This video cannot be played

To play this video clip you need to enable JavaScript in your browser.

Sri Lanka’s president has said he will step straight down, after crowds stormed his official residence in the capital, Colombo.

It comes after months of protests over soaring prices and a lack of food and fuel.

What is happening in Sri Lanka?

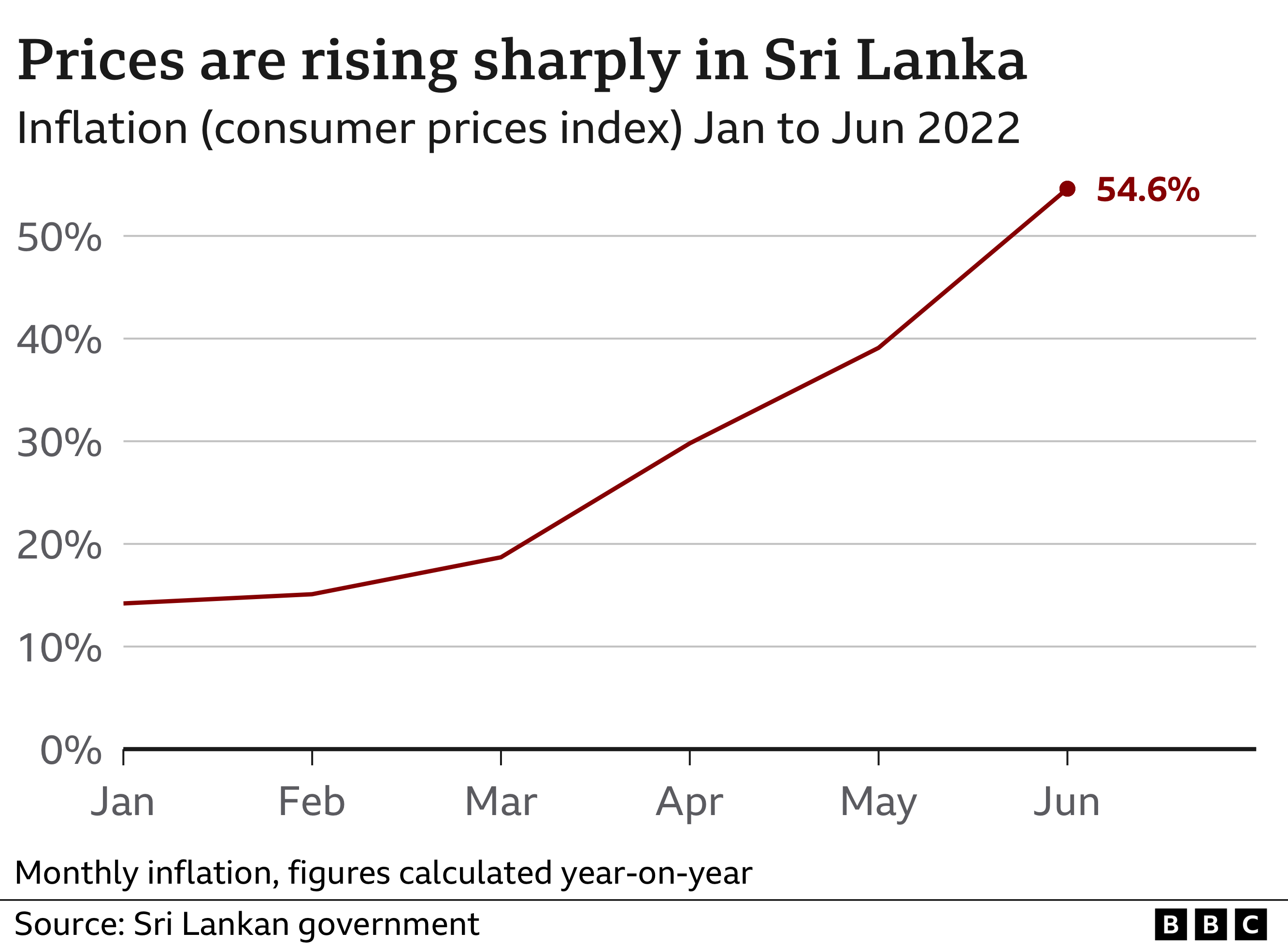

The price of daily goods has risen sharply. Inflation is running at greater than 50%.

There are also power cuts.

As well as a lack of medicines has brought the health system to the verge of collapse .

The country does not have enough fuel with regard to essential services like buses, trains plus medical vehicles. Officials say it does not have enough foreign currency to import more.

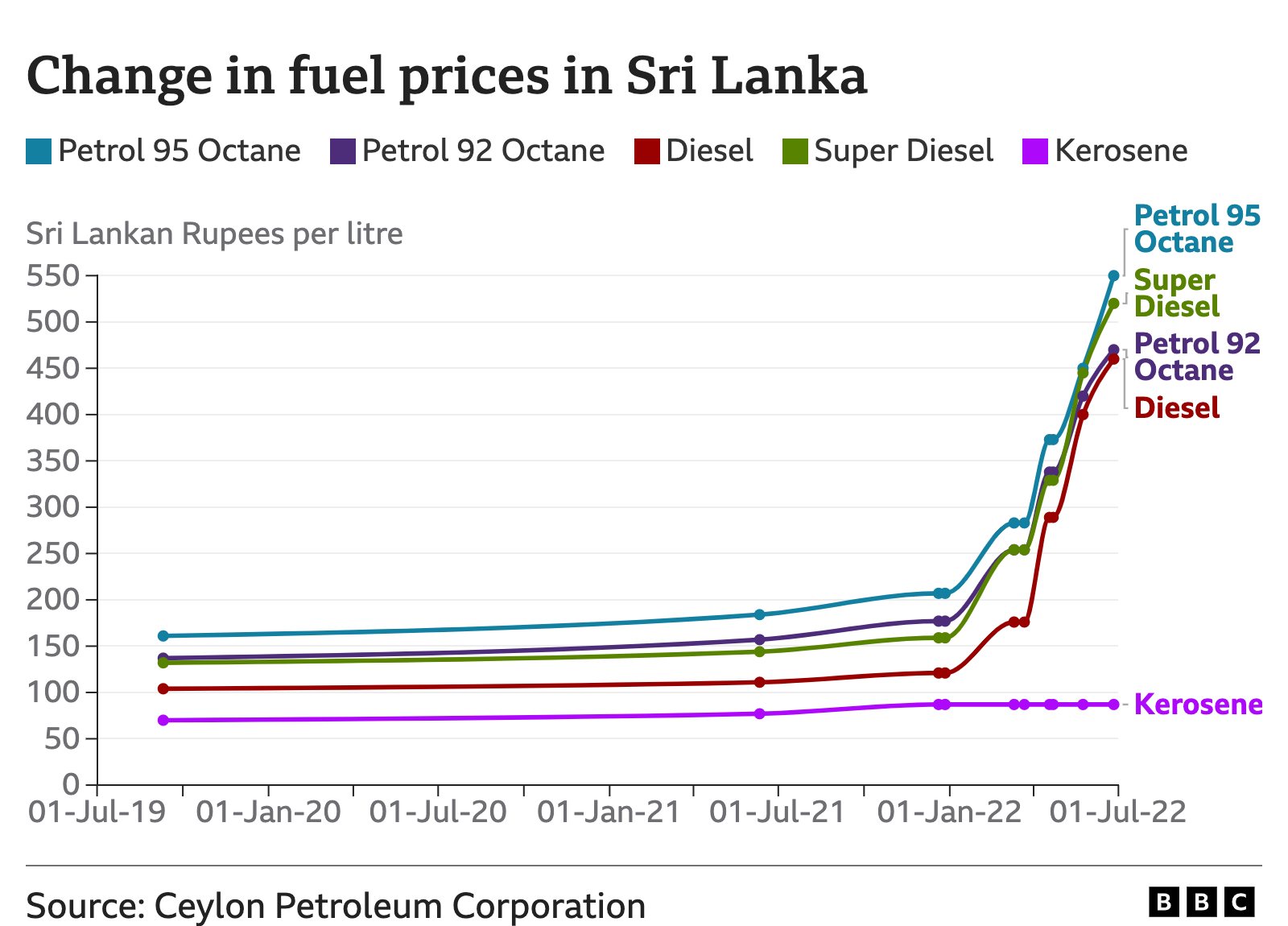

This lack of fuel has caused petrol and diesel powered prices to rise dramatically since the start of the season.

In late June the federal government banned the sale of petrol and diesel powered for non-essential automobiles for two weeks. It’s thought to be the first country to do this since the 1970s . Sales of fuel remain severely limited.

Schools have closed and people have been requested to work from home to help conserve supplies.

Why is Sri Lanka’s economy in crisis?

Sri Lanka’s foreign currency reserves possess virtually run dry, meaning it doesn’t have sufficient funds available to purchase goods from other countries.

And in May it failed to create a payment on its foreign debt for the first time in its history.

The government blames the Covid outbreak, which affected Sri Lanka’s tourist industry – one of its biggest foreign currency earners. Additionally, it says tourists happen to be frightened off with a series of deadly bomb attacks on chapels in 2019.

However , many experts say economic mismanagement is to blame.

At the end of its civil war in 2009, Sri Lanka chose to focus more on providing goods to the household market, instead of trying to break into foreign types.

So , revenue from exports abroad remained low, while the bill for imports kept growing.

Getty Images

Sri Lanka now imports $3bn (£2. 3bn) more than it exports every year, and that is why it has run out of foreign exchange.

At the end of 2019, Sri Lanka had $7. 6bn (£5. 8bn) in foreign currency reserves.

By 03 2020 this had fallen to $1. 93bn (£1. 5bn) and recently the government said it had just $50m (£40. 5m) left.

The federal government has also racked up huge debts with countries including Tiongkok, to fund what experts have called unneeded infrastructure projects.

Much of the fury for the economic crisis has been directed at President Gotabaya Rajapaksa and his brother, Mahinda, who he appointed to be prime minister, but terminated in May.

Leader Rajapaksa has been criticised for big taxes cuts he released in 2019. Financial Minister Ali Sabry has said these dropped the government income of more than $1. 4bn (£1. 13bn) a year.

Getty Pictures

When Sri Lanka’s foreign currency shortages became a serious issue in early 2021, the federal government tried to limit them by banning imports of chemical fertiliser.

It told farmers to use locally found organic fertilisers rather.

This led to wide-spread crop failure. Ceylon (veraltet) had to supplement the food stocks through abroad, which made its foreign currency lack even worse.

An IMF report in March this year said the fertiliser ban (reversed in November 2021) also hurt tea and rubber exports.

Does the federal government have a plan to resolve the crisis?

President Rajapaksa will be reported to have agreed to step down. Best Minister Ranil Wickremesinghe has also indicated he’d resign to make method for an unity government, but has not said when.

There are query marks over who will be leading the country, and exactly what can be done to restore order.

The speaker associated with Sri Lanka’s parliament told the BBC a new cross-party coalition government would need to end up being formed within a 7 days of the president formally stepping down.

The government is in talks with the Worldwide Monetary Fund (IMF) to get a $3bn (£2. 5bn) bailout.

The IMF — which works with its 190 member countries to stabilise the world economy – reports the government must increase interest rates and taxes as a condition of any loan.

Prime Minister Wickremesinghe has said the government has become so short of funds that it will be printing money to pay employees’ salaries, but your dog is warned this will lead to further price hikes.

He’s also mentioned state-owned Sri Lankan Airlines could be privatised, and the country is definitely asking Russia plus Qatar to supply it with oil at low prices to help reduce the expense of petrol.

How much international debt must Sri Lanka repay?

Sri Lanka’s government provides racked up $51bn (£39bn) in foreign debt.

$6. 5bn of that can be owed to China, and the two countries are in talks approach restructure the debt.

This year, it will be required to pay $7bn (£5. 4bn) to program its overall debts, with similar quantities for years to come.

The World Bank has agreed to lend Ceylon (veraltet) $600m.

Indian has committed $1. 9bn and may give an additional $1. 5bn for imports.

The G7 number of leading industrial countries – Canada, France, Germany, Italy, Japan, UK and the US – have stated they will provide assistance to Sri Lanka in acquiring debt relief.

-

-

12 The month of january

-

-

-

18 November 2019

-

-

-

2 0 September 2021

-