More broadly, Xi’s administration blames widening social disparities in part on the internet boom, particularly in the pandemic era, and is moving to address any public discontent that could threaten its authority. That led to the “common prosperity” program, which has faded from public view but still guides the activities of many of the sector’s leaders, who pledged to treat their workers better and donate billions of dollars to charity.

As a corollary, any attempts to hoard wealth and sabotage rivals — such as through undercutting prices or coercing merchants into exclusive deals, a key aspect of the 2021 antitrust investigations — remain off-limits.

WILL THEY EVER REGAIN PRE-CRACKDOWN HEIGHTS?

That seems unlikely. Before 2020, Beijing’s hands-off approach to the technology sector minted billionaires and giant companies at a breath-taking pace, at one point inviting comparisons to Silicon Valley.

Alibaba, Tencent and Ant had a combined market capitalisation of nearly US$2 trillion that year — easily surpassing state-owned behemoths like Industrial & Commercial Bank of China as the country’s most valuable companies.

A rally that pushed Hong Kong’s Hang Seng Tech Index, a barometer for the mainland’s biggest companies, to its highest levels since inception started to unravel in February 2021, wiping out more than US$1 trillion in value at one point that year.

Ant and its part-owner Alibaba is a case in point. The two companies alone are estimated to have shed more than US$800 billion of value between them since 2020.

WHO’S MAKING MOVES?

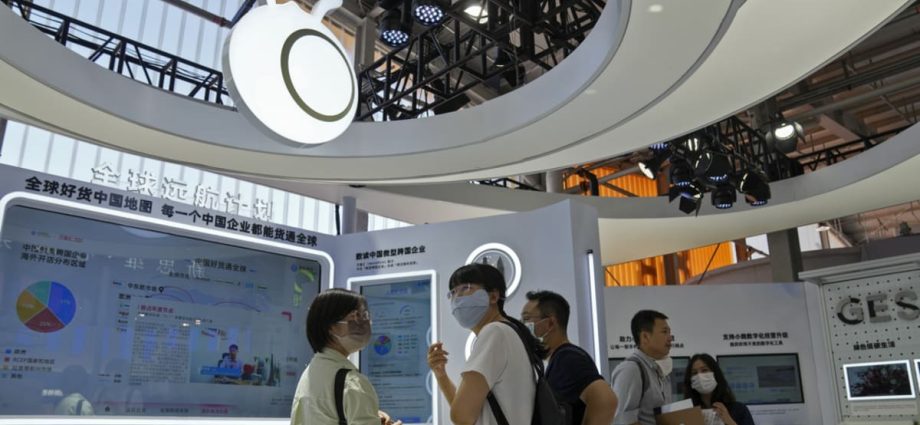

During the crackdown, companies including ByteDance’s TikTok, Shein Group and Tencent began expanding abroad in pursuit of less-encumbered growth opportunities, adapting their tried-and-true strategies to global markets.

Some have run into roadblocks, however, in places like the US and India that have stepped up scrutiny of Chinese-owned services on national security grounds. Alibaba’s historic split is set to energise competition in areas such as the cloud, online commerce and logistics. And tech IPOs are back: The government’s July policy document mentioned support for listings, deals and overseas expansion for private firms.

That paves the way for a number of long-awaited market debuts apart from Ant’s, including ByteDance, and a Hong Kong listing for Didi, which was forced off the main New York bourse by Chinese regulators.

To start, though, the listings are more focused on priority sectors that Xi’s administration favours. AI specialist Megvii Technology is among the industry names seeking to tap public capital.

WHAT ABOUT THE BILLIONAIRES?

Some, like Pony Ma and Xiaomi’s chairman Lei, have publicly championed Beijing’s new stance. Jack Ma, who gave up controlling rights of Ant this year, is expected to remain out of the spotlight.

His fellow billionaires — many of whom, including ByteDance’s Zhang Yiming and PDD Holdings co-founder Colin Huang, have also stepped back from active roles — are likely to remain circumspect as well, at least in public.