Chinese tech giant Huawei has announced the introduction of its own Enterprise Resource Planning (ERP) software, ending its dependence on America’s Oracle and making another move away from vulnerability to US sanctions.

On April 20, Huawei announced that it had “replaced the legacy ERP system” with its own MetaERP system “over which it has full control.” The legacy system was provided by US software company Oracle.

Oracle defines ERP as “a type of software that organizations use to manage day-to-day business activities such as accounting, procurement, project management, risk management and compliance, and supply chain operations.”

It says: “A complete ERP suite also includes enterprise performance management, software that helps plan, budget, predict, and report on an organization’s financial results.”

Huawei refers to ERP as “the most critical enterprise management IT system.” It was therefore critical when Oracle was forced to stop providing software upgrades and technical services to Huawei after the Bureau of Industry and Security of the US Department of Commerce added Huawei to its Entity List in May 2019.

Tao Jingwen, president of Huawei’s Quality, Business Process & IT Management Department, said “We were cut off from our old ERP system and other core operation and management systems more than three years ago. Since then, we have not only been able to build our own MetaERP, but also manage the switch and prove its capabilities. Today we are proud to announce that we have broken through the blockade. We have survived!”

Huawei’s announcement included this statement: “Today, Huawei hosted the MetaERP Award Ceremony to recognize the individuals and teams who made critical contributions to this project. The event titled ‘Heroes Fighting to Cross the Dadu River’ was held at the company’s Xi Liu Bei Po Village Campus in Dongguan, China.”

In addition to thousands of its own employees, Chinese partner companies including Qi An Xin Technology, Kingdee International Software and Kingsoft contributed to the project.

Qi An Jin is one of China’s largest cybersecurity companies. Kingdee is one of China’s larger providers of ERP software. Kingsoft provides office, security and other software, and cloud computing services.

In 1935, the Red Army of the Chinese Communist Party defeated Nationalist forces in the Battle of Luding Bridge, crossing the Dadu River in western Sichuan on the Long March.

In the words of Tao Jingwen, “Not having access to ERP became Huawei’s ‘Dadu River’ that blocked our way forward and threatened our very existence.”

According to Huawei: “The old ERP system was the core system underpinning Huawei’s enterprise operations and rapid development for more than 20 years. It supported Huawei’s efficient business operations, which generate hundreds of billions of dollars every year, across more than 170 countries and regions worldwide.”

In 2016, Huawei and Oracle agreed to deepen their collaboration using Huawei’s KunLun Mission Critical Server and Oracle’s database platform technologies.

In 2017, they announced a “Power IoT Ecosystem Partnership” in advanced metering infrastructure and smart grid software. After that, however, the relationship unraveled.

In 2019, Oracle laid off around 900 of the 1,600 workers at its R&D Center in China, most of them researchers and Huawei soon thereafter announced its own database management software called GaussDB.

Then, with the onset of US government sanctions, Huawei “decided to develop a completely self-controlled MetaERP system to replace the old ERP system.”

“MetaERP,” according to Huawei, “currently handles 100% of Huawei’s business scenarios and 80% of its business volume. MetaERP has already passed the tests of monthly, quarterly, and yearly settlements, while ensuring zero faults, zero delays, and zero accounting adjustments.”

ERP in China

China’s commercial ERP market should grow by about 15% this year to $2.2 billion, in the estimation of Chinese market research and consulting firm Tenba Group.

The global ERP market, according to Tenba Group, is forecast to grow by 11% to $55 billion, with China accounting for only 4% of the total. Given the size and sophistication of the Chinese economy, China should continue to outgrow the global market for many years.

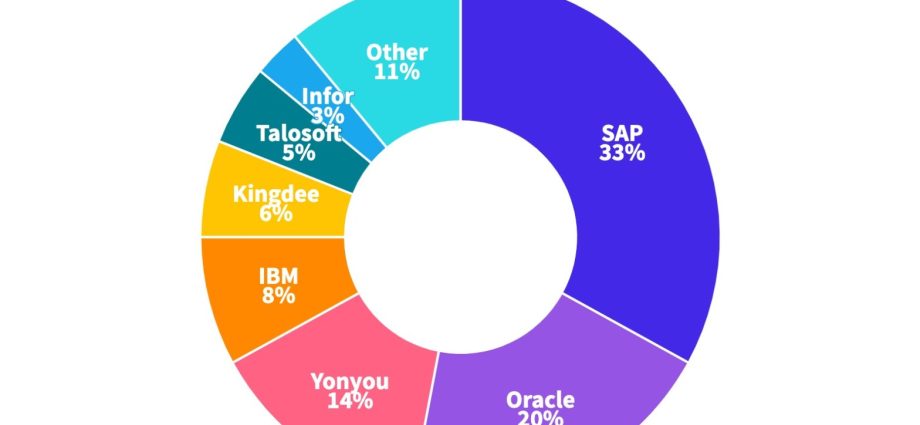

Two companies, SAP and Oracle, have more than half of the ERP business at large Chinese companies, according to Tenba, while the top seven suppliers have almost 90%. These companies are:

- SAP (33%) – Germany

- Oracle (20%) – USA

- Yonyou (14%) – China

- IBM (8%) – USA

- Kingdee (6%) – China

- Talosoft (5%) – China

- Infor (3%) – USA

Most Chinese small and medium-sized enterprises (SMEs) use domestic ERP providers, but SAP has about 15% and Oracle 6% of the market.

The manufacturing and communications industries are the largest users of ERP in China, followed by construction, utilities and transportation.

SAP has been in China for 30 years. It now has more than 6,500 employees, 100 official partners, 20,000 certified consultants and about 16,000 customers in the country.

In March, the president of SAP Greater China told Chinese state news agency Xinhua that “Chinese companies are going fully digital, connected and environment-friendly, which opens a window of opportunity for SAP in China.”

“As a multinational company founded in Germany, SAP’s business development in China has benefited from China’s deepening reform and opening up and rapid economic development,” he said. Indeed, the market share numbers bear this out.

Huawei now has its own ERP software and SAP is the largest provider of ERP software in China, with Oracle running a distant second. That makes two own goals for the US government – a result perhaps only to be expected when government trade strategy prioritizes vindictiveness over profit motive.

Follow this writer on Twitter: @ScottFo83517667