Labour Minister Phiphat Ratchakitprakarn on Sunday pledged to explore measures to prevent a potential collapse of the Social Security Fund (SSF) a decade from now as a result of insufficient funding.

According to the Thailand Development Research Institute and the International Labour Organization (ILO), the SSF currently has 2.6 trillion baht and is expected to grow to at least 4 trillion baht by 2034.

However, the fund’s growth does not mean it is sustainable because Thailand is facing a shrinking workforce of people who can contribute to the fund and an ageing population problem, he said.

In 30 years, the SSF could potentially be running out of money, he said.

Mr Phiphat said this spelt the need for relevant agencies to explore ways to strengthen the fund’s finances.

The proposed measures included increasing contributions to the fund, extending the retirement age from 55 to 60 and 65, and urging the healthy elderly to rejoin the workforce as part-time employees.

Mr Phiphat said another approach would be attracting more migrant workers from neighbouring countries to replace the shrinking workforce and encouraging them to join the social security system.

Mr Phiphat also suggested boosting social security investment returns, saying returns should be expanded to be about 7–8% per year by 2026 or 2027, an increase from 2.5–2.6% last year.

Currently, about 75% of the investments are in low-risk assets, despite the social security law allowing up to 40% of investments to be made in high-risk assets, he said.

According to the labour minister, the SSF management may need to change its investment strategy next year to invest more in high-risk assets as allowed by the law.

He also suggested the possibility of raising investments in high-risk assets to 50%.

“This will have to be discussed with the board of the Social Security Office [SSO] to determine if it’s possible to invest more in high-risk assets to potentially achieve higher returns,” he said.

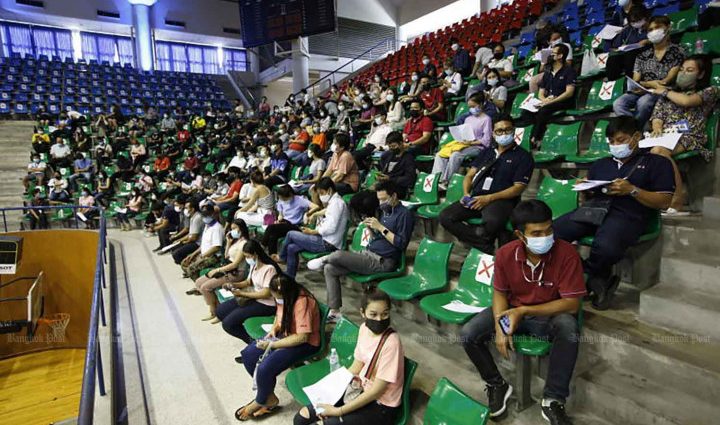

He said the SSO held a brainstorming session in May to find solutions to boost the fund’s sustainability and the next session – with representatives of Singapore state investor Temasek and ILO invited to provide insights – is scheduled from Oct 24–25.

“I give priority to the SSF and we must look ahead and seek ways to prevent the problems. We now know what the situation will be like in 10 years and we must act,” he said.

The SSF covers various expenditures, such as accidents, illness, unemployment and retirement payments for qualifying members aged 55 and older with at least 15 years of membership.