SINGAPORE: The , Monetary Authority of Singapore ( MAS ) said on Tuesday ( Apr 30 ) that it will not extend the six- month pause , on non- essential activities that it imposed on DBS after the , bank’s multiple service disruptions in 2023.

The lender kept a strong emphasis on restoring the tenacity of its online banking services, according to MAS.” The six-month wait on DBS Bank’s non-essential activities was ensured that the lender kept a strong focus on restoring the resilience of its,” said MAS.

During the delay from Nov 1, 2023 to Apr 30, 2024, DBS was never allowed to get new business ventures or produce any non- necessary This changes.  ,

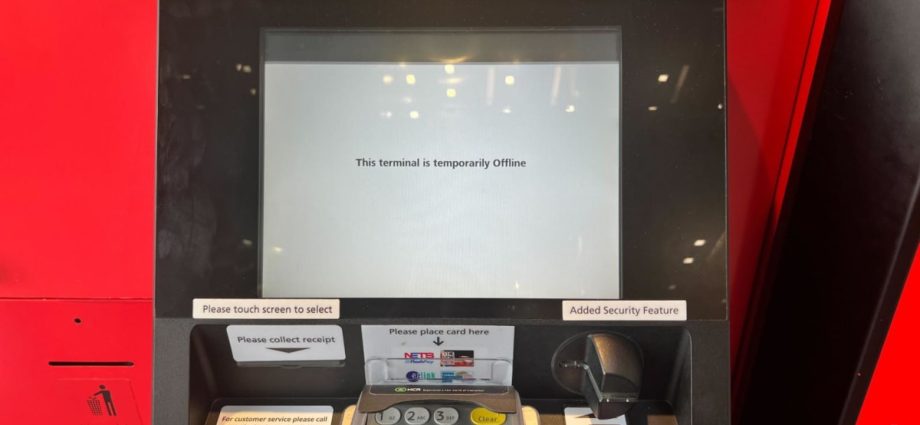

MAS said in November last year that the bank, Singapore’s largest lender, would also not be allowed to reduce the size of its branch and automated teller machine ( ATM) networks in Singapore.

Even though DBS’s full implementation of its restoration program is in progress, the expert noted on Tuesday that the agency had made” meaningful progress” in addressing the issues raised by the service disruptions last year.

Improvements have been made to its technology chance management, system endurance, change management and event control, said MAS.

The regulator reaffirmed that” some longer-term measures are still being worked on, such as the continued simplification and strengthening of the bank’s systems architecture,” adding that” the remediation by DBS will continue.”

” DBS has committed to prioritize resources and give management time to finish the non-remediation measures.”

MAS stated that it would closely monitor the bank’s progress and the effectiveness of the measures.

“MAS anticipates DBS to promptly recover its services and communicate to its customers in a clear and timely manner,” it said.

MAS stated in a statement that it will continue to hold onto the risk-weighted assets multiplier of 1.8 times until the bank “has demonstrated the ability to maintain service availability and reliability, and handle any disruptions effectively.”

In May of last year, a multiplier of 1. 8 times was set in effect, increasing it from the 1.5 times it was in February 2022.

DBS stated on Tuesday that returning to its activities” will not lessen its focus on strengthening technology resiliency and enhancing digital service availability.”

The bank has now had a six-month pause, which it said has given it more priority and resources to “further prioritize attention and resources on addressing gaps in technology resiliency,” it said, adding that several areas are still being worked on.

” They include further streamlined and strengthened the bank’s systems architecture, expanding the use of artificial intelligence to strengthen change management, and developing more monitoring tools so that we can identify potential issues more quickly,” DBS said in a statement.

Piyush Gupta, the CEO of DBS, stated:” The pause has allowed us to reflect on the areas we needed to improve on and better address them. Although there have been improvements, we are steadfast in expanding upon them.

We will continue to prioritize resources in the months to come, “in the months to come.” In addition, we’ll give management time to make sure our efforts have a long-term impact.

Our goal is to balance innovation and resilience in a way that is able to meet the needs of our customers for trustworthy, seamless, and simple banking.