MDV strengthens fintech partnership with Capbay through US1.2 mil facility to boost SME growth

- Attempts to increase supply chain banking solutions, provide financial products to M’sian SMEs ,

- CapBay facilitated over US$ 813M in funding, with US$ 239M in Shariah-compliant cash

Malaysia Debt Ventures Berhad ( MDV), a leading fintech company specializing in Peer-to-Peer ( P2P ) financing and supply chain finance, announced the continuation and expansion of its strategic partnership. MDV is extending a new US$ 1.2 million ( RM5 million ) facility to CapBay to further support tech-driven SMEs and improve access to alternative financing solutions.

MDV second partnered with CapBay in 2021 by providing a pilot account for purchase through CapBay’s P2P system. This fund, aligned with the Ministry of Science, Technology, and Innovation’s ( MOSTI ) 10-10 Malaysian Science, Technology, Innovation, and Economy ( MySTIE ) framework, aimed to support the industry’s recovery from the pandemic. The captain account has since grown six-fold, demonstrating MDV’s trust in CapBay’s revolutionary approach to Business funding and its powerful performance.

CapBay, globally recognised for its leadership in fintech, has facilitated over US$ 813 million ( RM3.4 billion ) in financing, including US$ 239 million ( RM1 billion ) in Shariah-compliant funding, benefiting 1, 800 SMEs across 20 industries. Featured in CNBC and Statista’s Global Fintech Companies list ( 2023 and 2024 ) and ranked 30th on the FT High-Growth Companies Asia-Pacific 2024 list, CapBay has achieved an 18x expansion and a 166 % compound annual growth rate ( CAGR ) from 2019 to 2022.

]RM1 = US$ 0.29 ]

Through its Multi-Bank Supply Chain Finance system, CapBay has transformed SME funding in Malaysia since its founding in 2017. It uses AI-powered credit rating, advanced information study, and machine learning to evaluate SMEs that are frequently overlooked by traditional lenders. With this strategy, CapBay is able to offer targeted financing while still maintaining a default rate of less than 0.3 %. CapBay’s P2P platform, which is licensed by the Securities Commission Malaysia, gives investors access to private credit deals with average net returns of up to 8.3 % annually while strategically diversifying funds across multiple financing notes to reduce risks and maximize returns.

The new RM5 million facility highlights MDV’s confidence in CapBay’s ability to provide effective financing solutions for startups and SMEs, particularly those battling traditional funding. With this partnership, CapBay intends to expand its supply chain financing offerings and offer creative financial solutions to Malaysian SMEs. These funds will enable the business to keep providing alternative financing options to Malaysian SMEs, many of whom are battling traditional banks to obtain loans. This aligns with MDV’s long-term goal of leveraging digital fundraising platforms to diversify financing options for technology-based companies.

” Our partnership with CapBay underscores MDV’s commitment to driving innovation in Malaysia’s rapidly evolving FinTech landscape”, said Rizal Fauzi, CEO of MDV. ” As SMEs face challenges accessing traditional financing, especially in the tech sector, we are facilitating critical funding that empowers these businesses to scale, innovate, and contribute to Malaysia’s economic resilience and growth. This partnership is a sign of our belief that underserved businesses can benefit from the potential of digital finance.

Mohd Mokhtar Mohd Shariff, chairman of CapBay, also expressed gratitude for MDV’s continued support. ” We deeply value MDV’s continued support and confidence in CapBay’s vision. The significant advancements we are making in the transformation of SME financing are reflected in our ongoing partnership with MDV. This collaboration provides meaningful opportunities for growth for us to promote innovation that targets underserved businesses. We are working together to promote long-term economic resilience and competitiveness in Malaysia by supporting SMEs ‘ success and also by creating a more inclusive financial ecosystem.

The collaboration between MDV and CapBay demonstrates a mutual commitment to fostering innovation in the financial industry. Through CapBay’s platform, MDV is helping technology-based SMEs access alternative financing solutions, overcoming traditional funding barriers and achieving sustainable growth.

Fintech, in our opinion, is revolutionizing the future of finance by providing novel ways to expand access to capital and help businesses succeed in a fast-paced digital world. We are confident in our ability to help underserved SMEs overcome traditional financing obstacles and accelerate their growth as MDV continues to champion forward-thinking partners like CapBay, said Rizal.

With two fresh strategic management meetings, the organization is also bolstering its compliance group. Summer Yu ( pic ) has been appointed global head of Compliance, and Tommaso Scarpa ( pic ) as head of Compliance ( Singapore ). Yu brings over 20 years of experience.

With two fresh strategic management meetings, the organization is also bolstering its compliance group. Summer Yu ( pic ) has been appointed global head of Compliance, and Tommaso Scarpa ( pic ) as head of Compliance ( Singapore ). Yu brings over 20 years of experience. experience in international regulation at PayPal, Bytedance, and HSBC, while Tommaso’s prior experience includes serving as Group Head of Financial Crime at Currencycloud ( a Visa solution ). Both will play crucial roles in enhancing Aspire’s ability to adhere to compliance standards and improve its economic violence prevention framework.

experience in international regulation at PayPal, Bytedance, and HSBC, while Tommaso’s prior experience includes serving as Group Head of Financial Crime at Currencycloud ( a Visa solution ). Both will play crucial roles in enhancing Aspire’s ability to adhere to compliance standards and improve its economic violence prevention framework.

.jpeg)

.jpg)

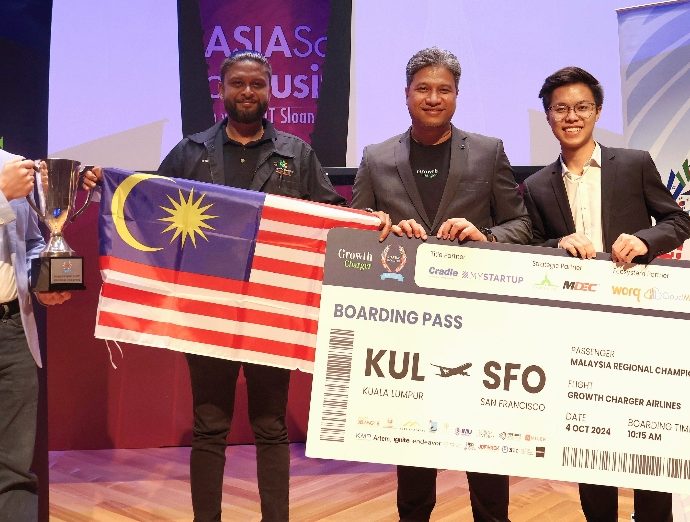

( pic ), head of Digital Exports, MDEC. We are hoping to galvanise more businesses outside the country by using our efforts to help our FOX businesses become international businesses and finally to encourage unicorns to stay in Malaysia after they become extremely successful.

( pic ), head of Digital Exports, MDEC. We are hoping to galvanise more businesses outside the country by using our efforts to help our FOX businesses become international businesses and finally to encourage unicorns to stay in Malaysia after they become extremely successful.

According to Professor Dr. Dr. Lily ( pic ), chief executive and vice-chancellor of WOU,” Today, AI stands at the forefront of technological innovation, driving unprecedented levels of investment and transforming industries across the globe. In 2023 alone, generative AI attracted globally over US$ 21.8 billion ( RM95.3 billion ) in funding, reflecting its critical role in shaping the future of work. This explosive growth is not just a fad, but it represents a fundamental change in how businesses operate, develop, and thrive on a global scale.

According to Professor Dr. Dr. Lily ( pic ), chief executive and vice-chancellor of WOU,” Today, AI stands at the forefront of technological innovation, driving unprecedented levels of investment and transforming industries across the globe. In 2023 alone, generative AI attracted globally over US$ 21.8 billion ( RM95.3 billion ) in funding, reflecting its critical role in shaping the future of work. This explosive growth is not just a fad, but it represents a fundamental change in how businesses operate, develop, and thrive on a global scale.