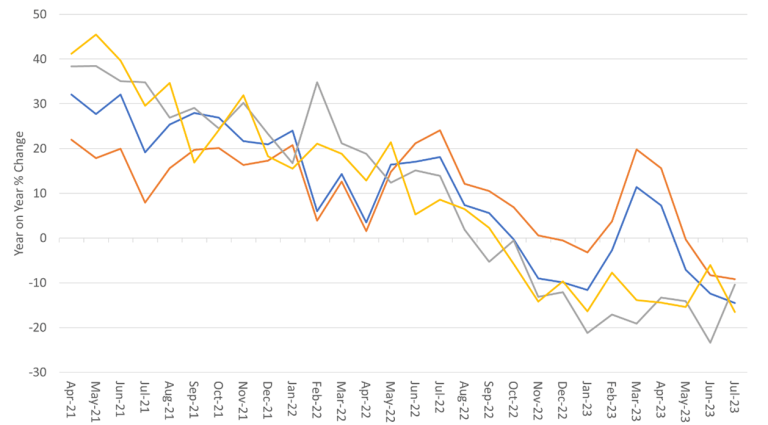

US imports of consumer goods dropped by a record 17% in the second quarter of 2023, as the Covid boom in work-from-home electronics faded. All the major exporters of electronics, including Taiwan, South Korea and China, showed corresponding declines in exports.

US manufacturing has also slowed. In an August 23 note, Standard and Poors reported:

The headline S&P Global Flash US PMI Composite Output Index indicated only a fractional increase in output across the private sector midway through the third quarter. At 50.4 in August, down from 52.0 in July, the latest reading signaled the weakest upturn in activity since February. Persistent challenges stimulating demand in the manufacturing sector were accompanied by slower growth in service sector output.

The freefall in US imports was concentrated in home electronics, which saw a surge in demand during the Covid pandemic and a subsequent decline. US auto imports meanwhile rose during the second quarter to $105.8 billion from $102.5 billion in the first quarter.

The decline in China’s second-quarter exports had nothing to do with re-shoring, contrary to the claims of some economic commentators including Northern Trust, which wrote in an August 2023 note to clients that:

Despite a weaker renminbi (RMB), China’s exports to America plummeted by 25% in the first half of 2023, compared to only a 7% decline in U.S. goods imports from the rest of the world. Beijing’s politically sensitive trade surplus with Washington narrowed by 27% to $30 billion. For the first time in 15 years, China is no longer the top provider of goods to the US. As the flow of goods from Beijing into America declines, imports are growing from nearly every United States ally.

This is simply false. Mexico’s auto exports to the United States kept the overall shipments stable during the second quarter, but other US allies, such as South Korea and Taiwan, registered sharp declines.

In an April 2023 study, Asia Times showed that China’s exports of intermediate goods to “friend-shoring” venues like Mexico, Vietnam and India rose in lockstep with American “friend-shoring” imports.

A new study presented to the Kansas City Federal Reserve’s annual conference at Jackson Hole August 26 came to the same conclusion as the Asia Times study. Professors Laura Alfaro of Harvard Business School and Davin Chor of Dartmouth “documented a decrease in the share of US imports from China and a corresponding increase in the share of US imports from Vietnam and Mexico between 2017 and 2022,” according to Bloomberg News.

Alfaro and Chor concluded that US “indirect supply-chain links to China remain intact; along some dimensions — through China’s economic ties with Vietnam and Mexico — these indirect links have even been intensifying. Even though the US may be reallocating its sourcing and imports toward Vietnam and Mexico, it may de facto remain connected with and dependent on China through third-countries, including through Vietnam and Mexico.”