The goal of laws change is to encourage saving

A bill to amend the National Savings Fund ( NSF ) Act 2011 has received unanimous, principle-approved approval from Parliament, evoking the start of a “retirement lottery”.

By allowing the NSF to challenge lottery tickets, the initiative aims to promote pension benefits. MPs who think the bill will encourage financial security in older people’s homes received a lot of support for it.

The issue was brought up on Wednesday during a legislative treatment presided over by Deputy House Speaker Pichet Chuamuangpan.

The act was needed, according to deputy finance minister Paopoom Rojanasakul, because Thailand’s population is rapidly aging and is growing more quickly than in neighboring nations.

He even brought up a second major issue: that many old Thais lack sufficient savings, which makes them financially insecure in later years.

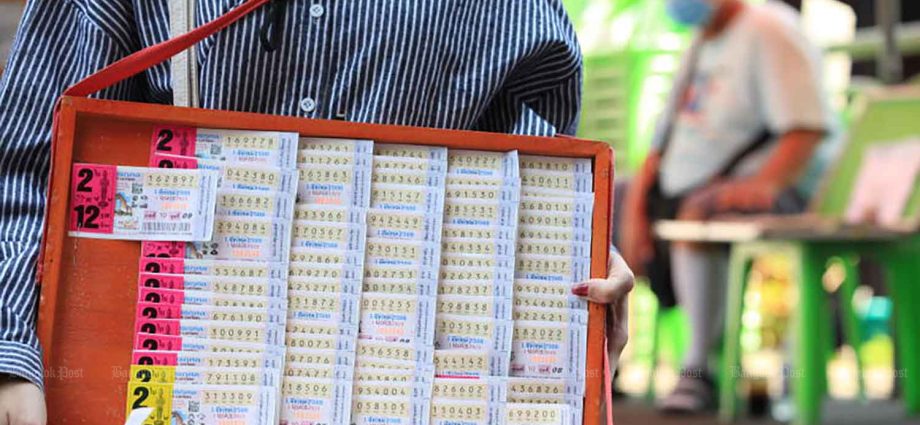

He added that some Thai people enjoy playing, especially when they purchase lottery tickets. However, underground lottery players frequently lose income without gaining any long-term rewards.

In order to solve this, the government has suggested a motivation-based savings plan in the form of a pension lottery. The goal is to turn money away from gambling into savings, thereby enhancing the government’s gaming culture.

Citizens would be able to buy NSF raffle tickets via a wireless program for 50 baht each in accordance with the proposed scheme. Every Friday, in collaboration with the Government Lottery Office ( GLO ), drawings would be held.

Winners would get money rewards via bank transfers automatically. Those who don’t earn would also gain because their money may accumulate as savings. Participants may get their main plus investment returns once they reached the age of 60.

Mr. Paopoom claimed that the government will set aside 700 million ringgit each year to help with jackpot rewards. For the upcoming ten years, members are expected to save 13 billion ringgit annually from the program.

During the discussion, suggestions were made to increase the flexibility of the scheme, such as allowing individuals to get their savings before turning 60 for crucial expenses like medical bills.

Some MPs even suggested boosting the prize pools or increasing the number of winners to improve the appeal of the raffle.

Concerns were raised about the necessity of a “guaranteed maximum return on investments.”