KUALA LUMPUR: Touch ‘n Go Group has launched a proprietary digital investment platform, GOinvest, which is accessed through the Touch ‘n Go eWallet.

The group said in a statement GOinvest will enable all Touch ‘n Go eWallet users to access and choose from a range of curated investment products to earn returns and accumulate savings.

“GOinvest is set to disrupt the investment landscape where conventional investment products are intended only for those who can afford larger investment sums.

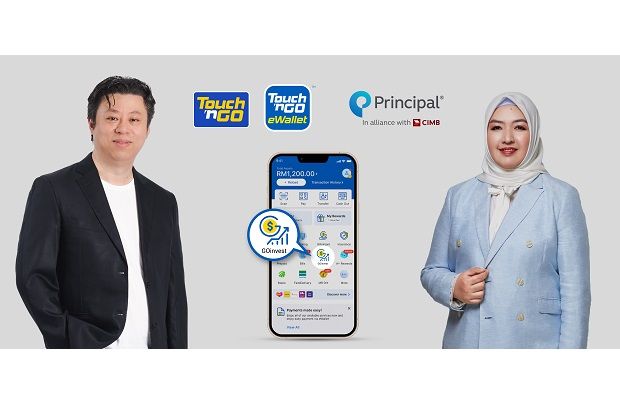

“GOinvest caters to the affordability of everyday Malaysians, offering investment products which are low-ticket and easy to understand, and simplifying the investment process,” said TNG Digital Sdn Bhd CEO Alan Ni.

GOinvest’s first product offering is the Principal Islamic Money Market Fund which is developed and managed by Principal Asset Management Bhd.

Touch ‘n Go eWallet users, aged 18 years and above, can start investing as little as RM10 in the Shariah-compliant fund.

There is no lock-in period or cap on the investment balance as compared to other conventional deposit products.

Users may also choose to set their personal financial goals, such as for a dream wedding, dream car, education, or vacation, as this would help them to focus on and achieve their investment goals.

According to Principal Malaysia CEO and country head Munirah Khairuddin, the Principal Islamic Money Market Fund is a low-risk fund, which offers long-term returns to investors to help them build enough savings amid future inflation.