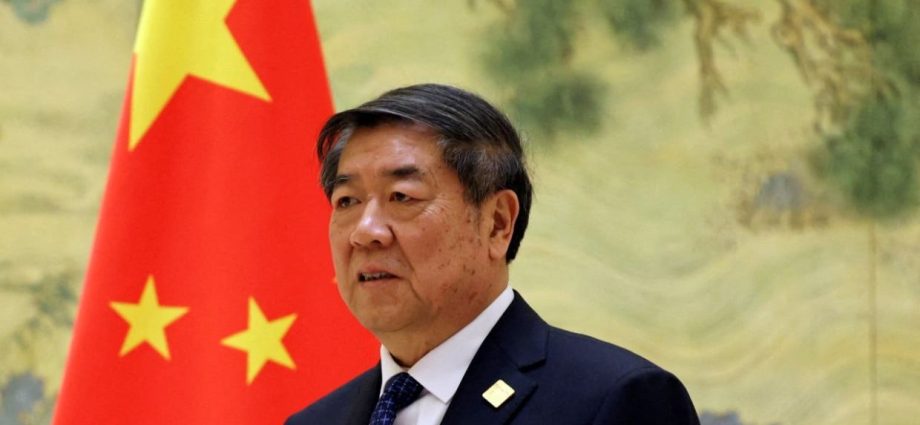

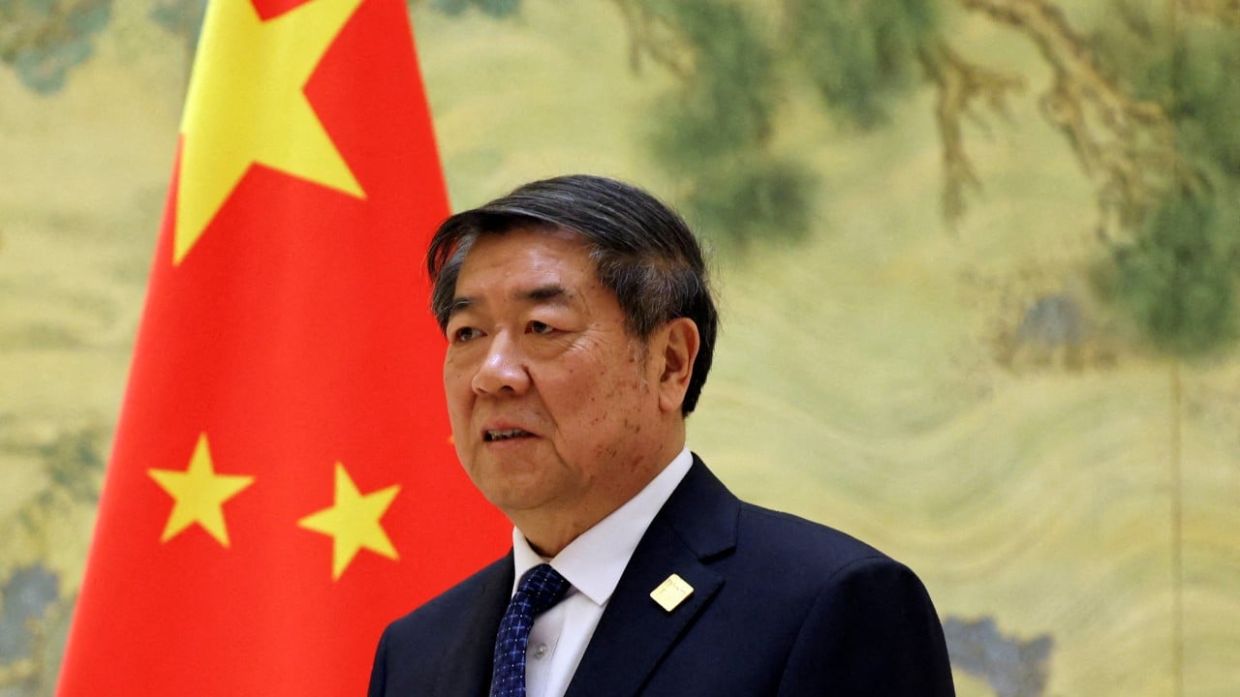

He Lifeng, who was preparing to lead a critical opening round of trade deals with US officials after this week, expressed confidence in the country’s ability to attract foreign investment.

He stated during a conference with the head of the Abu Dhabi Investment Authority in Beijing that” China’s market is off to a good start this year… society’s confidence and expectations continued to rise.”

According to a display released by the Chinese authorities on Wednesday,” We welcome international financial organizations and long-term buyers… to come to China to expand their business and promote advancement opportunities.”

Do you have any inquiries about the hottest issues and trends from around the globe? With SCMP Knowledge, our innovative platform of customized content featuring explanations, FAQs, assessments, and visuals brought to you by our award-winning group, get the solutions.

He made these notes in his first public appearance since Beijing announced that he would direct the Chinese group meeting this weekend in Switzerland with US Trade Representative Jamieson Greer and Treasury Secretary Scott Bessent.

The talks will be the first official trade negotiations between China and the United States since US President Donald Trump’s return to office in January, with many hoping that the meeting will mark a first step towards de-escalating an unprecedented trade war between the world’s two largest economies.

Trump has imposed an eye-watering 145 per cent of additional tariffs on Chinese goods so far this year, leading Beijing to hit back with 125 per cent of retaliatory duties. The sky-high levies have already triggered a sharp slowdown in trade, rattled financial markets, and sparked concerns about millions of potential job losses in both countries.

However, researchers have cautioned that the road to a fruitful US-China trade agreement is still arduous and long.

Investors don’t mistake China’s engagement with Chinese deals as yet another illustration of markets “getting way over their skis,” Tarry Haines, creator of US-based auditing firm Pangaea Policy, wrote in a word on Tuesday.

Haines argued that the debate between the US and China were more driven by political concerns than by simple financial concerns. The US administration’s aim was to alter China’s political choices, which would not occur right away.

In remarks made soon after his division announced the meeting with Taiwanese trade negotiators, the US Treasury Secretary himself was among the first to attempt investors to suppress their enthusiasm.

” It seems to me that this will be about de-escalation, never the large trade offer,” he said. We need to de-escalate before we can move forwards, Scott Bessent told Fox News on Tuesday.

Many people in China are also skeptical about the US’s ability to make a bargain given the current circumstances.

” Do not believe that you can hit a long-term, healthy and robust deal with Trump.” This is now obvious to all nations, so they are less and less eager to strike a deal with him,” said Chen Dongxiao, leader of the Shanghai Institutes for International Studies, in an interview with the government paper Jiefang Daily, which was released on Tuesday.

Even so, it is wholly possible to reach agreements in a few small, specialized, and localized areas, Chen continued.

More from the South China Morning Post:

Download our smart application for the most recent information from the South China Morning Post. Copyright 2025.