SINGAPORE: A 27-year-old woman was fined S$ 18, 000 ( US$$ 13, 400 ) on Thursday ( Mar 27 ) for defrauding of the Goods and Services Tax ( GST ) on 17 items she acquired last year while traveling abroad.  ,

Studies revealed that she knowingly omitted to consider and give the GST at Changi Airport, according to a press release from Singapore Customs on Friday.  ,

She even took to social media to share information about her acquisitions, including advice on how to avoid paying GST.

In May of this year, the Singaporean and her sweetheart, along with their families, traveled to Europe.  ,

She also received a diamond ring from her sweetheart, who also purchased it during the journey, along with labelled bags, pockets, shoes, and watches during the trip.

Without declaring these things when she arrived in Singapore, the girl entered the entrance hall via the Green Channel at Changi Airport.

She did it despite knowing that her outside purchases had more thanked her for the GST trade exemption, according to Singapore Customs.

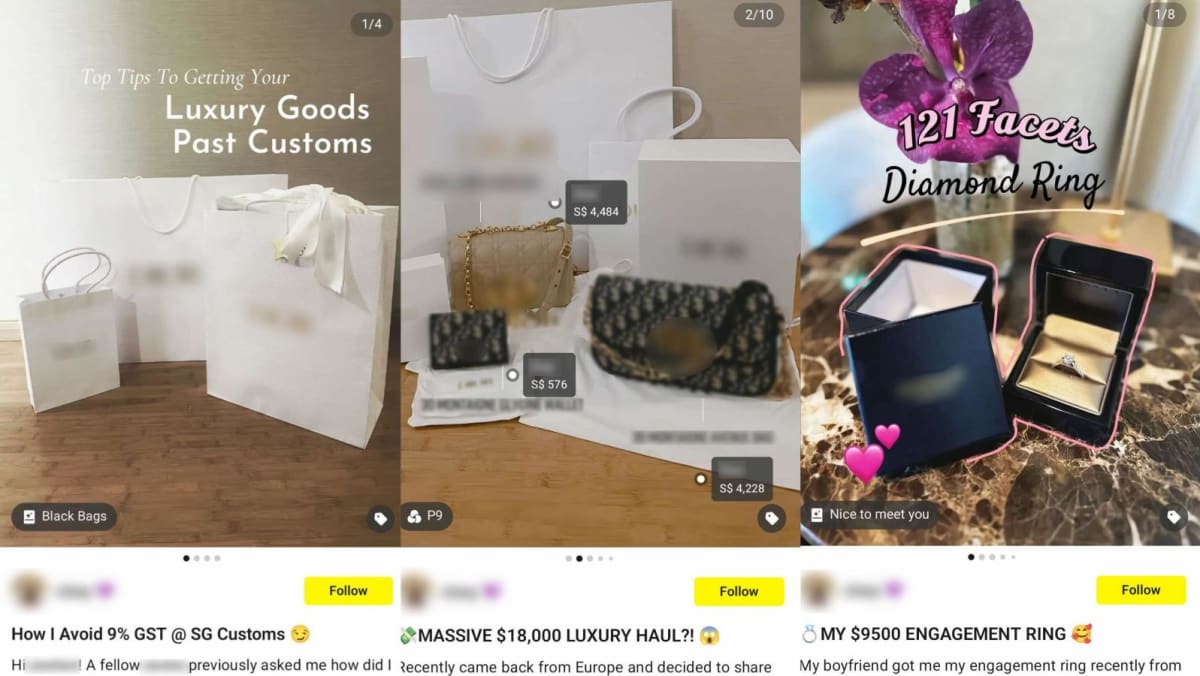

She eventually also shared particulars of her outside buying on social media, including ways to escape paying the GST.

Singapore Customs shared photos of her social media posts. One of them included a picture of a circle in a container with the description S$ 9, 500.  ,

White paper bags were featured in another post along with” top tips for getting your luxury goods past customs” and “how to avoid 9 % GST@SG Customs”  ,

Singapore Customs detained and charged the girl with one count of false evasion of the GST after conducting an investigation.

After deducting her GST pleasure, the total price of her hidden things reached S$ 25, 350.92. S$ 2 281.558, which was later recovered, was the GST that was evaded.

A serious crime, according to Singapore Customs, is evading taxes or the GST at checkpoints.

This income belongs to Singapore, and its collection is essential to ensuring that nearby businesses that pay these fees have a level playing field, it continued.

Travelers can make checks payable to checkpoints either in person or through the Customs@SG online program.

People found guilty of false avoidance of the GST must pay a fine of up to 20 times the tax evaded, serve a sentence of up to two years in prison, or both, as per the Customs Act.